Fintech is one of the fastest growing industries in the world. The Boston Consulting Group (BCG) estimates that the market will reach a size of US$1.5 trillion in revenue 2030, representing a roughly fivefold increase from 2024.

This growth has driven a surge in demand for fintech professionals, leading to the launch of a wide range of educational programs, courses, and certifications tailored to both young students and experienced professionals looking to navigate the rapidly evolving and intricate world of fintech.

Today, we look at the top fintech courses and certifications available Switzerland in 2025. These programs include certificates of advanced studies (CAS), master’s degrees, seminars, and special courses. They cover a diverse range of topics, from

Articles by Fintechnews Switzerland

Crypto VC Funding Remains Steady at US$10B in 2024

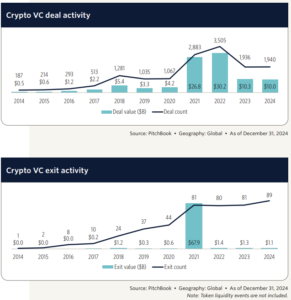

February 14, 2025PitchBook has released its Q4 2024 Crypto VC Trends Report, providing an overview of venture capital investment in the cryptocurrency sector.

The report highlights key trends across blockchain infrastructure, Web3, decentralised finance (DeFi), and AI-driven decentralised systems.

Crypto venture funding saw a modest recovery in the fourth quarter, increasing by 13.6% compared to the previous quarter.

Deal value rose from US$2.2 billion in Q3 to US$2.5 billion in Q4.

However, the number of deals continued to decline, falling from 411 to 351, a 14.6% drop.

For the full year, total crypto VC investment reached US$10 billion across 1,940 deals, close to the US$10.3 billion recorded in 2023.

This stability reflects the sector’s resilience despite macroeconomic

10 Must Read Bitcoin and Blockchain Blogs and Webpages

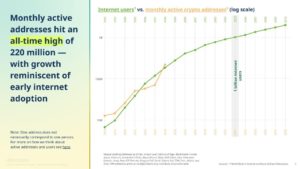

February 14, 2025Over the past decade, the cryptocurrency sector has transformed from a niche experiment into a global financial phenomenon. This growth accelerated as more people and businesses recognized the potential of digital assets and blockchain technology, and as the price of bitcoin soared, garnering widespread media attention.

In 2024, crypto activity continued to reach new heights. According to Andreessen Horowitz’s 2024 State of Crypto report, the number of monthly active crypto addresses hit unprecedented levels, totaling 220 million addresses interacting with a blockchain at least once in September 2024, a figure that’s more than tripled since the end of 2023.

In parallel, the number of monthly mobile crypto wallet users hit an all-time high of 29 million in June

Read More »BlackRock Plans to Launch Bitcoin-Linked ETP in Switzerland

February 7, 2025BlackRock is preparing to introduce a new exchange-traded product (ETP) tied directly to Bitcoin in Europe, following the success of its US$58 billion US-based cryptocurrency ETF.

Sources familiar with the matter suggest that the fund will likely be domiciled in Switzerland, with BlackRock potentially beginning its marketing efforts as early as this month.

However, as these individuals were not authorised to discuss the details publicly, they remained anonymous. A spokesperson for BlackRock declined to comment.

Managing over US$4.4 trillion in assets across its exchange-traded funds, BlackRock is a leading player in the ETF industry.

While cryptocurrency-linked ETPs have been available on European exchanges for years, this would mark BlackRock’s first foray into

Swiss Bitcoin App Relai Raises US$12M Funding, Eyes MiCA License for EU Growth

December 16, 2024Swiss-based cryptocurrency app Relai has secured US$12 million in funding to drive its expansion across Europe.

The investment was led by ego death capital with participation from Plan B Bitcoin Fund, Timechain, and Solit Group.

The heavily oversubscribed funding round will enable Relai to enhance its platform, streamline the Bitcoin buying process, and educate users on the benefits of the crypto as a savings tool.

Relai also shared its plans to obtain the Markets in Crypto-Assets Regulation (MiCA) license to gain access to a potential user base of 400 million.

The company has reported significant growth, with a 300% year-on-year increase in user adoption, and is on track to reach 1 million downloads by 2025.

