Asian stocks rose lifted by commodity names; European equities trade mostly lower but with little in the way of conviction or firm direction while the Italian banking index is at the highest level in a year following domestic earnings; S&P index futures are modestly in the red after the cash market closed at a record high Wednesday and investors prepared for earnings from retailers; we expect the now general vol selling program to promptly lift the S&P into new all time highs minutes after today's open. Global sentiment was boosted for the second day by a rebound in energy shares as oil prices rose, with Brent regaining the level and reverse all of last week's losses, after U.S. fuel inventories declined and Saudi Arabia cut supplies of crude to Asia more than expected. The MSCI's gauge of global stock markets was up 0.1 percent, bringing their gains for the year to nearly 10 percent, and into fresh record territory. After starting off deep in the red, the Shanghai Composite managed to recover and close green, despite another tumble in iron ore on SGX AsiaClear in Singapore, where it fell as much as 4.5% to a ton, the lowest since October amid a clampdown on leverage in China, the top consumer, and expanding global supply.

Topics:

Tyler Durden considers the following as important: Across the Curve, ASX 200, Australian Dollar, Bank of England, Bloomberg Dollar Spot, BOE, Bond, Boston Fed, Brent Crude, Business, CAD, Canadian Dollar, China, Commodity markets, Continuing Claims, Copper, Credit Conditions, Crude, Dutch Parliament, economy, Economy of the United Kingdom, Equity Markets, Euro, European Central Bank, European Commission, European Union, FBI, FDA, Federal Bureau of Investigation, Federal government, Financial economics, Fitch, France, FTSE 100, G7, Gilts, Gold Spot, Hang Seng 40, Hong Kong, inflation, Initial Jobless Claims, Internal Revenue Service, Investors Service, Iraq, Italy, Japan, Jim Reid, Monetary Policy, MSCI World, New Zealand, Nikkei, Nikkei 225, Obamacare, OPEC, Organization of Petroleum-Exporting Countries, People's Bank Of China, Petroleum, Price Action, Price of oil, Pricing, recovery, Reserve Bank of New Zealand, S&P, S&P 500, S&P/ASX 200, Saudi Arabia, SSE 50, Starwood, Taiex, Tata, Trade Balance, Unemployment, US Asia, Volatility, West Texas, White House, World oil market chronology from, Yen, Zurich

This could be interesting, too:

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Marc Chandler writes Geopolitics Roil Capital Markets

Lance Roberts writes Yardeni And The Long History Of Prediction Problems

Marc Chandler writes Fragile and Consolidative Tone Starts the Week in FX

Asian stocks rose lifted by commodity names; European equities trade mostly lower but with little in the way of conviction or firm direction while the Italian banking index is at the highest level in a year following domestic earnings; S&P index futures are modestly in the red after the cash market closed at a record high Wednesday and investors prepared for earnings from retailers; we expect the now general vol selling program to promptly lift the S&P into new all time highs minutes after today's open.

Global sentiment was boosted for the second day by a rebound in energy shares as oil prices rose, with Brent regaining the $51 level and reverse all of last week's losses, after U.S. fuel inventories declined and Saudi Arabia cut supplies of crude to Asia more than expected.

The MSCI's gauge of global stock markets was up 0.1 percent, bringing their gains for the year to nearly 10 percent, and into fresh record territory. After starting off deep in the red, the Shanghai Composite managed to recover and close green, despite another tumble in iron ore on SGX AsiaClear in Singapore, where it fell as much as 4.5% to $59 a ton, the lowest since October amid a clampdown on leverage in China, the top consumer, and expanding global supply.

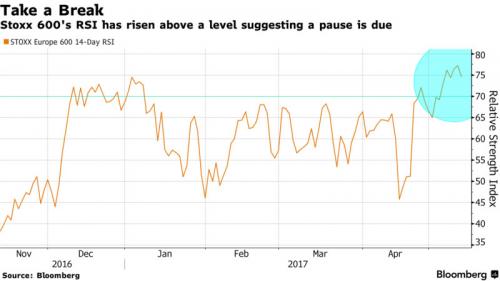

European stocks dropped for the first time in three days as a rebound in mining and energy shares failed to offset a broader negative mood at least in early trading. The Stoxx Europe 600 Index slipped following a raft of corporate results. Companies including Telefonica, UniCredit and Maersk reported good earnings, but the index this week climbed to near the highest on record and as the Bloomberg chart below shows, it is now massively overbought.

