Crude oil prices rose over 25% last week and as I sit down to write this evening the overnight futures are up another 8% to around $125. Almost every other commodity on the planet rose in prices last week too, as did the dollar. Those two factors – rising dollar and rising commodity prices – mean the likelihood of recession in the coming year has risen significantly in just the last week. Rising oil prices, in particular, have been a regular feature of past...

Read More »Reserve Bank of Australia’s upbeat stance turns upside down

Dovish signals on monetary policy reduce upside for the Australian dollar.On 6 February, Philip Lowe, governor of the Reserve Bank of Australia (RBA), sent clear dovish signals, indicating that a rate cut was now as probable as a rate hike. This led to a significant decline in the Australian dollar. This change in the RBA’s stance highlights increasing concerns around the Australian economic outlook.This change in monetary stance mostly reflects increasing concerns over the accumulation of...

Read More »Weekly Technical Analysis: 04/06/2018 – USD/CHF, EUR/JPY, GBP/USD, AUD/USD, WTI

USD/CHF The USDCHF pair managed to break 0.9850 level and closed the daily candlestick below it, which supports the continuation of our bearish overview efficiently in the upcoming period, paving the way to head towards 0.9723 level as a next station, noting that the EMA50 supports the expected decline, which will remain valid for today conditioned by the price stability below 0.9870. Expected trading range for today...

Read More »Weekly Technical Analysis: 21/05/2018 – USD/JPY, EUR/USD, GBP/JPY, USD/CAD, USD/CHF

USD/CHF The USDCHF pair reaches the key support 0.9955 now, and as we mentioned in our last report, breaking this level will confirm completing the double top pattern that appears on the chart, to rally towards our negative targets that begin at 0.9900 and extend to 0.9850. Therefore, we will continue to suggest the bearish trend supported by the negative pressure formed by the EMA50, unless the price managed to rally...

Read More »Weekly Technical Analysis: 14/05/2018 – USD/JPY, EUR/USD, EUR/JPY, GBP/USD, USD/CHF

USD/CHF The USDCHF pair provided positive trading yesterday to test 1.0000 level and settles around it, and as long as the price is below this level, our bearish overview will remain valid, noting that our next target is located at 0.9900, while breaching 1.0000 followed by 1.0055 levels represent the key to regain the main bullish trend again. Expected trading range for today is between 0.9920 support and 1.0055...

Read More »Weekly Technical Analysis: 07/05/2018 – USD/JPY, EUR/USD, GBP/USD, Gold

USD/CHF The USDCHF pair’s recent trades are confined within mew minor bearish channel that we believe it forms bullish flag pattern, thus, the price needs to breach 1.0035 to activate the positive effect of this pattern followed by rallying towards our waited target at 1.0100. Therefore, we will continue to suggest the bullish trend supported by the EMA50, unless we witnessed clear break and hold below 1.0000. Expected...

Read More »Weekly Technical Analysis: 23/04/2018 – USD/JPY, EUR/USD, GBP/USD, AUD/USD, WTI oil futures

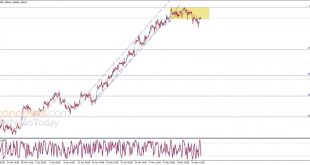

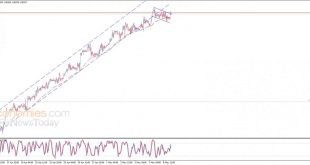

USD/CHF The USDCHF pair touched the bullish channel’s resistance that appears on the chart, and the price might be forced to show some temporary decline to test the support base formed above 0.9790 before resuming the rise again. In general, we will continue to suggest the bullish trend supported by the EMA50, depending on the organized trading inside the mentioned bullish channel, noting that our next target is...

Read More »Weekly Technical Analysis: 16/04/2018 – USD/JPY, EUR/GBP, GBP/USD, USD/CAD, USD/CHF

USD/CHF The USDCHF pair breached 0.9675 level and closed the daily candlestick above it, to open the way to achieve more rise in the upcoming sessions, paving the way to head towards 0.9790 as a next main station. Therefore, the bullish trend will be suggested, supported by the EMA50, noting that breaking 0.9675 and holding below it will push the price to test 0.9581 level before determining the next trend clearly....

Read More »Weekly Technical Analysis: 02/04/2018 – Gold, WTI Oil Futures, GER30 Index, USD/JPY

USD/CHF The USDCHF pair attempted to breach 0.9581 level yesterday but it returns to move below it now, which keeps the bearish trend scenario valid until now, supported by stochastic move within the overbought areas, waiting to head towards 0.9488 as a first target. We reminding you that confirming breaching 0.9581 will push the price to visit 61.8% Fibonacci correction level at 0.9675 before any new attempt to...

Read More »Weekly Technical Analysis: 26/03/2018 – USD/JPY, EUR/USD, GBP/USD, AUD/JPY, GBP/JPY, USD/CHF

USD/CHF The USDCHF pair provided negative trades after 0.9488 proved its strength against the recent positive attempts, to keep the bearish trend scenario valid efficiently in the upcoming period, supported by the EMA50 that pushes negatively on the price, waiting to test 0.9373 initially. Breaking the mentioned level will extend the bearish wave to reach 0.9300 as a next station, while holding below 0.9488...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org