Founded by Julian Liniger and Adem Bilican in 2020,

Retail Investors Show Divergent Behaviors in Crypto versus Traditional Assets

December 10, 2024Retail investors are showing distinct behavioral patterns when trading cryptocurrencies compared to traditional assets such as gold and stocks. Traditionally, investors tend to sell their stocks and gold when prices rise.

In contrast, when cryptocurrency prices increase, retail investors are more likely to hold or buy more. This aligns with a “momentum-like” strategy, reflecting the belief that rising prices signal greater future adoption and value, a new research found.

The research, published in September by finance academics from the US and the UK, analyzed trading behaviors for cryptocurrencies and traditional assets, using a dataset of trades from 200,000 individual retail accounts on brokerage eToro between 2015 and 2019.

The analysis used the 200 most

21Shares and Crypto.com Forge Strategic Partnership

October 9, 202421.co, the parent company of 21Shares – one of the world’s largest issuers of crypto exchange traded products (ETPs), and Crypto.com announced that they have entered into a strategic partnership.

Central to the partnership, 21.co Wrapped Bitcoin (21BTC) will source Bitcoin liquidity from Crypto.com, leveraging the exchange’s liquidity. Looking ahead, 21.co and Crypto.com intend to build on the strategic partnership, with future announcements in the pipeline.

Eliezer Ndinga“We are thrilled to integrate 21BTC with Crypto.com, enhancing user access to crypto and marking the starting point of a long-term, strategic partnership. As two leaders in digital asset innovation, know-how and operations, the 21.co–Crypto.com partnership creates a powerful combination,”

said

Taurus Partners with Aktionariat to Launch Token Secondary Market for SMEs

September 30, 2024Swiss equity token specialist Aktionariat AG and securities firm Taurus SA announced a new partnership.

Aktionariat’s tokenization tools and Taurus Digital Exchange (TDX) organized trading facility are natural complements. Under the newly announced partnership, Taurus will support selected shares tokenized with Aktionariat on the Ethereum blockchain and Aktionariat will offer client companies a smooth path towards being admitted to trading on TDX as they grow in market capitalization and match admission criteria.

This collaboration brings together Aktionariat’s expertise in tokenizing Swiss companies’ equity with Taurus’ institutional-grade trading technology. It aims to increase liquidity and unlock value for tokenized SMEs and their shareholders by providing

LUKB bietet neu sichere Ein- und Auslieferung von Kryptowährungen an

September 25, 2024Die Luzerner Kantonalbank (LUKB) bietet ab dem 1. Oktober 2024 ihren Kunden die Ein- und Auslieferung für die Kryptowährungen Bitcoin und Ethereum an.

Bereits im Juni 2024 hat die LUKB einen Kryptoanlageplan auf den Markt gebracht und ergänzend zu Bitcoin, Ethereum und USD Coin neu auch Investitionen in die Kryptowährungen Chainlink und Polygon ermöglicht.

Ab dem 1. Oktober 2024 können Kunden der LUKB ihre Kryptowährungen Bitcoin und Ethereum aus anderen Wallets in ihr Wertschriftendepot bei der LUKB übertragen. Die LUKB wird diese Dienstleistung schrittweise einführen. Sie ergänzt damit das bestehende Angebot im Bereich des Handels und der Verwahrung von Kryptowährungen.

Kryptoanlageplan seit Juni 2024

Der bereits im Juni 2024 lancierte Kryptoanlageplan

FBI Crypto Report: Fraud Surges Driven by Investment Scams

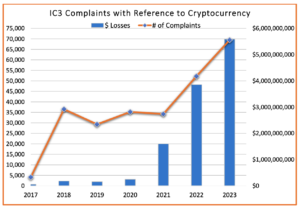

September 25, 2024In 2023, cryptocurrency fraud continued to surge globally as rising adoption of digital currencies attracted scammers seeking to exploit the hype and target credulous users.

Last year, the Federal Bureau of Investigation’s (FBI) Internet Crime Complaint Center (IC3) received a record of 69,468 crypto-related complaints, a 33.6% increase from 2022’s ~52,000, new data released by the division show. Losses soared by a whopping 45% year-over-year (YoY) to an all-time high of US$5.6 billion.

