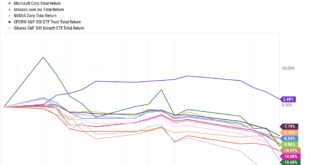

Stocks had a rip snorter of a rally last week and a lot of people are pondering the question in the title over this long weekend. The S&P 500 was down 20.9% from intraday high (4818.62, January 4th) to intraday low (3810.32, May 20th). From that intraday low the market has risen 9.1% in just six trading days. That still leaves the market 13.7% from the intraday high and most investors still down double digits on the year (-11.5% for the standard 60/40 portfolio)....

Read More »Weekly Market Pulse: Fear Makes A Comeback

Fear tends to manifest itself much more quickly than greed, so volatile markets tend to be on the downside. In up markets, volatility tends to gradually decline. Philip Roth Be fearful when others are greedy and be greedy when others are fearful. Warren Buffett The new year hasn’t gotten off to a great start for growth stocks or any of the other speculative assets that have drawn so much attention over the last couple of years. Bitcoin is down 25% since the...

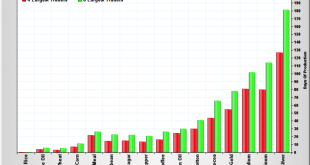

Read More »Why Are People Now Selling Their Silver? Report 15 Sep

This week, the prices of the metals fell further, with gold -$18 and silver -$0.73. On May 28, the price of silver hit its nadir, of $14.30. From the last three days of May through Sep 4, the price rose to $19.65. This was a gain of $5.35, or +37%. Congratulations to everyone who bought silver on May 28 and who sold it on Sep 4. To those who believe gold and silver are money (as we do) the rising price of silver may seem right as rain. Why shouldn’t the dollar go...

Read More »Bi-Weekly Economic Review: Investing Is Not A Game of Perfect

The market volatility this year has been blamed on a lot of factors. The initial selloff was blamed on a hotter than expected wage number in the January employment report that supposedly sparked concerns about inflation – although a similar number this month wasn’t mentioned as a cause of last Friday’s selling. The unwinding of the short volatility trade exacerbated the situation and voila, 12% came off the market in a...

Read More »Bi-Weekly Economic Review: One Down, Three To Go

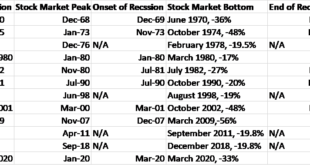

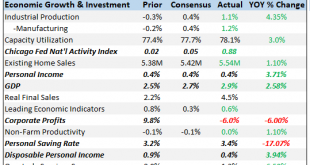

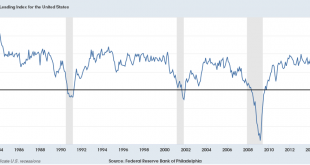

Economic Reports Economic Growth & Investment We pay particular attention to broad based indicators of growth. The Chicago Fed National Activity Index and the Conference Board’s Leading Economic Indicators are examples. We watch them because we are mostly interested in identifying inflection points in the broad economy and aren’t as interested in the details. Why? Because, while bear markets do happen outside of...

Read More »Great Graphic: FX Vol Elevated, but Still Modest

Summary: FX implied vol bottomed before the VIX took off. FX vol is at the highs for the year, but euro and yen vol is lower than last September. Sterling vol has risen the most. With the substantial swings in the volatility of equities that have captured the imagination of journalists and punished investors who bought financial derivatives that profited from the low vol environment, we thought it would be...

Read More »Global Asset Allocation Update:

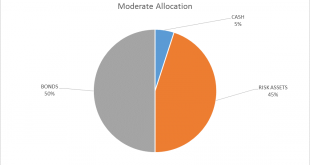

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. Despite the selloff of the last week I don’t believe any portfolio action is warranted. While the overbought condition has largely been corrected now, the S&P 500 is far from the opposite condition, oversold. At the lows this morning, the S&P 500 was officially in...

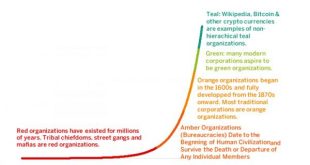

Read More »If Bitcoin Is A Bubble…

Our earlier articles on bitcoin discuss the crypto asset as a currency and a commodity. Both papers focused on the consequences of bitcoin’s defining feature: the asymptotic supply limit of 21 million coins. This gives it an unusual juxtaposition of demand uncertainty and supply certainty (as well as inelasticity). As a currency, it gives rise to a tension between its use as a store of value and as medium of exchange....

Read More »Buy Gold, Silver Time After Speculators Reduce Longs and Banks Reduce Shorts

Buy Gold, Silver Time After Speculators Reduce Longs and Banks Reduce Shorts – Gold and silver COT suggests bottoming and price rally coming– Speculators cut way back on long positions and added to short bets– Commercials/banks significantly reduced short positions– Commercial net short position saw biggest one-week decline in COMEX history– ‘Big 4’ commercial traders decreased their short positions by 28,800...

Read More »Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm. The financial markets seem to like it: Stocks are close to record levels...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org