European gov't bond yields rose as rising oil prices reinforced expectations inflation would pick up, and raised risks of a hike or taper by the ECB. Those expectations also boosted the euro, which rose 0.3 percent against the dollar to $1.0868.

The problem for traders is a familiar one: while company earnings (if not so much U.S. data lately) are painting a picture of robust global growth - mostly on a non-GAAP basis of course - and political risk has eased following France’s presidential election, investors are "showing a lack of conviction as global equities trade at record-high levels and volatility evaporates. The path for interest rates will remain a major focus, with the Bank of England meeting today amid growing bets for a Fed increase in June and talk of tapering by the European Central Bank."

Today, the paradox of "good news is bad news" was summarized by Ben Kumar, a London-based investment manager at Seven Investment Management, who said that “Investors are trying to make sense of contradictory forces. Everyone’s quite optimistic and companies are making lots of money and this is all good stuff, and they start thinking about Mario Draghi and the taper and how much that will hurt.”

In a note overnight, Goldman warned that despite the Fed's two rate hikes in the past 5 months, financial conditions are the easiest in two years, which may prompt the Fed to "shock" markets.

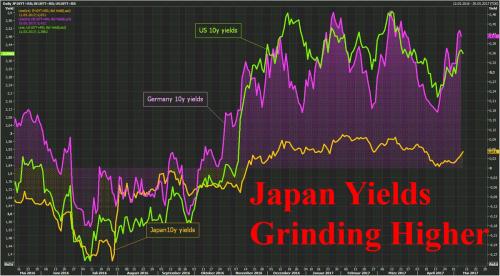

Also of note: the reflation trade appears to have returned again, if only for the time being, and in addition to TSYs and Bunds, Japanese JGBs saw upward pressure on yields despite the strongest bidside demand for 30Y paper in the overnight auction in months.

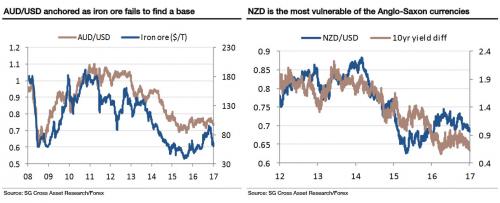

In FX, the dollar weakened against a basket of major currencies, though most major currency pairs were all holding in tight ranges. Earlier in the Asian session, the New Zealand dollar sank as much as 1.5 percent after the country's central bank stuck with a neutral bias on policy, warning markets they were reading the outlook wrong and expressing approval of the currency's declines this year.

As SocGen's Kit Juckes writes, "overnight currency drivers have been a pretty eclectic collection of unrelated developments. The biggest mover is the NZD which plunged to an 11 month low, weakened by the RBNZ's policy decision, which left rates on hold and shows no sign of wanting to act any time soon. The second biggest mover is the Canadian dollar, undermined by Moody's downgrading six banks on concerns about private sector debt. The Korean won was the main appreciating currency, rising with the equity market on anticipation of easier fiscal policy. And the final mover (apart from these four, very little happened) is the Australian dollar, down as iron ore prices fall again (a move which has weakened Chinese equities, too). The bounce in oil prices - Brent hit $51/bbl in early trading - is worthy of mention too."

Elsewhere, "EUR/USD, USD/JPY and EUR/JPY for that matter, are marking time after recent moves. Mario Draghi was given a plastic tulip but didn't take the bait and remained steadfastly dovish. EUR/USD needs Bund support and while both EUR/USD and EUR/JPY are a buy here, patience will be needed. The yen has fallen significantly on low vol and rising yields elsewhere. There is no data due today in the US and only one speaker (Dudley, this morning, in Mumbai)."

