Swiss Franc The Euro has fallen by 0.04% to 1.0879 EUR/CHF and USD/CHF, June 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The 10-year US Treasury yield steadied after reaching a three-month low near 1.43%, despite the US CPI rising more than expected to 5% year-over-year. On the week, the decline of around a dozen basis points would be the largest in a year. Australia, New Zealand, and Italy benchmark...

Read More »FX Daily, June 04: US and Canada Report on Jobs as G7 Fin Mins Talk Taxes

Swiss Franc The Euro has fallen by 0.12% to 1.094 EUR/CHF and USD/CHF, June 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Stronger than expected US employment data, ahead of today’s monthly report and compromise proposal on corporate tax by the White House to help secure a deal on infrastructure sent US bond yields and the dollar high. Late dollar shorts were forced to cover. The greenback is mixed now,...

Read More »FX Daily, March 16: Monday Blues: Fed Moves Bigly and Stocks Slump

Swiss Franc The Euro has fallen by 0.01% to 1.0541 EUR/CHF and USD/CHF, March 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Federal Reserve and central banks in the Asia Pacific region acted forcefully, but were unable to ease the consternation of investors. The Reserve Bank of New Zealand cut key rates by 75 bp. The Bank of Japan appears to have doubled its ETF purchase target to JPY12 trillion, and...

Read More »Die Weltwirtschaft steht vor einem Sturm

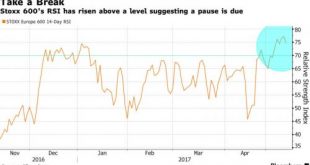

Präsident Trump tut alles, um die internationale wirtschaftliche Architektur zu zerstören. Foto: Keystone Die Zeichen für die Weltwirtschaft stehen auf Sturm. Für das wirtschaftlich bedeutendste Land der Eurozone und den mit Abstand wichtigsten Handelspartner der Schweiz, Deutschland, warnt dessen Bundesbank vor einer Rezession. Auch in den USA nehmen die Rezessionsängste zu. Diese Aussicht wäre keine Katastrophe. Notenbanken und Staaten haben in gewöhnlichen Zeiten die Möglichkeit,...

Read More »G7 to Deliver a Nothing Burger

A Bloomberg article about the weekend G7 meeting says, “multilateralism is dead.” An op-ed in the Financial Times suggests that the most important political alliance may be “rejuvenated” at the G7 meeting. The truth is likely found somewhere in between. Economic nationalism, personalities of (some) of the leaders are not conducive to deepening or broadening cooperation among the leading market economies. At the same time, the G7 is an expression of...

Read More »Europe, US Futures Slip Despite Brent Bouncing Back To $51

Asian stocks rose lifted by commodity names; European equities trade mostly lower but with little in the way of conviction or firm direction while the Italian banking index is at the highest level in a year following domestic earnings; S&P index futures are modestly in the red after the cash market closed at a record high Wednesday and investors prepared for earnings from retailers; we expect the now general vol selling program to promptly lift the S&P into new all time highs minutes...

Read More »G7 Summit: Risk of a Global Crisis, Maritime Disputes and the Dollar

The G7 heads of state summit has begun. The host, Japan’s Prime Minister Abe began with doom and gloom. Accounts suggest he warned of the risk of a crisis on the scale of Lehman if appropriate policies are not taken. It is not clear to whom Abe was addressing. It may not have been the other heads of state. It may have been a domestic audience Abe had in mind. At the finance ministers and central bankers meeting last week, Japan’s Aso indicated that contrary to speculation, the retail...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org