National Conservatives are a growing movement on the political right. They are largely united by their belief in the failings of liberalism, in protectionist trade policy, a halt to mass migration, and a more Christianized nation. The attendees of this year’s conference, hosted by the Edmund Burke Foundation, focused on many topics: free trade, their desire to decouple from China, weaponization of government, bureaucracy in government, and even the building of parallel institutions. But one topic, one that should be vitally important to anyone wishing to preserve a nation, was absent. That, being monetary policy.In my time listening to many panels, and many a plenary speaker, the Federal Reserve and monetary policy was brought up once: by Senator Rick Scott (R-FL)

Topics:

David Brady, Jr. considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

National Conservatives are a growing movement on the political right. They are largely united by their belief in the failings of liberalism, in protectionist trade policy, a halt to mass migration, and a more Christianized nation. The attendees of this year’s conference, hosted by the Edmund Burke Foundation, focused on many topics: free trade, their desire to decouple from China, weaponization of government, bureaucracy in government, and even the building of parallel institutions. But one topic, one that should be vitally important to anyone wishing to preserve a nation, was absent. That, being monetary policy.

In my time listening to many panels, and many a plenary speaker, the Federal Reserve and monetary policy was brought up once: by Senator Rick Scott (R-FL) who made allusions to bringing down energy costs so ‘interest rates can come down.’ That is hardly in-depth analysis into the monetary realm. A greater focus on monetary policy may solve many of the problems that they, correctly or not, identify. Hard money is a requirement of a free and prosperous society, not an optional policy choice.

We must stress the importance of money to the market economy. Its first and foremost use is as a medium of exchange. But there are critical secondary uses that outline the importance of hard money. The use of money for accounting is incredibly important. Economic calculation is only possible with money. Money acts as the good which all other goods and services are compared in ratios to. Being able to calculate profit and loss is a valuable tool for making entrepreneurs aware of whether their ventures create value or waste resources. Money is also a store of value, at least it should be a store of value. Money enables everyone to save over time, to hold cash in the face of the uncertain future and not in goods that are perishable. Further, the saving of money is unique from holding other goods as money can be exchanged for whatever goods and services you wish.

With these in mind, we can properly understand how the undermining of money by central banking is disastrous and the cause of many of the woes of the National Conservatives.

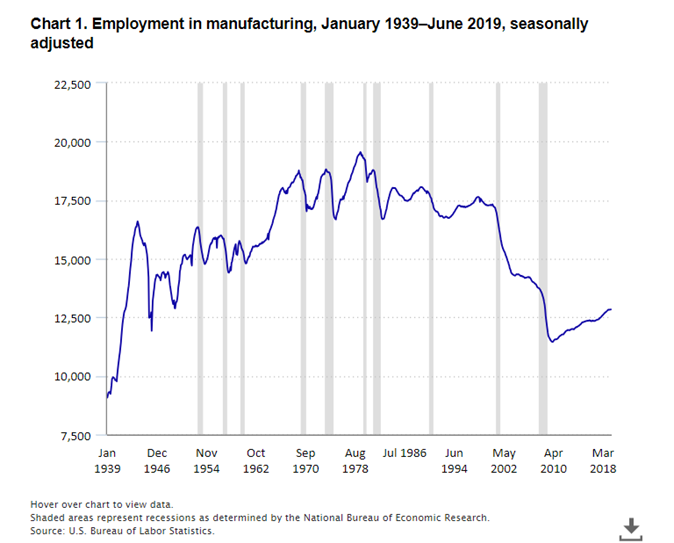

Let’s start with the problem of the collapse of manufacturing in America. The National Conservatives attribute much of this to outsourcing, that cheap labor abroad is the primary reason for manufacturing leaving. There is some truth to this, but Bureau of Labor Statistic data points to the sharpest decline occurring during the collapse of the ‘Dotcom Bubble’ and the 2008 Financial Crisis.

Source: Bureau of Labor Statistics

Recessions have hollowed out the industrial base. Interest rates were held at a level that should have been higher, pumping credit into the economy. Businesses overextend, bidding for more capital goods that don’t exist, and into markets that have no demand. As Mises characterized it, the master builder must realize he has not the resources to complete his venture and liquidate. Because the central bank plays with interest rate price controls, entrepreneurs (including those at already existing firms) are tricked into overextending and malinvesting. They must liquidate and close shop so profitable ventures can make use of the capital goods that truly exist.

Sadly, much of manufacturing was dragged along. Inflation compounds the problems with the existing capital structure. Inflation increases costs of capital and capital maintenance but creates the illusion of greater profits and spending especially in capital good markets. Nominally it looks like greater profits, but greater costs have not been accounted for. This leads to capital consumption as the business scrapes away what appears to be nominal profits and is soon unable to replace and maintain their capital goods. Capital consumption occurs.

Capital consumption means that firms are more likely to abandon their locations in favor of underdeveloped nations with lower labor costs. It is mostly capital goods that help to make labor more productive, meaning greater productivity and higher wages. Mises points out in Economic Policy: Thoughts for Today & Tomorrow, that it is the stock of capital goods of a nation that help determine prosperity. Capitalists have every incentive to make use of the current stock of capital goods and existing capital structure. It is because the capital has become consumed that they may justify investment elsewhere, to rebuild the capital structure somewhere else with cheaper labor. The existing capital has been destroyed and thus they may cut costs by reinvesting elsewhere.

This does not need to occur in one bloody event, though many companies fell during recessions, but a slow process of capital consumption caused by inflation. Inflation also promotes more consumption in the present as opposed to saving. Saving increases the capital goods stock and supply, but inflation is prohibitive to saving. Increasing costs causes consumers to move into purchasing more goods faster than they would have before. They fall into what Mises called the ‘flight into real values.’

Inflation has another impact on the working class that National Conservatism cares for. I have already briefly touched on it. It punishes saving. With a sound money with study deflation, one’s money appreciates in value. With a constant stream of even steady inflation, one’s money depreciates in value. You can no longer expect the money you stow away to hold onto its purchasing power. In order to possibly beat inflation, you must now invest in the stock market that falls into problems with credit expansion and the boom-bust cycle. That is hardly helpful to the working man who wishes to save for his family. Inflation always makes costs higher, making life harder for the everyday working man.

We must realize that inflation and business cycles are not inevitabilities, they are policy choices. Fractional reserve banks lobby for protection in their credit expansion. Inflationism is utilized by the government to fund endless wars, the usurping of responsibilities from fair society, and all of its worst abuses. Inflationism is an easy trick by governments to make their policies appear costless. The costs come hidden in the form of higher costs and a destruction of civil society.

We need not accept inflation. Strong money and removing money creation from the power of government should be a rallying point for everyone who cares for a just society. We cannot begin to talk about bringing back manufacturing and saving the working man if real value is expropriated away by a government that cares not for its people. The government makes those at the front end of its spigot the beneficiaries: Wall Street cronies, the big banks, military contractors, and the bureaucrats. But it leaves everyone else poorer. The National Conservatives should turn their eyes to the Fed and realize how much of an impact strong money might have on the world they want to see.

Tags: Featured,newsletter