Oil rose after posting the biggest advance this year on Wednesday as U.S. crude stockpiles fell by more than twice what had been forecast, declining further from record and easing glut. EIA data showed stockpiles -5.25m bbl last week, the 5th weekly drop and biggest fall this year; compared to a -2m bbl median estimate in Bloomberg survey. Gasoline, distillate supplies also shrank, helping allay concerns over gaining U.S. crude output.

“The support that we see relates directly to the larger- than-expected draw on crude inventories” said Michael McCarthy, a chief market strategist at CMC Markets in Sydney. “U.S. demand is a bit of a surprise factor for the market. Daily production has climbed again and stockpiles still remain very elevated, so that suggests this rally might not last too long.”

Brent crude rose another 1.3% following a 3 percent gain in the previous session. The advance helped Brent regain the $51 level and reverse all of last week's losses.

"We saw the biggest draw in (U.S.) inventories for the year last week with stockpiles down more than 5 million barrels, and it looks like OPEC's production cut is finally biting," said Greg McKenna, chief market strategist at brokerage AxiTrader.

Gold was poised to snap its six-day losing streak amid a wider commodity bounce. The precious metal added 0.3 percent to $1,223.51 following the longest losing streak since October.

* * *

Market Snapshot

- S&P 500 futures down 0.15% to 2,391.75

- STOXX Europe 600 down 0.2% to 395.84

- MXAP up 0.3% to 150.67

- MXAPJ up 0.5% to 493.02

- Nikkei up 0.3% to 19,961.55

- Topix up 0.1% to 1,586.86

- Hang Seng Index up 0.4% to 25,125.55

- Shanghai Composite up 0.3% to 3,061.50

- Sensex up 0.2% to 30,306.64

- Australia S&P/ASX 200 up 0.05% to 5,878.34

- Kospi up 1.2% to 2,296.37

- German 10Y yield rose 3.0 bps to 0.452%

- Euro up 0.1% to 1.0880 per US$

- Italian 10Y yield fell 3.1 bps to 1.955%

- Spanish 10Y yield rose 4.0 bps to 1.646%

- Gold spot up 0.2% to $1,221.34

- U.S. Dollar Index down 0.1% to 99.57

- Brent Futures up 1.55% to $51.00/bbl

Top Overnight News from Bloomberg

- Growth in the euro area will be slightly stronger this year than previously forecast, the European Commission said, adding that some risks to the outlook have eased following the defeat of populist parties in France and the Netherlands

- Bank of England Governor Mark Carney may point to a first- quarter slowdown in economic growth and downside risks to inflation from Brexit and the imminent U.K. election as reasons to avoid rushing into an interest-rate increase

- President Donald Trump’s firing of FBI director James Comey is an unwelcome distraction for a White House already straining to enact its agenda and could hamper its efforts to pass a repeal of Obamacare and cut taxes

- New Zealand’s dollar dropped to an 11-month low after a central bank policy statement was unexpectedly dovish. Canada’s currency weakened after Moody’s Investors Service downgraded six of the nation’s banks

