Overview: Escalating tensions in Europe and comments from Bank of Japan Ueda that spurred speculation of a December hike are the main drivers of the foreign exchange market today. The yen is the strongest of the G10 currencies, up about 0.65%, while the euro is the weakest, off a little more than 0.25%, and sterling is down almost as much. Most of the other G10 currencies are little changed. Led by central European currencies, most emerging market currencies are...

Read More »“A Macroeconomic Perspective on Retail CBDC and the Digital Euro,” EIZ, 2023

In Christos V. Gortsos and Rolf Sethe, editors: Central Bank Digital Currencies, EIZ Publishing, ch. 3, Zurich, October 2023. PDF.

Read More »Weekly Market Pulse: A Fatal Conceit

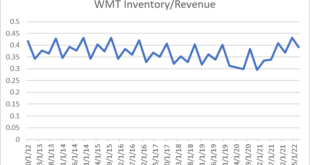

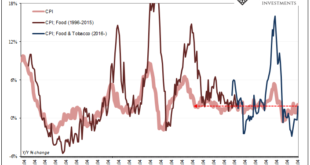

Inflation* in the US is falling rapidly with the CPI rising just 0.9% in the second half of 2022 versus 5.4% in the first six months. Existing home sales are down 14.6% in the last 3 months and 34% over the last year. Housing starts are down 22% and permits are down 30% year-over-year. Orders for durable goods are down 1.2%, exports are down 3.8%, and imports are down 4.3% over the last 3 months. Real disposable income is up 0.8% in the last six months but was down...

Read More »50 Jahre und kein bisschen weiter?

Am 23. Januar 1973, einem trübkalten Dienstag, um 08.30 Uhr fand in der Schweiz ein Staatsstreich statt – mehr oder weniger unfreiwillig, von der Öffentlichkeit kaum beachtet, und nur als provisorisch gedacht. Putschistin contre coeur war die Schweizerische Nationalbank. Nach kurzer Rücksprache mit dem Bundesrat teilte sie den Banken mit, dass sie “heute darauf verzichtet, ihre Interventionen am Dollarmarkt aufzunehmen. Sie wird sich vom Markte fernhalten, bis eine Beruhigung eingetreten...

Read More »Weekly Market Pulse: Currency Illusion

When we think about the challenges facing an investor today, the big problems, the things we worry about that could cause a lot more harm than some interest rate hikes, are mostly outside the United States. China is prominent this weekend because of demonstrations against their zero COVID policies. The Chinese people appear to be pretty well fed up with the endless lockdowns and have finally decided to try and do something about it. Unfortunately, I’m not sure...

Read More »Weekly Market Pulse: The Real Reason The Fed Should Pause

The Federal Reserve has been on a mission lately to make sure everyone knows they are serious about killing the inflation they created. Over the last two weeks, Federal Reserve officials delivered 37 speeches, all of the speakers competing to see who could be the most hawkish. Interest rates are going up they said, no matter how much it hurts, no matter how many people have to be put on the unemployment line, because that’s the only way to kill this inflation, to...

Read More »EUR/CHF forecast to 0.93 (Swiss National Bank to hike rates in September and December)

This via the folks at eFX. Danske forecast via eFX: “We expect the SNB to hike by 50bp again in September and December to curtail underlying inflation pressures bringing the policy rate to 0.75%. With the SNB broadly following the ECB, we see relative rates as an inferior driver for the cross,” Danske notes. “We continue to forecast the cross to move lower on the back of fundamentals and a tighter global investment environment. We thus lower our overall forecast...

Read More »FX Daily, July 8: Abe’s Assassination Shocks the World

Swiss Franc The Euro has risen by 0.14% to 0.9906 CHF. EUR/CHF and USD/CHF, July 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge Overview: News that former Prime Minister Abe was assassinated while campaigning in Japan ahead of the weekend election shocked the nation and world. The immediate market impact looks minimal. Asia Pacific equities mostly advanced. Chinese stocks were the main exception and generally underperformed the...

Read More »Is Gold Starting to Behave Itself?

Gold is doing what it is supposed to do! Equity markets are tumbling, “NASDAQ 100 Rout Erases $1.5 Trillion in Market Value in 3 Days” reads one Bloomberg headline. The big names such as Apple lost over US$225 billion, Microsoft almost US$200 billion, Amazon and Tesla each lost US$175 billion market value over the three trading days from May 4 to May 9. Bonds are also declining in value as yields are rising. The market selloff has been the most extreme in the tech...

Read More »Synchronizing Chinese Prices (and consequences)

It isn’t just the vast difference between Chinese consumer prices and those in the US or Europe, China’s CPI has been categorically distinct from China’s PPI, too. That distance hints at the real problem which the whole is just now beginning to confront, having been lulled into an inflationary illusion made up from all these things. To start with, yesterday China’s NBS reported the index for its consumer prices rose 2.1% year-over-year in April 2022. That’s up from...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org