Though crypto fraud represented only 10% of total financial fraud complains in 2023, it accounted for nearly 50% of total fraud losses, highlighting the disproportionately severe financial impact of these schemes compared to traditional fraud.

IC3 complaints with reference to

The Top 11 Fintech Startups in Switzerland in 2024

September 5, 202411 fintechs made it to this year’s TOP 100 Swiss Startup list, an award organized by Venturelab.

The 2024 ranking features in total 100 Startups, Yokoy is once again the highest ranking fintech.

Highest fintech newcomer this year is Calvin Risk on rank 44.

Of the 11 fintechs 5 were repeats from the 2023 startup ranking and 6 were newcomers.

Meet the 11 Swiss fintechs that made the TOP 100 Swiss Startups 2024 list:

Yokoy Group AG (#3)-1

Your expenses and company credit cards on autopilot

Relai AG (#24) unchanged

Relai is Europe’s leading Bitcoin app, made in Switzerland

Unique AG (#32) -1

Supercharge Your Team With Unique FinanceGPT

Numarics AG (#33) new

Switzerland’s digital accountant

Calvin Risk (#44) new

Risk management platform for AI algorithms

Read More »ZKB bietet neu den Handel und die Verwahrung von Crypto an

September 4, 2024Ab dem 4. September 2024 können Kundinnen und Kunden über die Zürcher Kantonalbank Kryptowährungen rund um die Uhr direkt im ZKB eBanking oder ZKB Mobile Banking Crypto handeln.

Die Bestände der Kryptowährungen werden dabei in die bestehende Depotsicht integriert. Vorerst stehen Bitcoin und Ethereum zur Auswahl.

Crypto Verwahrung

Kryptowährungen nutzen die Blockchain. Mit den Chancen und Risiken dieser Technologie beschäftigt sich die Zürcher Kantonalbank schon seit Längerem.

2021 war die Bank beispielsweise an der Emission der weltweit ersten digitalen Anleihe an der SIX Digital Exchange beteiligt, 2023 wickelte sie als Joint Lead Managerin im Rahmen eines Pilotprojekts der Schweizerischen Nationalbank die Ausgabe digitaler Anleihen mit digitalem Zentralbankgeld

SNB Study: Tornado Cash Case Highlights the Challenge of Regulating Decentralized Services

September 4, 2024Tornado Cash, a decentralized smart contract protocol built on the Ethereum blockchain, was sanctioned in 2022 by the US Treasury’s Office of Foreign Assets Control (OFAC) for its role in laundering over US$7 billion worth of illicit funds since 2019.

The sanctions initially led to a drop in Tornado Cash use, weakening its ability to provide anonymity. However, transactions on the platform continue, reflecting the mixed effectiveness of sanctions on decentralized networks and highlighting the challenges in regulating these systems, a new research paper by the Swiss National Bank (SNB) says.

The SNB working paper, released in August 2024, assesses the impact of OFAC sanctions on Ethereum communities and actors, with a particular focus on Tornado Cash.

Tornado Cash

Crypto Wealth Report: Integration of Cryptocurrencies Boosted by Institutional Interest

August 8, 2024Cryptocurrencies are increasingly being integrated into traditional finance, driven by both retail and institutional interest. Financial institutions are embracing tokenization and institutional investors are increasingly entering the cryptocurrency market.

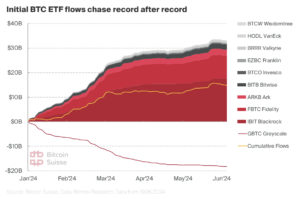

Bitcoin, in particular, is emerging as a valuable diversification tool in wealth management, highlighted for its low correlation with traditional asset classes and its strong growth performance, a new report by Bitcoin Suisse, a Swiss crypto services provider, says.

The inaugural “Crypto Wealth Management Report”, released in July 2024, looks at the historic performance of bitcoin, showcasing the crypto’s position as a potential powerhouse within diversified portfolios. The report explores the key drivers

Eurex Launches Ether Derivatives

July 18, 2024Eurex expands its crypto derivatives portfolio with the launch of FTSE Ethereum Index Futures and Options as of 12 August 2024.

Following the launch of FTSE Bitcoin Index Futures and Options in 2023, this is another major milestone in Eurex’s ambition to offer secure access to cryptocurrencies in a regulated market environment.

