As I sit here writing this Sunday afternoon, the US has just shot down a third UFO in the last 3 days in addition to the Chinese “weather” balloon last week. I have no insight into what these things might be but I do wonder if we haven’t declared war on the National Weather Service. The federal government has become so sprawling that it could easily be the case that NORAD has no idea what the NWS has up in the air. And with all the UFO shooting going on, the NWS...

Read More »Weekly Market Pulse: Things That Need To Happen

Perspective: per·spec·tive | pər-ˈspek-tiv b: the capacity to view things in their true relations or relative importance Merriam-Webster Perspective is something that comes with age I think. Certainly, as I’ve gotten older, my perspective on things has changed considerably. As we age, we tend to see things from a longer-term view. Things that seemed so important at the time, years ago, turned out to be nothing more than bumps along the road of life. That is as...

Read More »Market Pulse: Mid-Year Update

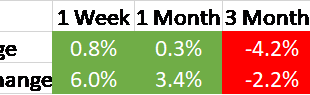

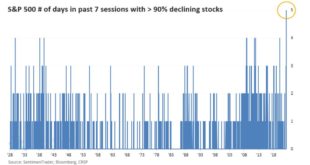

Note: This update is longer than usual but I felt a comprehensive review was necessary. The Federal Reserve panicked last week and spooked investors into the worst week for stocks since the onset of COVID in March 2020. The S&P 500 is now firmly in bear market territory but that is a fraction of the pain in stocks and other risky assets. Stocks are now down 10 of the last 11 weeks but the pain was concentrated in the last two weeks. 5 of the last 8 trading days...

Read More »It’s Not Nothing, It’s Everything (including crypto)

Markets got aggressive long before the FOMC did. Everything, and I mean everything, has been trending the other way. Jay Powell says inflation risks are most pressing when markets have consistently priced the opposite for a whole lot longer. It’ll be revised history when ultimately the mainstream attempts to write it over the months ahead, many will try to snatch some limited victory from the jaws of defeat. Should recession happen and bring an end to the...

Read More »Industrial Synchronized Demand

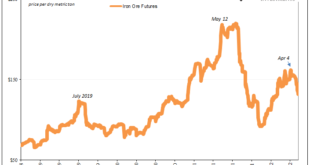

Are the industrial commodities starting to get a whiff of demand side rejection? Short run trends suggest that this could be the case. From copper to iron and the highest (formerly) of the high flyers, aluminum, this particular group has been exhibiting a rather synchronized setback going back to the end of March, start of April. This despite supply bottlenecks and production shortfalls which continue to plague each. Copper has now fallen to its lowest since last...

Read More »Weekly Market Pulse: Oil Shock

Crude oil prices rose over 25% last week and as I sit down to write this evening the overnight futures are up another 8% to around $125. Almost every other commodity on the planet rose in prices last week too, as did the dollar. Those two factors – rising dollar and rising commodity prices – mean the likelihood of recession in the coming year has risen significantly in just the last week. Rising oil prices, in particular, have been a regular feature of past...

Read More »Weekly Market Pulse: Fear Makes A Comeback

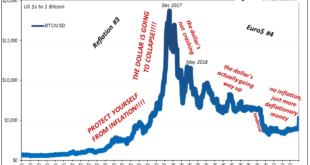

Fear tends to manifest itself much more quickly than greed, so volatile markets tend to be on the downside. In up markets, volatility tends to gradually decline. Philip Roth Be fearful when others are greedy and be greedy when others are fearful. Warren Buffett The new year hasn’t gotten off to a great start for growth stocks or any of the other speculative assets that have drawn so much attention over the last couple of years. Bitcoin is down 25% since the...

Read More »Big Week Begins Slowly

Overview: The global capital markets give little indication of the important economic and earnings data that lie ahead this week. There is an eerie calm. Equities in Asia were mixed. Japan and Hong Kong, and most small bourses were lower. Last week, the MSCI Asia Pacific Index gained almost 0.9%. Europe's Stoxx 600 is little changed after rising about 0.5% last week. US futures are firm. The S&P 500 and Dow Jones Industrials reached record-highs before the...

Read More »What’s The Real Downside To Some of These Key Commodities?

Last night, Autodata reported its first estimates for September auto sales in the US. According to its own as well as those compiled by the Bureau of Economic Analysis (the same government outfit which keeps track of GDP), vehicle sales have been sliding overall ever since April. For a couple months in the middle of Uncle Sam’s helicopter-fed frenzy, the number of vehicle units had surged to a high of more than 18 million (seasonally-adjusted annual rate) in both...

Read More »Weekly Market Pulse: As Clear As Mud

Is there anyone left out there who doesn’t know the rate of economic growth is slowing? The 10 year Treasury yield has fallen 45 basis points since peaking in mid-March. 10 year TIPS yields have fallen by the same amount and now reside below -1% again. Copper prices peaked a little later (early May), fell 16% at the recent low and are still down nearly 12% from the highs. Crude oil has recently joined in, falling 7% from its recent high. Energy stocks are in a full...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org