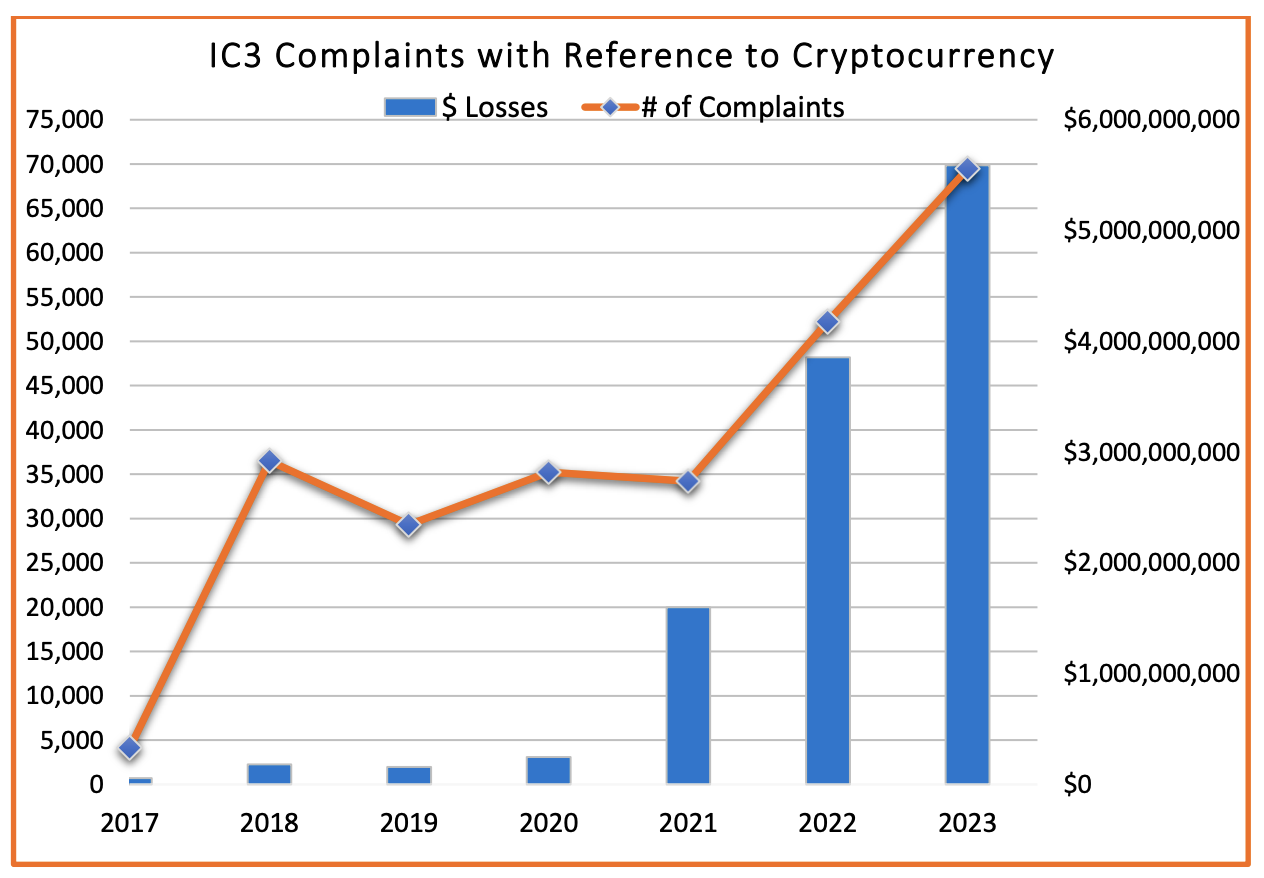

In 2023, cryptocurrency fraud continued to surge globally as rising adoption of digital currencies attracted scammers seeking to exploit the hype and target credulous users. Last year, the Federal Bureau of Investigation’s (FBI) Internet Crime Complaint Center (IC3) received a record of 69,468 crypto-related complaints, a 33.6% increase from 2022’s ~52,000, new data released by the division show. Losses soared by a whopping 45% year-over-year (YoY) to an all-time high of US.6 billion. Though crypto fraud represented only 10% of total financial fraud complains in 2023, it accounted for nearly 50% of total fraud losses, highlighting the disproportionately severe financial impact of these schemes compared to traditional fraud. IC3 complaints with reference to

Topics:

Fintechnews Switzerland considers the following as important: 6c.) Fintechnews, Blockchain, cryptocurrency, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

In 2023, cryptocurrency fraud continued to surge globally as rising adoption of digital currencies attracted scammers seeking to exploit the hype and target credulous users.