Ethereum is the second largest cryptocurrency with a market capitalization of approximately USD 400 billion. There is significant trading and hedging demand from institutional and professional customers, as reflected in record trading volumes in derivatives and other investment products.

The new options and futures are listed in EUR and USD, with the respective FTSE Ethereum Index as the underlying. The contract size is equivalent to 10

Maerki Baumann Cooperates With Bitcoin Suisse

June 7, 2024The Zurich-based private bank Maerki Baumann has entered into a cooperation with Bitcoin Suisse.

The collaboration will allow the private bank to utilize the proven crypto expertise of Bitcoin Suisse in managing its crypto investment solutions, and to expand its existing offering in the area of digital assets under the “ARCHIP” brand.

The cooperation is to be integrated into Maerki Baumann’s investment process via the “Joint Crypto Advisory Board”. Clients of Bitcoin Suisse will gain access to first-class private banking services for traditional assets. Maerki Baumann’s longstanding experience in serving clients with a crypto background makes the private bank Bitcoin Suisse’s preferred partner for traditional investments.

Bitcoin Suisse, Switzerland’s leading

Robinhood to Acquire Bitstamp For $200 Million in Cash

June 7, 2024Robinhood has entered into an agreement to acquire Bitstamp, a global cryptocurrency exchange. Bitstamp was founded in 2011 and has offices in Luxembourg, the UK, Slovenia, Singapore, and the US.

Acquiring a global exchange will significantly accelerate Robinhood Crypto’s expansion worldwide. Bitstamp holds over 50 active licenses and registrations globally and will bring in customers across the EU, UK, US and Asia to Robinhood.

This acquisition will introduce Robinhood’s first institutional business. Bitstamp has been trusted by its institutional clients for reliable trade execution, deep order books and industry-leading API connectivity. With Bitstamp’s other institutional offerings like white label solution Bitstamp-as-a-service, institutional lending, and

Schweizer Retailbanken im Krypto-Anlage-Fieber

May 28, 2024Trotz breiter Skepsis, immer mehr Retailbanken bieten Kryptowährungen als vollwertige Anlageklasse an. Während einige Banken gezielt eigenes Know-how rund um Blockchain aufbauen, greifen die meisten auf Drittanbieter zurück. Dies zeigt eine neue Studie der Hochschule Luzern.

Nach Rekordwerten im Jahr 2021 und einem darauffolgenden Einbruch sind die Preise von Kryptowährungen in den letzten Monaten wieder deutlich gestiegen. Verschiedene Retailbanken haben sich entschlossen, ein Angebot an Kryptowährungen aufzubauen.

Gemäss einer Studie der Hochschule Luzern (HSLU) bieten 28 Prozent der Retailbanken Kryptowährungen als vollwertige Anlageklasse an oder beabsichtigen, dies künftig zu tun. Nach Jahren der Zurückhaltung sieht es danach aus, dass mindestens grössere

US Spot Bitcoin ETFs Daily Trading Volume Soars to 6 Billion USD

March 1, 2024Ten newly launched US spot bitcoin exchange-traded funds (ETFs) broke their daily volume records on February 28, 2024, totaling nearly US$7.7 billion worth of assets being traded on that day alone, data shared on X by James Seyffart, an ETF analyst at Bloomberg Intelligence, reveal.

The figure represents a staggering 63.8% increase from their previous peak of US$4.7 billion from their first day of trading on January 11, 2024, and demonstrates booming interest from investors in the new asset class.

BlackRock’s iShares Bitcoin ETF (IBIT) is emerging as the clear winner, leading the group with US$3.4 billion traded on February 28 through with nearly 97 million shares traded. IBIT is followed by Grayscale Bitcoin Trust BTC (GBTC) with US$1.9 billion and 34 million

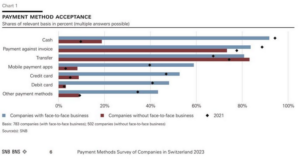

SNB Study: Results of the Swiss Payment Methods Survey

February 27, 2024In spring 2023, the Swiss National Bank conducted its second payment methods survey of companies in Switzerland.

