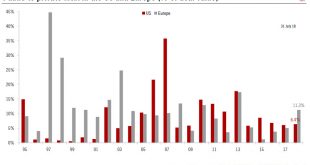

Despite a disappointing equity market performance this year, M&A activity remains buoyant.Mergers and acquisitions (M&A) activity has proven resilient so far this year, despite higher volatility and lower equity returns. However, the derating of equities has neither depressed target valuations nor premiums paid by acquirers, particularly in Europe. The acceleration of M&A in 2018 could even approach the previous peak reached in 2015, at around USD 1.2 trillion in the US.Since...

Read More »SNB: It’s A Bonfire Of The Absurdities

Authored by John Mauldin via MauldinEconomics.com, “Vanity of vanities, saith the Preacher, vanity of vanities; all is vanity.” – Ecclesiastes 1:2, King James Version (attributed to King Solomon in his old age) This week’s letter will take a look at the growing number of ridiculous, inane, and otherwise nonsensical absurdities that fill the daily economic headlines. I have gone from the occasional smile to scratching my...

Read More »SNB: It’s A Bonfire Of The Absurdities

Authored by John Mauldin via MauldinEconomics.com, “Vanity of vanities, saith the Preacher, vanity of vanities; all is vanity.” – Ecclesiastes 1:2, King James Version (attributed to King Solomon in his old age) This week’s letter will take a look at the growing number of ridiculous, inane, and otherwise nonsensical absurdities that fill the daily economic headlines. I have gone from the occasional smile to scratching my...

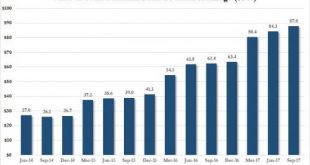

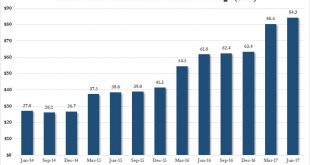

Read More »The Swiss National Bank Now Owns A Record $88 Billion In US Stocks

In the third quarter of 2017, one in which the global economy was supposedly undergoing an unprecedented “coordinated growth spurt”, and in which central banks were preparing to unveil their QE tapering intentions, in the case of the ECB, or raising rates outright, at the Fed, what was really taking place was another central bank buying spree meant to boost confidence that things are now back to normal, using “money”...

Read More »Dollar Surge Continues Ahead Of Jobs Report; Europe Dips As Catalan Fears Return

World stocks eased back from record highs and fell for the first time in eight days, as jitters about Catalonia’s independence push returned while bets on higher U.S. interest rates sent the dollar to its highest since mid August; S&P 500 futures were modestly in the red – as they have been every day this week before levitating to record highs – ahead of hurricane-distorted nonfarm payrolls data (full preview here)....

Read More »“Under Any Analysis, It’s Insanity”: What War With North Korea Could Look Like

Now that the possibility of a war between the US and North Korea seems just one harshly worded tweet away, and the window of opportunity for a diplomatic solution, as well as for the US stopping Kim Jong-Un from obtaining a nuclear-armed ICBM closing fast, analysts have started to analyze President Trump’s military options, what a war between the US and North Korea would look like, and what the global economic...

Read More »“Mystery” Central Bank Buyer Revealed: SNB Now Owns A Record $84 Billion In US Stocks

In the second quarter of the year, one in which unlike in Q1 fund flows showed a persistent and perplexing outflow from US stocks and into European and Emerging Markets, a trading desk rumor emerged that even as institutional traders dumped stocks and retail investors piled into ETFs, a “mystery” central bank was quietly bidding up risk assets by aggressively buying stocks. And no, it was not the BOJ: the Japanese...

Read More »Risk Off: Global Stocks Slide As “Fire And Fury” Results In “Selling And Fear”

US futures are set for a sharply lower open (at least in recent market terms) following a steep decline in European stocks and a selloff in Asian shares, following yesterday’s sharp escalation in the war of words between the U.S. and North Korea. In a broad risk-off move U.S. Treasuries rose, the VIX surged above 12 overnight, while German bund futures climbed to the highest level in six weeks. The Swiss franc gained...

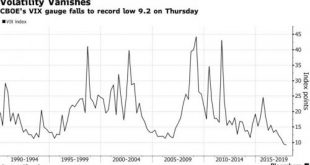

Read More »When Do We Know These Are Delusional Markets

Latest Investment Outlook In his latest investment outlook, Fasanara Capital’s Franceso Filia, who two months ago explained in one chart how the “fake market” operates… … discuss what happens when a “Twin Bubble meets quantitative tightening” and answers why record-low volatility breeds market fragility and precedes system instability. We’ll have more to share on that shortly, but for now, here is Filia with his take...

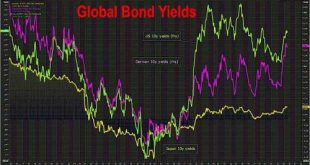

Read More »Bond Selloff Returns As EM Fears Rise; Oil Slides; BOJ Does Not Intervene

U.S. index futures point slightly lower open. Asian shares rose while stocks in Europe fell as energy producers got caught in a downdraft in oil prices and reversed an earlier gain after Goldman unexpectedly warned that WTI could slide below $40 absent "show and awe" from OPEC. The dollar rose, hitting a four-month high against the yen and bonds and top emerging market currencies were back under pressure on Tuesday, following last week’s hawkish rhetoric from central bankers. Nonetheless,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org