The near-term impact will likely be limited but this is a clear negative for trade negotiations. Shortly after the renminbi’s sharp depreciation on Monday, the US Treasury Department labelled China a currency manipulator. This is the first time in 25 years that the US government has designated a country as a currency manipulator. According to the US Treasury Department, the decision was triggered by the perceived lack...

Read More »Currency update – the Chinese renminbi

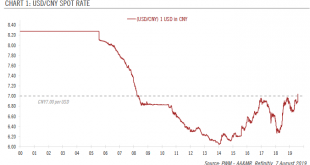

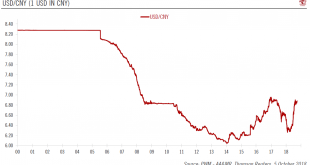

Despite the CNY’s recent fall, we believe the People’s Bank of China will refrain from competitive devaluation Following US President Donald Trump’s announcement of a new 10% tariff on USD300 billion of Chinese goods, the Chinese renminbi (rmb) weakened sharply and breached CNY7.00 per USD. The recent rmb move, in our view, represents a major shift in the People’s Bank of China’s (PBoC) currency policy, reflecting the...

Read More »The US labels China a currency manipulator

The near-term impact will likely be limited but this is a clear negative for trade negotiations.Shortly after the renminbi’s sharp depreciation on Monday, the US Treasury Department labelled China a currency manipulator. This is the first time in 25 years that the US government has designated a country as a currency manipulator.According to the US Treasury Department, the decision was triggered by the perceived lack of action by the PBoC to resist the renminbi depreciation. Given that the US...

Read More »Currency update – the Chinese renminbi

Despite the CNY's recent fall, we believe the People's Bank of China will refrain from competitive devaluationFollowing US President Donald Trump’s announcement of a new 10% tariff on USD300 billion of Chinese goods, the Chinese renminbi (rmb) weakened sharply and breached CNY7.00 per USD.The recent rmb move, in our view, represents a major shift in the People’s Bank of China’s (PBoC) currency policy, reflecting the deteriorating outlook for trade negotiations with the US and the resulting...

Read More »China: Q1 growth beats expectations

The Chinese economy grew at a faster rate than expected in the first quarter as policy stimulus effects kick in. The National Bureau of Statistics of China published Q1 GDP figures along with some key economic indicators for March. The data generally surprised on the upside. While we had previously flagged the upside risk to our earlier GDP forecast following the rebound in PMIs and strong credit numbers, the latest...

Read More »China: Q1 growth beats expectations

The Chinese economy grew at a faster rate than expected in the first quarter as policy stimulus effects kick in.The National Bureau of Statistics of China published Q1 GDP figures along with some key economic indicators for March. The data generally surprised on the upside. While we had previously flagged the upside risk to our earlier GDP forecast following the rebound in PMIs and strong credit numbers, the latest data releases still surprised to the upside. In light of the strong Q1...

Read More »Inflation Environment remains Benign in China

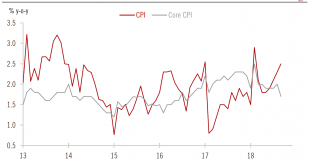

Inflation is unlikely to be a constraint on central bank’s policy. The headline consumer price index (CPI) in China picked up slightly in September, rising by 2.5% year-over-year (y-o-y) compared with 2.3% in August, driven by higher food price and fuel prices. Excluding food and energy, core inflation in China actually eased to 1.7% y-o-y in September from 2.0% in August. Looking forward, we see some moderate upward...

Read More »Inflation environment remains benign in China

Inflation is unlikely to be a constraint on central bank’s policy.The headline consumer price index (CPI) in China picked up slightly in September, rising by 2.5% year-over-year (y-o-y) compared with 2.3% in August, driven by higher food price and fuel prices. Excluding food and energy, core inflation in China actually eased to 1.7% y-o-y in September from 2.0% in August.Looking forward, we see some moderate upward pressure on Chinese headline inflation due to tariffs on US imports and...

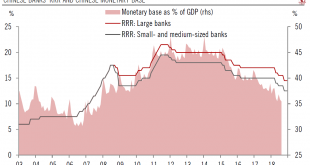

Read More »No massive monetary stimulus on the way from the PBoC

The latest cut in banks’ required reserve ratios seems likely to have been motivated by additional signs of slowdown in the Chinese economy, but may not herald a massive monetary stimulus.Over the weekend, the People’s Bank of China (PBoC) announced a cut of 100 basis points (bps) in banks’ required reserve ratio (RRR). This is the third RRR cut since April. The PBoC estimates that it will free up about Rmb 750 billion of net new liquidity in the banking system. According to the central...

Read More »Renminbi nears a psychological threshold

The People’s Bank of China is unlikely to welcome further currency weakness.Having dropped more than 5% year to date, our scenario of weaker growth in China in 2019 (we expect GDP growth to decline to 6.1% from 6.6% in 2018) is likely to further weigh on the renminbi through the interest rate differential. The Chinese current account is unlikely to provide much relief, as it has moved into deficit in 2018. However, given that the renminbi is around 10% off its recent peak, a further sharp...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org