Around 1,750 companies, across all sizes, language regions and industries, participated in this survey on payment method topics. In-depth knowledge of these topics helps the SNB to fulfil its statutory tasks in relation to the supply and distribution of cash and to cashless payments.

.

The most important findings of the payment methods survey of companies are as follows:

Companies are creating a good basis for freedom of choice between cash and cashless payment methods in everyday transactions by accepting a wide range of payment methods. Since the last survey in 2021, companies have tended to broaden their payment method acceptance. In particular,

UBS Issues Hong Kong’s First Investment-Grade Tokenised Warrant on Ethereum

February 15, 2024UBS has launched Hong Kong’s first investment-grade tokenised warrant, leveraging the Ethereum public blockchain. This product is part of the bank’s UBS Tokenise initiative, aimed at advancing its in-house tokenisation services.

The product is a call warrant with Xiaomi Corporation as the underlying stock. The tokenised warrant is also reportedly the first natively issued warrant on a public blockchain that was sold to OSL Digital Securities Limited, a licensed virtual asset platform operator and wholly-owned subsidiary of OSL Group (formerly BC Technology Group).

Tokenised warrants are distinguished by enhanced accessibility, efficiency, and transparency. They enable investors to access digital structured products through blockchain technology, which facilitates

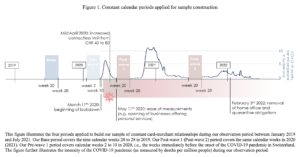

New SNB Study Reveals Critical Role of Card Schemes and Banks in the Contactless Payment Usage

January 12, 2024Financial intermediaries, including card schemes and issuing banks, are playing a critical role in the use and promotion of new payment methods in Switzerland. A 2023 research by the Swiss National Bank (SNB) revealed that the rules and standards set by these intermediaries are impacting usage and frequency of contactless payments.

The findings, shared in a new report titled “Consumer adoption and use of financial technology: “tap and go” payments”, are based on an analysis of anonymized, transaction-level data for more than 400,000 payment cards and almost 18,000 merchants in Switzerland between 2019 and 2021. The study looked at data retrieved during four different periods, comparing contactless payment usage in 2019 (Base period), during the weeks immediately

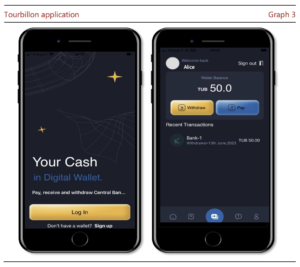

Swiss-Backed CBDC Project Explored Feasibility of Cash-Like, Anonymous Digital Currency

December 21, 2023Project Tourbillon, an initiative led by the Bank for International Settlements (BIS) Innovation Hub Swiss Centre and supported by the Swiss National Bank (SNB), explored the feasibility of a retail central bank digital currency (CBDC), finding that it is possible to implement a CBDC design that provides anonymity to the payer and which is scalable and secure.

In a new report released in November 2023, BIS shares details of the project, outlining findings of their efforts.

Project Tourbillon, which had been running since at least late-2022, saw the development and testing of two CBDC prototypes based on the eCash design by American computer scientist, cryptographer and inventor David Chaum.

These prototypes were designed to address three features simultaneously:

Miles & More and qiibee Transform Loyalty Rewards with Blockchain

December 14, 2023Miles & More, the loyalty program of the Lufthansa Group, has partnered with blockchain-based B2B marketplace qiibee to allow small and mid-size enterprises (SMEs) to join the program easily.

The key highlight of this collaboration is the integration of blockchain technology, which simplifies the onboarding process for SMEs while ensuring the secure and efficient management of loyalty rewards.

qiibee’s blockchain-based marketplace offers instant, cost-effective transactions and guarantees full data privacy control. Through this integration, Miles & More members gain access to a broader and more diverse network of partners, including regional businesses.

The partnership also aims to enhance connectivity between enterprises and customers, with plans to onboard more

Robinhood Crypto Trading App Arrives in EU, Offers Bitcoin Rewards

December 11, 2023Robinhood is set to make a significant stride in the European Union by launching the Robinhood Crypto app for all eligible customers in the region. The company claims that the app is the only custodial crypto platform in the EU where customers can earn a portion of their trading volume back every month in Bitcoin (BTC).