- Calif. Judges Call for Utility Rate Decisions by Jan. 1, 2019

- Florida High-Speed Rail Project Defeats Suit by Two Counties

- JBS Said to Delay New York Initial Offering After Meat Scandal

- BD Prices Offerings of $2.25b Shares, $2.25b Depositary Shares

- Marriott Sees First Few Months of Starwood Merger Positive: COO

- Microsoft Sees FY2017 Commercial Cloud Sales Close to $15b

- Apple Supplier AAC Tumbles After Gotham Short-Selling Report

- Seacor Spinoff to Trade on When-Issued Basis on May 18

- Merck & Co’s Keytruda Combo Wins FDA Approval in Lung Cancer

- Hawthorn Bancshares Declares 4% Stock Dividend

- Abercrombie & Fitch Confirms Receiving Indications of Interest

- Aetna Says It Will Quit All Obamacare Exchanges in 2018

- Intertrust Accelerated Bookbuild Completed

- US Foods Holding Files to Sell 35m Shares for Holders

- Fidelity National Gets IRS Ruling on Tax-Free Distribution Plan

- Adidas Drops Golf Handicap as Buyer Found After Yearlong Search

- Deutsche Telekom CEO Eyeing Up Merger Partners for T- Mobile US

Asia equity markets traded mostly higher following a similar lead in the US where energy outperformed in the wake of the DoEs. This in turn supported energy names in the ASX 200 (+0.1%) with a continued recovery in the largest weighted financials sector also helping the index to stay afloat. Nikkei 225 (+0.3%) remained driven by recent JPY weakness as the index extended on its highest levels last seen in 2015 to draw closer to the 20,000 level. Hang Seng (+0.4%) and Shanghai Comp. (+0.3%) were mixed with the latter weighed amid a slump in Chinese commodity prices and tougher regulatory concerns. 10yr JGBs were lower as safe-haven demand was dampened amid gains in riskier Japanese assets, while the 30yr auction failed to support with the auction prices lower than last month.

Top Asian News

- Moon Seeks to Mend China Ties Over Thaad in Call With Xi

- China April Vehicle Sales Fall 2.2% on Year, CAAM Says

- AAC Technologies Falls After Gotham Questions Profit Margins

- China Sovereign Bond Rout Seen Ending Amid Stress on Economy

- Wage Gains Set to Split Japan Inc. Into Winners and Losers

- Taiwan Stock Index Rises Above 10,000 for First Time in 17 Years

- China Said to Prepare Hong Kong Stock Support for Handover Day

- Nikkei 225 Inches Closer to 20,000 With Yen Near Two-Month Low

- China Small Caps Head for Lowest Close in More Than Two Years

In Europe it has been another morning dictated by earnings updates. Italian banking index has been propelled to the highest level in a year after the likes of UniCredit, Mediobanca and UBI report better than expected profits, as such, this has seen the FTSE MIB outperform against its counterparts. Telco names lag the session thus far amid soft financial figures from BT in which they announced that annual profits fell 19%. Elsewhere, a slew of UK companies are trading without entitlement to their latest dividend pay-out , consequently trimming roughly around 13.7 points off the FTSE 100. In credit markets, the German 10yr benchmark softens on a technical breach above 0.45% with the 10yr notably underperforming across the curve as yields tick up 4.4bps, levels of resistance to the upside reside at 0.5% through to 0.51 % (YTD high). Elsewhere, gilts saw a slight move higher in the wake of the aforementioned soft UK data release.

Top European News

- EU Raises Euro-Area GDP Forecast, Says Risks Are More Balanced

- EU Raises U.K. Growth Outlook, But Warns of Brexit Uncertainty

- Trade Weighs on U.K. Growth as Deficit Widens in First Quarter

- Concerns Over Thyssenkrupp’s Tata Steel Deal Are Spreading

- Hikma, Vectura Drop; Generic Advair Approval Unlikely This Yr

- Credit Agricole Tops Estimates on Mortgage Fees, Capital Markets

- IPIC Says Settlement With 1MDB, Malaysia Now Unconditional

- Gilts Fall Before Industrial Output Data; BOE Decision in Focus

- Hedge Funds Help Zurich Absorb Hit From U.K. Rate Reform

- Deutsche Telekom CEO: Merger Talks With T-Mobile US Very Likely

In currencies, the euro added 0.1 percent to $1.0882 as the Bloomberg Dollar Spot Index fell less than 0.1 percent. The kiwi fell 1.3 percent to 68.49 U.S. cents. The Reserve Bank of New Zealand kept its benchmark rate unchanged and said it will keep rates there for an extended period in expectation that inflation will slow. The Canadian dollar dropped 0.4 percent after Moody’s Investors Service downgraded six Canadian banks. The NZD remains lower by over a percent, to trade at 7-month lows as the RBNZ dispels hawkish speculation by stating that accommodative monetary policy will remain for a considerable amount of time, while Governor Wheeler noted that inflation expectations will have to rise in order to consider tightening. CAD continues to soften with USD/CAD meandering around 1.3700, the impetus this time caused by Moody's downgrading 6 Canadian banks which was prompted by weakening credit conditions in Canada. EUR saw a modest push higher amid the pick in German bund yields which tripped above 0.45%, alongside this, EUR/GBP saw a break above 0.8400. Not so super so far with GBP taking a dip on soft construction, industrial and Mfg. figures, however remains above 1.29 with all eyes on the BoE QIR.