Last year, the Federal Bureau of Investigation’s (FBI) Internet Crime Complaint Center (IC3) received a record of 69,468 crypto-related complaints, a 33.6% increase from 2022’s ~52,000, new data released by the division show. Losses soared by a whopping 45% year-over-year (YoY) to an all-time high of US$5.6 billion.

Though crypto fraud represented only 10% of total financial fraud complains in 2023, it accounted for nearly 50% of total fraud losses, highlighting the disproportionately severe financial impact of these schemes compared to traditional fraud.

Investment fraud emerges as top crypto fraud type

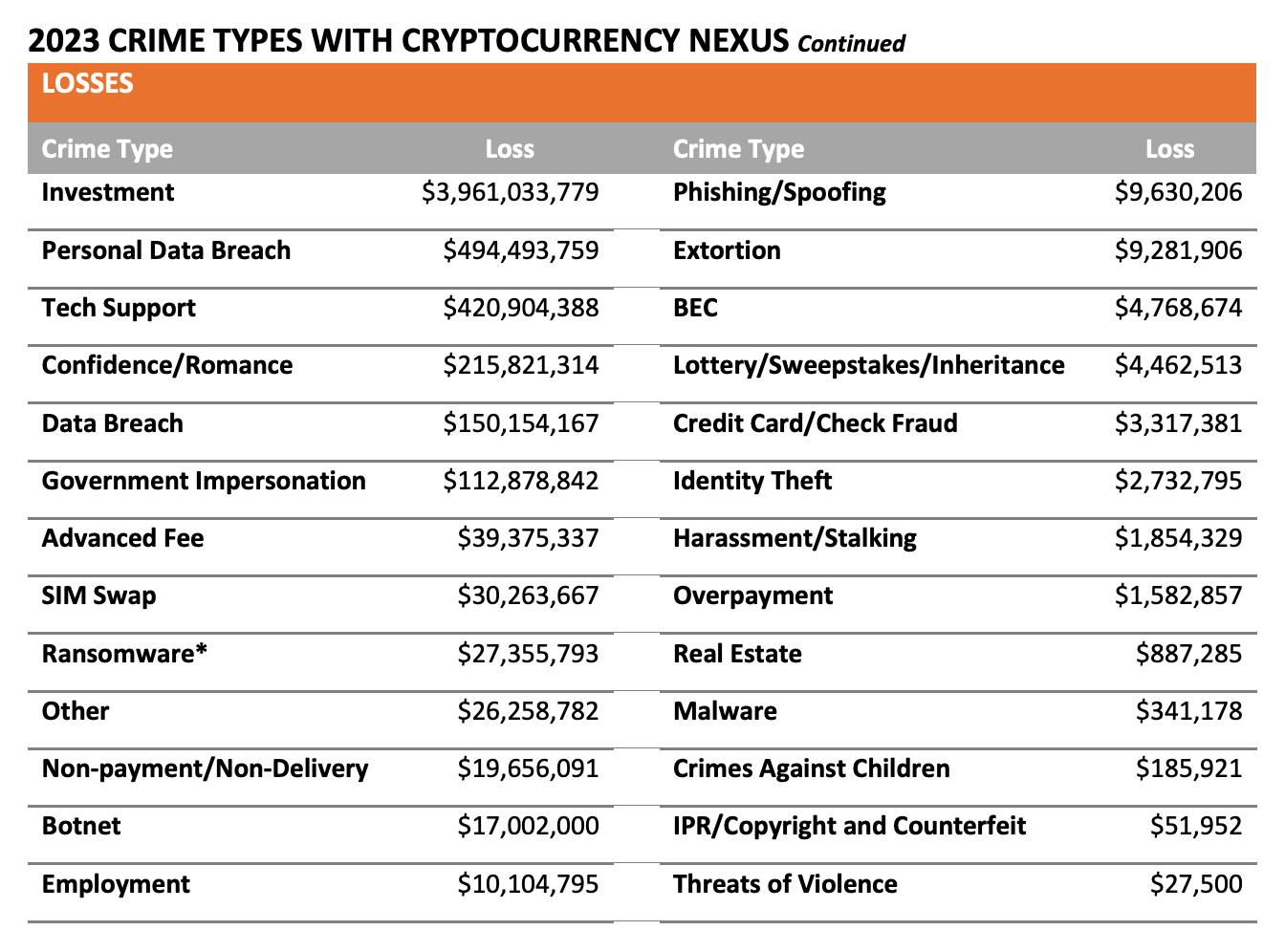

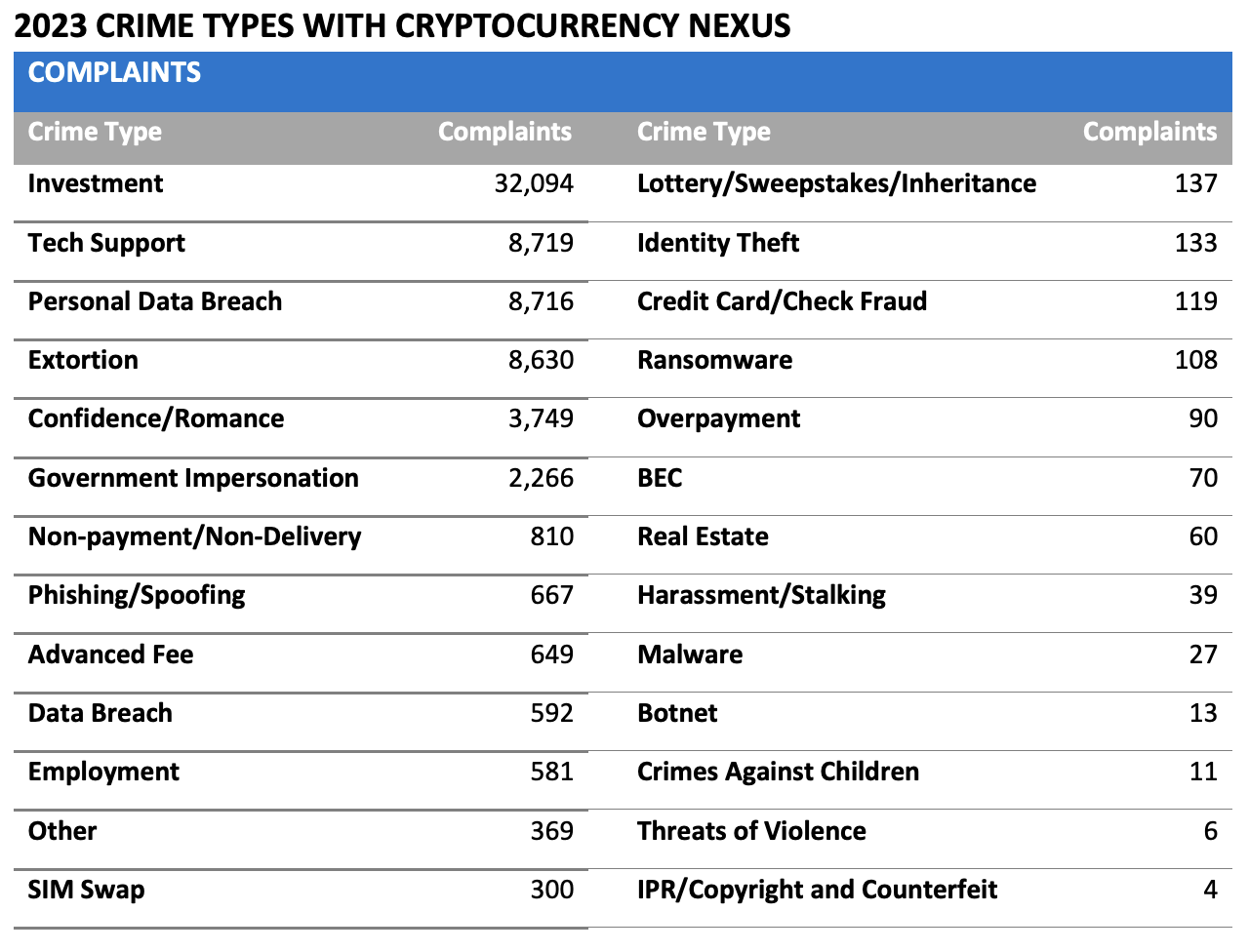

Investment fraud fueled much of the rise in crypto-related scams, emerging as the most reported crypto scheme in 2023. Last year, it accounted for nearly half of all complaints received and a staggering 71% of the losses associated with these complaints.

The increasing popularity of cryptocurrencies, driven by the potential for high returns and belief in blockchain’s future, is attracting fraudsters. As cryptocurrencies are increasingly perceived as viable alternatives to traditional investments, and with major companies enhancing the market’s legitimacy, scammers are exploiting this trend, taking advantage of the hype, investors’ lack of experience, and the anonymity of blockchain transactions to deceive unsuspecting individuals with promises of high returns and minimal risks.