In an effort to drive new users, Robinhood Crypto is offering a unique opportunity for both new and existing customers. New customers are eligible to earn up to one Bitcoin when they open a Robinhood Crypto account and trade a minimum amount of €10 in crypto. Similarly, existing customers can earn up to one Bitcoin for every referred friend who successfully opens an account and trades a minimum €10 worth of crypto.

Johann Kerbrat

Johann Kerbrat,

Societe Generale Issues Digital Green Bond on Public Blockchain

December 7, 2023End of November Societe Generale issued its first digital green bond as a Security Token directly registered by SG-FORGE on the Ethereum public blockchain with increased transparency and traceability on ESG data.

Security tokens have been fully subscribed AXA Investment Managers and Generali Investments, through a private placement.

This transaction is the first digital green bond issued by Societe Generale to leverage blockchain’s differentiating functionalities. This digital format enables increased transparency and traceability as well as improved fluidity and speed in transactions and settlements.

This operation is structured as a EUR 10m senior preferred unsecured bond with a maturity of 3 years. An amount equivalent to the net proceeds of this bond will

After Zug and Zermatt, Now You Can Pay Taxes Also in Lugano with Bitcoins

December 7, 2023The Swiss city of Lugano announced that it has broadened its payment options by including cryptocurrencies for the payment of tax invoices and all other community fees.

Lugano will accept Bitcoin (BTC) and Tether (USDT) as a means of payment through a simple and fully automated process.

The new payment option introduced by the City of Lugano marks a modern shift in how people handle city-related expenses. Citizens and companies alike may now use Bitcoin (BTC) and Tether (USDT) to pay any invoice issued by Lugano, including tax invoices. While cryptocurrency payments in Lugano were reserved for transactions made on the City’s online portal, Lugano is now extending this possibility to all its invoices, regardless of the nature of the service or the amount invoiced.

Swiss National Bank Launches Wholesale Central Bank Digital Currency Project

December 4, 2023On 1 December 2023, the Swiss National Bank – together with five Swiss and one German commercial bank – started a pilot project with central bank digital currency for financial institutions (wholesale central bank digital currency) on the regulated platform of SIX Digital Exchange (SDX).

With this pilot, called Helvetia Phase III, the SNB will for the first time issue real wholesale CBDC in Swiss francs on a financial market infrastructure based on distributed ledger technology (DLT). The SNB is thus moving its work from test environments into production and is making wholesale CBDC available for the settlement of real bond transactions. The banks involved will carry out the transactions on the DLT platform as intermediaries for issuers and investors. The

DZ BANK startet eigene Crypto Verwahrung

November 3, 2023Deutschland’s DZ BANK hat eine neue Plattform für die Abwicklung und Verwahrung digitaler Finanzinstrumente in Betrieb genommen.

Damit gehört das genossenschaftliche Institut zu den ersten Kreditinstituten, die auf Basis der Blockchain-Technologie ein solches Angebot für institutionelle Kunden auf den Weg gebracht haben. Die DZ BANK ist mit einem Volumen von über 300 Mrd. EUR nach BNP Paribas und State Street die drittgrößte Verwahrstelle in Deutschland, unter den deutschen Verwahrstellen ist sie die größte.

Holger Meffert

„Wir gehen davon aus, dass innerhalb der nächsten zehn Jahre wesentliche Anteile des Kapitalmarktgeschäfts über Distributed Ledger Technologie (DLT) basierte Infrastrukturen abgewickelt werden. Auf mittelfristige Sicht sehen wir die DLT als

Swiss National Bank Launches Pilot Project With CBDC for Financial Institutions

November 3, 2023On 1 December 2023, the Swiss National Bank – together with six commercial banks – will start a pilot project with central bank digital currency for financial institutions (wholesale CBDC) on the regulated platform of SIX Digital Exchange (SDX).

With this pilot, called Helvetia Phase III, the SNB will for the first time issue real wholesale CBDC in Swiss francs on a financial market infrastructure based on distributed ledger technology (DLT). The SNB is thus moving its work from test environments into production and is making wholesale CBDC available for the settlement of real bond transactions. The banks involved will carry out the transactions on the DLT platform as intermediaries for issuers and investors. The tokenised bonds will be settled against wholesale