In commodities, West Texas oil rose 1.3 percent to $47.93 a barrel after jumping more than 3 percent Wednesday. Gold added 0.2 percent to $1,221.53 following the longest losing streak since October. Iron ore on SGX AsiaClear in Singapore fell as much as 4.5 percent to $59 a ton, the lowest since October amid a clampdown on leverage in China, the top consumer, and expanding global supply. WTI and Brent crude futures remain at elevated levels post yesterday's DoE report, Brent stalls just before USD 51, WTI briefly breaks above USD 48. Crude prices unfazed by comments out of Iraq in which the oil ministry stated that lifting output to 5mln bpd would not be a conflict with output cut agreement. Elsewhere, Price action across the commodities complex overnight was centred around China as Dalian iron ore futures resumed its recent rout and dropped 5% shortly after the open of metals trade in China. Copper was uneventful, edging minimal gains amid a mostly positive risk tone.

Looking at the day ahead, due out today are the latest economic forecasts from the European Commission. All this comes before the BoE policy meeting at midday. Over in the US the April PPI report is due, along with the latest weekly initial jobless claims print. Away from the data, the Fed’s Dudley is scheduled to speak at 6.25am ET on the topic of globalization. The ECB’s Praet also speaks this afternoon while BoE Governor Carney speaks after the BoE meeting decision. G7 finance ministers also meet in Italy for the start of a three-day meeting today.

US Event Calendar

- 8:30am: PPI Final Demand MoM, est. 0.2%, prior -0.1%

- PPI Ex Food and Energy MoM, est. 0.2%, prior 0.0%

- PPI Ex Food, Energy, Trade MoM, est. 0.2%, prior 0.1%

- PPI Final Demand YoY, est. 2.2%, prior 2.3%

- PPI Ex Food and Energy YoY, est. 1.6%, prior 1.6%

- PPI Ex Food, Energy, Trade YoY, prior 1.7%

- 8:30am: Initial Jobless Claims, est. 245,000, prior 238,000; Continuing Claims, est. 1.98m, prior 1.96m

- 9:45am: Bloomberg Consumer Comfort, prior 50.9

DB's Jim Reid concludes the overnight wrap

Despite an initial dip lower at the start, US equity markets were fairly unmoved by that news of President Trump dismissing FBI Director James Comey despite it potentially taking the focus away from some of the more market focused reform stuff. Instead it was Oil which was the big mover in an otherwise very quiet today yesterday. WTI rallied +3.16% to close at $47.33/bbl and back to the highest closing level since last Wednesday (although still remains some 12% off last month’s highs). The move higher yesterday came following the some supportive EIA data which revealed that US crude stockpiles declined by the most in a single week this year.

That data came out towards the end of the European session after we had already seen European bond yields generally edge lower (Bunds -1bp, Peripherals -2-3bps) on the back of decent auction demand. ECB President Draghi’s speech at the Dutch parliament didn’t really move the dial with the President not really shedding any light on policy and instead repeating the mantra that monetary policy needs to remain accommodative to build underlying inflation pressures which continue to remain benign. Treasury yields were also tracking the move in European yields however that move in Oil helped yields climb into the close, along with a fairly weak 10y auction. 10y yields finished at 2.414% which was about 5bps off the intraday lows.

Whether or not markets are a bit more exciting today might depend on if the BoE surprises in any sense when they deliver their MPC meeting outcome along with the minutes and an updated inflation report. Our economists caution against assuming that the weaker than expected Q1 GDP report and recent sterling appreciation (equating to less imported inflation) will substantially alter the sense of declining tolerance for higher inflation. They note that on the one hand the first estimate of UK GDP is notoriously inaccurate and the latest PMI data is more consistent with the MPC’s recently more constructive stance on growth.