In 2023, losses from crypto-related investment fraud schemes reported to the IC3 skyrocketed from US$2.57 billion in 2022 to US$3.96 billion, a 53% increase, with many victims accumulating massive debt to cover losses from these fraudulent investments.

While various schemes were used to defraud individuals last year, the IC3 has identified a particularly prominent method that emerged in 2023. These schemes were socially engineered and involved criminals using dating applications, social media platforms, professional networking sites, or encrypted messaging apps to establish relationships with their targets. Once trust was established, the criminals introduced the topic of cryptocurrency investment and convinced their targets to invest through fraudulent websites or apps controlled by them.

The IC3 also warns of the risk of false job advertisements linked to labor trafficking at scam compounds overseas. These compounds hold workers against their will and use intimidation to force the workers to participate in scam operations.

In these schemes, criminals would post false job advertisements on social media and online employment sites to target people, primarily in Asia, offering a wide range of opportunities across tech support, call center customer service, and beauty salon technicians. These opportunities would include enticing salaries, lucrative benefits as well as coverage for travel experiences and accommodation.

However, upon arrival in the foreign country, victims would find their passports and travel documents confiscated, facing threats and coercion to comply with their captors.

These cyber scam centers are primarily located across Southeast Asia, mainly in the poorer states of Cambodia, Laos, and Myanmar, and are operated by well-connected organized criminal groups, largely originating from China. They are often staffed by thousands of people, most of whom the criminal groups have illegally trafficked and forced to work in inhumane and abusive conditions.

The UN High Commissioner for Human Rights estimates that more than 200,000 people have been trafficked into Myanmar and Cambodia to execute these online scams.

Crypto kiosks and recovery as rising trends

In addition to crypto investment fraud, the IC3 report also highlights the rise of crypto kiosks scams. Crypto kiosks are ATM-like devices or electronic terminals that allow users to exchange cash and cryptocurrency. They enable a more anonymous transaction than depositing the cash at a financial institution, making them attractive to criminals.

Typically, criminals would instruct victims to use these kiosks to send funds, providing detailed guidance on withdrawing cash, locating a kiosk, and completing the transaction. These scams frequently involve QR codes, allowing the victim to send cryptocurrency directly to the criminal’s intended destination.

According to IC3 data, the use of cryptocurrency kiosks to perpetrate fraudulent activity is increasing. In 2023, the division received more than 5,500 complaints reporting the use of cryptocurrency kiosks, with losses over US$189 million. Top crime types involving crypto kiosks in 2023 were tech support (46%), extortion (17%) and government impersonation (10%), all of which were among the top fraud complaints for the year.

Crypto recovery schemes are another rising form of fraud, often emerging as the next iteration of a fraud scheme.

In these schemes, criminals would pose as representatives from businesses offering crypto tracing services, falsely claiming they can recover lost funds.

They would typically contact individuals who lost money from the scheme via social media or messaging platforms or advertise their fraudulent cryptocurrency recovery services in the comment sections of online news articles and videos about crypto; among online search results for cryptocurrency; or on social media.

These fraudsters would charge an up-front fee and either cease communication after receiving an initial deposit or produce an incomplete or inaccurate tracing report and request additional fees to recover funds. To appear legitimate, they may also falsely claim affiliation with law enforcement or legal services.

Global crypto activity continues to grow this year, driven by the launch of bitcoin and ether exchange-traded funds (ETFs) in the US, rising adoption in developing economies and a rebound in crypto prices.

Data from Chainalysis show that between Q4 2023 and Q1 2024, the total value of global crypto activity rose substantially, reaching higher levels than those of 2021 during the crypto bull market. This growth was mainly fueled by lower-middle income countries, with nations in Central and Southern Asia, as well as Oceania (CSAO) recording the strongest increase crypto adoption.

The launch of spot bitcoin and ether exchange-traded funds (ETFs) in the US this year also played a key role in boosting adoption. A recent Gemini survey reveals that 37% of US cryptocurrency owners now hold some of their crypto through an ETF. Moreover, 13% of respondents own cryptocurrencies exclusively through an ETF, underscoring the role of these instruments in driving growth within the sector and improving accessibility.

The price of bitcoin increased substantially in 2023, soaring by a staggering 153% from about US$17,000 in January to about US$43,000 by the end of the year.

Featured image credit: edited from freepik

The post FBI Crypto Report: Fraud Surges Driven by Investment Scams appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Tags: Blockchain,cryptocurrency,Featured,newsletter