In our post on August 11 titled End of an ERA: The Bretton Woods System and Gold Standard Exchange, we discussed the significance of then-President Nixon’s action of closing the gold window thereby ending the Bretton Woods Monetary system. Under the Bretton Woods monetary system, central banks could exchange their US dollar reserves for gold. This also ended the gold fixed price of US$35 per ounce. This week we explore the two questions that concluded last week’s...

Read More »BIS Finds Global Debt May Be Underreported By $14 Trillion

In its latest annual summary published at the end of June, the IIF found that total nominal global debt had risen to a new all time high of $217 trillion, or 327% of global GDP... ... largely as a result of an unprecedented increase in emerging market leverage. While the continued growth in debt in zero interest rate world is hardly surprising, what was notable is that debt within the developed world appeared to have peaked, if not declined modestly in the latest 5 year period. However,...

Read More »Forget Tulips & Bitcoin – Here’s The Real Bubble

While the broader market for Swiss stocks has risen modestly this year, one ‘entity’ has outperformed its peers by such a staggering margin, it has left bamboozled market experts struggling for an explanation. And that company is…the Swiss National Bank. The price of a share in Swiss National Bank in August rose above 3,000 francs ($3,143) for the first time, more than double the level of a year ago, and up 50% since...

Read More »Forget Tulips & Bitcoin – Here’s The Real Bubble

While the broader market for Swiss stocks has risen modestly this year, one 'entity' has outperformed its peers by such a staggering margin, it has left bamboozled market experts struggling for an explanation. And that company is…the Swiss National Bank. The price of a share in Swiss National Bank in August rose above 3,000 francs ($3,143) for the first time, more than double the level of a year ago, and up 50% since mid-July, as the Financial Times noted in a story about its...

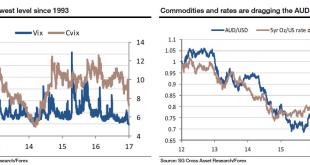

Read More »SocGen: Beware The Ghost Of 1993

With Monday’s financial media blasting reports about the VIX collapse to levels not seen in 24 years, going all the way back to 1993, it is worth remembering that the near record low volatility collapse of 1993 did not end well either for stocks, or for bonds, with the great 1994 bond tantrum. Reminding us of that, and of broader implications for the cross-asset space, is SocGen’s Kit Juckes with his overnight note,...

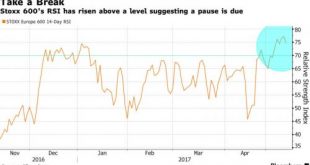

Read More »Europe, US Futures Slip Despite Brent Bouncing Back To $51

Asian stocks rose lifted by commodity names; European equities trade mostly lower but with little in the way of conviction or firm direction while the Italian banking index is at the highest level in a year following domestic earnings; S&P index futures are modestly in the red after the cash market closed at a record high Wednesday and investors prepared for earnings from retailers; we expect the now general vol selling program to promptly lift the S&P into new all time highs minutes...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org