On the other hand, sterling appreciation would mean lower inflation all else unchanged. However, other things have changed and our team expect the MPC forecasts for inflation to rise further above target in 2017 and 2018. In summary, their expectation for what we get today is as follows: (1) Interest rates and asset purchases to remain unchanged. (2) The “balanced risks” assessment to remain unchanged. (3) Kirsten Forbes to maintain her vote for a 25bp policy rate hike. They see significant risk that Michael Saunders will start voting for a hike also in the next few months; it cannot be ruled out that he votes for it in May. (4) They expect the sentence that “some members” could consider a more rapid tightening of policy to remain. (5) The concessions towards a more positive economic performance to remain in the minutes despite the weaker Q1 GDP number. (6) A repeat of the statement in the minutes that “some modest withdrawal of monetary stimulus over the course of the forecast period remains appropriate”.

That meeting is due at 12pm BST, followed by Governor Carney speaking shortly after. Before we get there, it's a familiar story playing out in Asia this morning with most major bourses firmer, with the exception of China. The Nikkei (+0.15%), Hang Seng (+0.62%), Kospi (+1.01%) and ASX (+0.49%) are all higher with a consistent theme being the strong rally for energy names, however in China the Shanghai Comp is -0.36%. That in part may reflect the news that the PBoC is increasing its coordination with the banking, securities and insurance regulators in China on implementing fresh regulations. It’s worth noting that the Shanghai Comp is on course for its lowest close since September 2016 while the Hang Seng is at the highest level since July 2015. US equity futures are little changed this morning.

Moving on. The Fedspeak yesterday was again mostly focused on the non-voting Boston Fed’s Rosengren (who appears to have been particularly busy this week). The most significant takeaway from his speech was his mention of unwinding the balance sheet as being “appropriate” after one more rate hike (his call is for 3 more this year to prevent any overheating). Away from this and with regards to the macro data, in the US the import price index was revealed as rising more than expected in April (+0.5% mom vs. +0.1% expected) with ex-petroleum also high at +0.4% mom. The other data released was the federal budget which showed a budget surplus of $182bn which was more or less in line with market expectations.

Staying with the US, it’s worth highlighting that yesterday our US economists made changes to their forecasts in light of recent economic data and other developments. They argue that the passage of legislation entailing a substantial tax cut and significant fiscal stimulus now seems much less likely than it did in the wake of the US election results. Accordingly, they have marked down their forecast for US growth this year by a couple tenths (to a still above-consensus 2½%) and for 2018 by a full percentage point (to 2¼%). Despite the markdown of their growth forecast, their outlook for unemployment, inflation, and the Fed has moved in a slightly more hawkish direction. This is partly because smaller tax cuts and lower investment spending yield smaller gains in labour productivity and a slower pick up in supply-side growth. But they also think that the cyclical rebound in labour force participation now appears to have less room to run than they had assumed previously, resulting in an unemployment rate that falls noticeably below 4% next year. Recent soft inflation prints will weigh on core inflation in the near-term, which, combined with recent commodity price softness, will lower headline inflation. But they expect an uptrend in core inflation to resume later this year, with core PCE rising above the Fed's 2% inflation target by end-2018. Their Fed outlook remains more hawkish than that implied by the median dot in the Fed’s own projections. They continue to expect two more rate hikes this year with the next occurring in June, and the Fed should announce the start of phasing out its reinvestment policy by year-end. In 2018, they expect the Fed to raise rates four times.

Looking at the day ahead, this morning in Europe the main data of note is from the UK where the March industrial and manufacturing production report is due (both expected to decline slightly) along with the March trade balance reading. Also due out today are the latest economic forecasts from the European Commission. All this comes before the aforementioned BoE policy meeting at midday. Over in the US this afternoon the April PPI report is due, along with the latest weekly initial jobless claims print. Away from the data, the Fed’s Dudley is scheduled to speak at 11.25am BST on the topic of globalization. The ECB’s Praet also speaks this afternoon while BoE Governor Carney speaks after the BoE meeting decision. G7 finance ministers also meet in Italy for the start of a three-day meeting today.