Following this week’s sharp movement in the USD overnight repurchase agreement (repo) rate, people are wondering what the US Federal Reserve (Fed) can do to counter a similar event in the future.One measure of the USD overnight repo rate (there exist several) spiked to 6% on Tuesday 17 September, probably due a scarcity of bank reserves at the Fed at a time when US corporates needed cash to pay their taxes as did investors/banks (probably to absorb strong US Treasury issuance. Hence, cash became dearer, and its scarcity led to a spike in the overnight repo rate. It is unusual to see such a spike in September, although it is quite normal at the end of each calendar year. There was a similar sharp rise in September 2008, coinciding with the Lehman Brothers collapse. At this stage we do not

Topics:

Laureline Chatelain considers the following as important: Fed quantitative tightening, Macroview, Quantitative Easing, Repo rate, US bond issuance

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: Is This A Bear Market?

Joseph Y. Calhoun writes Weekly Market Pulse: Has Inflation Peaked?

Joseph Y. Calhoun writes Weekly Market Pulse: Discounting The Future

Cesar Perez Ruiz writes Weekly View – Big Splits

Following this week’s sharp movement in the USD overnight repurchase agreement (repo) rate, people are wondering what the US Federal Reserve (Fed) can do to counter a similar event in the future.

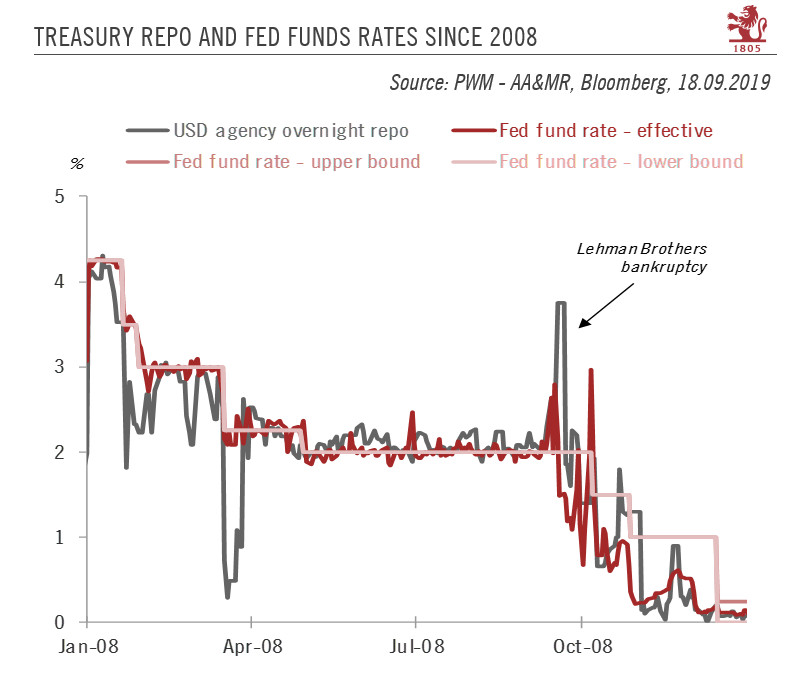

One measure of the USD overnight repo rate (there exist several) spiked to 6% on Tuesday 17 September, probably due a scarcity of bank reserves at the Fed at a time when US corporates needed cash to pay their taxes as did investors/banks (probably to absorb strong US Treasury issuance. Hence, cash became dearer, and its scarcity led to a spike in the overnight repo rate. It is unusual to see such a spike in September, although it is quite normal at the end of each calendar year. There was a similar sharp rise in September 2008, coinciding with the Lehman Brothers collapse. At this stage we do not see the latest episode as a sign of financial market stress linked to impaired interbank lending.

In response to this week’s events, we now see the Fed expanding the bank reserves it holds through a one-off purchase of US Treasuries, probably of the order of USD400 bn. This could be announced at the next Federal Open Market Committee meeting in October. Adding to that amount, it may reinvest maturing mortgage-backed securities into Treasuries (to the tune of around USD112 bn). We therefore expect the Fed to purchase net USD512 bn of Treasuries, having bought none in 2018. Quantitative tightening is over, say hello to “shadow” quantitative easing.

Overall, renewed Fed purchases of T-bonds would mean the Fed reducing net new paper available to the market, in sharp contrast to last year (marked by quantitative tightening) and in spite of rising Treasury issuance due to the ballooning US fiscal deficit. The volume of net new Treasuries available to the market will be USD600-700 bn this year and next, taking Fed actions into account. This is in sharp contrast to last year when the reduction in the Fed’s reinvestments (as part of quantitative tightening) ’added’ to the net supply of T-bonds.

We reiterate our year-end forecast of 1.4% for the 10-year US Treasury yield, with risks to the downside as a recent rebound to 1.8% has materialised faster than expected.