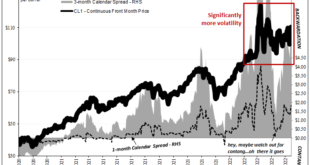

This one took some real, well, talent. It was late morning on April 11, the crude oil market was in some distress. The price was falling faster, already down sharply over just the preceding two weeks. Going from $115 per barrel to suddenly less than $95, there was some real fear there. But what really caught my attention was the flattening WTI futures curve. Up in the liquid front, it was closing in on contango and had it achieved that reshaping it would have been,...

Read More »Counting The Corroborated Stall, Not The Coming Lawfare Election Mess

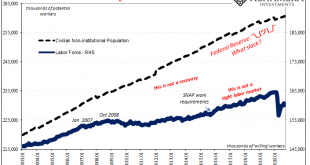

While we wait for the electoral count to be sorted out by what we hope are competent and honest people (not holding our breath), there’s a greater muddle growing where it actually counts and where it’s never fully nor properly accounted. By a large and growing number of accounts, the US economy’s rebound seems to have stalled out back around June or July, an inflection unrelated to COVID case counts, too. The rebound is still rebounding, of course, and this upturn...

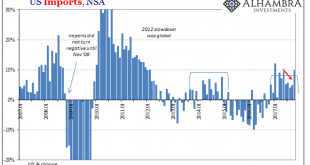

Read More »Reduced Trade Terms Salute The Flattened Curve

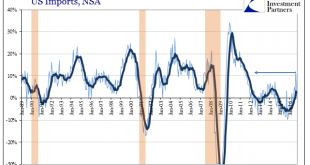

The Census Bureau reported earlier today that US imports of foreign goods jumped 9.9% year-over-year in October. That is the second largest increase since February 2012, just less than the 12% import growth recorded for January earlier this year. US Imports, Jan 2007 - 2017 - Click to enlarge In both monthly cases, however, the almost normal rates of increase which would have at least suggested moving closer to a...

Read More »WTI Tumbles Below $50 To 3-Week Lows

On the heels of continued dollar strength, output increases by OPEC (and US production at 2 year highs), and Libya restarting its biggest oilfield, WTI prices are tumbling for the 3rd time this week, back below $50 to their lowest in 3 weeks... As Bloomberg notes, while oil rallied into a bull market last month on the prospect of stronger demand, prices struggled to hold above $52 a barrel as supply grew from the U.S. and two members of the Organization of Petroleum Exporting...

Read More »Wholesale: No Acceleration, No Liquidation

In the same way as durable goods orders and US imports, wholesale sales in May 2017 were up somewhat unadjusted but down for the third straight month according the seasonally-adjusted series. As with those other two, the difference is one of timing. In other words, combining the two sets, seasonal and not, we are left to interpret a possible recent slowing in activity. There are gains year-over-year to be sure, but it...

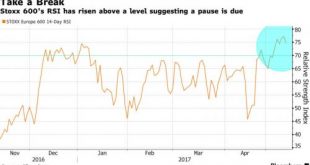

Read More »Europe, US Futures Slip Despite Brent Bouncing Back To $51

Asian stocks rose lifted by commodity names; European equities trade mostly lower but with little in the way of conviction or firm direction while the Italian banking index is at the highest level in a year following domestic earnings; S&P index futures are modestly in the red after the cash market closed at a record high Wednesday and investors prepared for earnings from retailers; we expect the now general vol selling program to promptly lift the S&P into new all time highs minutes...

Read More »February US Trade Disappoints

The oversized base effects of oil prices could not in February 2017 push up overall US imports. The United States purchased, according to the Census Bureau, 71% more crude oil from global markets this February than in February 2016. In raw dollar terms, it was an increase of $7.3 billion year-over-year. Total imports, however, only gained $8.4 billion, meaning that nearly all the improvement was due to nothing more...

Read More »WTI Crude tumbles To $49 Handle, Erases OPEC/NOPEC Deal Gains

But, but, but… growth, and inflation, and supply cuts, and growth again… Well that de-escalated quickly… As Libya restarts exports and The Fed sends the dollar soaring so WTI crude prices just broke back to a $49 handle for the first time since Dec 8th. WTI CrudeWTI Crude - Click to enlarge “The OPEC cuts are going to prevent some of the mega-glut,” said Olivier Jakob, managing director at Petromatrix GmbH in Zug,...

Read More »Trumpflation Takes A Breather As Global Stocks Rise, Oil Jumps On Renewed OPEC “Deal Optimism”

With the Trumpflation euphoria easing back slightly overnight, leading to a modest paring in the USD index and US Treasury yields, Asian and European stocks rose, while US equity futures rebounded to just shy of new all time highs, as crude jumped on renewed optimism that OPEC will agree to cut output; Italian equities underperformed ahead of the Italian referendum; metals rebounded from last week’s losses as yields dropped and the dollar halted its longest winning streak versus the euro....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org