Overview: The US dollar has extended its post-employment gains today, helped by firmer rates and several countries seeing downward revisions from the preliminary May PMI. The greenback is trading with a firmer bias against all the G10 currencies and most of the emerging market currencies, including Turkey, India, and China. July WTI gapped higher after the Saudi Arabia announced a voluntary and unilateral cut of one million barrels a day in output starting next...

Read More »Greenback Extends Recovery

Overview: The honeymoon for risk assets that began the year ended with a bang at the end of last week with the monster US jobs report and the rebound in the service ISM. Disappointing news from several large US tech companies provided extra encouragement. The yen's weakness helped Japanese stocks today, but the other larger bourses in the Asia Pacific area were sold, with losses in Hong Kong, the CSI 300, South Korea, and Taiwan off more than 1%. Europe's Stoxx 600...

Read More »China Steps away from the Abyss and Animal Spirits are Rekindled

Overview: Chinese officials using the carrot and the stick have succeeded in dampening the protests and easing some anxiety and rekindled the animal spirits. Hong Kong’s Hang Seng rallied 5.25% and its index of mainland shares surged 6.20%. South Korea and Taiwan indices gained more than 1%. Among the large bourses, only Japan failed to advance. Softer than expected Spanish and German inflation may also be helping the Stoxx 600 recoup around half of yesterday’s...

Read More »No Rest for the Weary: The Week Ahead

In Volcker’s days, when he used money supply to justify tightening monetary policy despite high unemployment, the money supply was released while markets were open, and it was The report. Later, by the mid-1980s, leading up to the Plaza Agreement, the deterioration of the US monthly trade balance was critical. It became The report. For several years now, the monthly jobs report superseded it. It is the first hard data for a new month and often sets the tone for the...

Read More »Volatility Snaps Near-Term Conviction

Overview: The markets seem to lack conviction today. Stocks in the Asian Pacific region advanced. Europe’s Stoxx 600 is giving up its earlier advance, and US futures are heavier. Australian and New Zealand bonds played catch-up after the rise in the US and Europe yesterday. Their benchmark yield rose 14 bp and 10 bp, respectively. The US 10-year Treasury yield is firm near 3.77%, while European bonds are narrowly mixed, though Gilts are under pressure. The 10-year...

Read More »Aussie Hit with Profit-Taking after RBA Hikes 50 bp

Overview: Speaker Pelosi's visit to Taiwan has added to the risk-off mood of the capital markets today. Most of the large Asia Pacific equities sold off, with Australia and India being notable exceptions. Europe's Stoxx 600 is off for the second consecutive session, and by the most (~0.60%) since mid-July. US futures are also weaker. Benchmark 10-year rates are lower. The 10-year Treasury is off a couple of basis points to below 2.55%, while European yields are...

Read More »Dollar Gains Pared

Overview: Asia Pacific equities were mostly lower. China and India bucked the trend. Europe’s Stoxx 600 is steady with no follow through selling after yesterday reversal. US index futures are posting modest gains and are trying to snap a two-day drop. The US 10-year yield is firm at 2.91%, while European benchmark rates are 2-3 bp higher. Asia Pacific bonds were dragged lower by the sell-off in the US yesterday. The dollar is broadly lower. The Swedish krona...

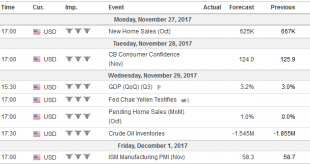

Read More »FX Daily, December 1: No Follow-Through After Month-End Adjustments

Swiss Franc The Euro has fallen by 0.06% to 1.0837 EUR/CHF and USD/CHF, December 1 (see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The near-record rallies seen in the major equity markets in November may have contributed to the month-end drama yesterday. There has been no follow-through activity. Stocks bounced back, and the US dollar is heavy, with few exceptions. In the Asia Pacific region, all the...

Read More »OPEC+ discipline will be key for oil prices in 2019

An extension of the December agreement to cut production, plus a slight increase in demand, could potentially bring the oil market into balance this year.Global oil supply is undergoing a structural shift. The US oil industry is growing in importance relative to the OPEC. As a result increased production from non-OPEC producers more than compensated for the output collapse among important OPEC producers such as Iran and Venezuela in 2018.Slowing global growth, and new US pipelines facilities...

Read More »FX Weekly Preview: Events + Market = Potential for Combustible Price action

There are a number of events and economic reports in the week ahead that will help shape the investment climate in the weeks and months ahead. In recognition of the importance of initial conditions, let’s briefly summarize the performance of the dollar and main asset markets. After recovering from a five-month decline in September and October, the dollar has lost ground against all the major currencies here in November,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org