On 29 January 2018, the Commodity Futures Trading Commission (CFTC) Division of Enforcement together with the Criminal Division of the US Department of Justice and the FBI announced criminal and civil enforcement actions against 3 global investment banks and 5 traders for involvement in trade spoofing in precious metals futures contracts on the US-based Commodity Exchange (COMEX). COMEX is by far the largest and most...

Read More »US Gold & Silver Futures Markets: “Easy” Targets

Following news coverage of the charging of five precious metals traders and three banks in January, Commodities Futures Trading Commission and Department of Justice documents reveal a global criminal cabal of 16 traders operating in at least four major financial institutions between 2008 and 2015 to defraud COMEX gold and silver futures markets. Of the many examples published, one reveals a UBS AG precious metals...

Read More »Fighting inflation with FX, a real traders market

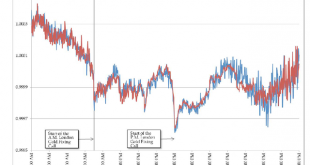

(GLOBALINTELHUB.COM) Dover, DE — 7/18/2017 — Hidden in plain site, as the Trump administration finally released something of substance regarding the so called promised “Trade Negotiation” we see FX take center stage in the global drama unfolding. As noted on a Zero Hedge article: The much anticipated document (press release and link to full document) released by U.S. Trade Representative Robert Lighthizer said the...

Read More »Fighting inflation with FX, a real traders market

(GLOBALINTELHUB.COM) Dover, DE — 7/18/2017 — Hidden in plain site, as the Trump administration finally released something of substance regarding the so called promised “Trade Negotiation” we see FX take center stage in the global drama unfolding. As noted on a Zero Hedge article: The much anticipated document (press release and link to full document) released by U.S. Trade Representative Robert Lighthizer said the Trump administration aimed to reduce the U.S. trade deficit by...

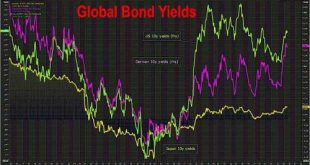

Read More »Bond Selloff Returns As EM Fears Rise; Oil Slides; BOJ Does Not Intervene

U.S. index futures point slightly lower open. Asian shares rose while stocks in Europe fell as energy producers got caught in a downdraft in oil prices and reversed an earlier gain after Goldman unexpectedly warned that WTI could slide below $40 absent "show and awe" from OPEC. The dollar rose, hitting a four-month high against the yen and bonds and top emerging market currencies were back under pressure on Tuesday, following last week’s hawkish rhetoric from central bankers. Nonetheless,...

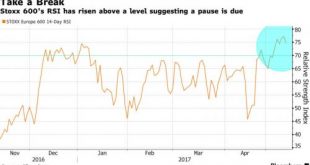

Read More »Europe, US Futures Slip Despite Brent Bouncing Back To $51

Asian stocks rose lifted by commodity names; European equities trade mostly lower but with little in the way of conviction or firm direction while the Italian banking index is at the highest level in a year following domestic earnings; S&P index futures are modestly in the red after the cash market closed at a record high Wednesday and investors prepared for earnings from retailers; we expect the now general vol selling program to promptly lift the S&P into new all time highs minutes...

Read More »“Dear President Putin…”

Submitted by Paul Craig Roberts, Vladimir PutinPresident of RussiaMoscow28 November 2016 Dear President Putin, Now that CIA agent Craig Timberg posing as a Washington Post reporter has blown my cover and exposed me as a Russian agent, I was wondering if I might ask you for a Russian passport and a bit of diplomatic cover, perhaps assistant press officer at the Russian embassy in Washington, until I can get out of the country. I saw that you gave a passport to Steven Seagal, so I am hopeful...

Read More »London Gold and Silver Fix lawsuits

By Allan Flynn, Guest Post at BullionStar.com Five months have lapsed without decision, since London gold and silver benchmark-rigging class action lawsuits received a cool response in a Manhattan court. Transcripts from April hearings show, in the absence of direct evidence, the claims dissected by a “very skeptical” judge, and criticized by defendants for lack of facts suggesting collusion, among other things. Judge...

Read More »Hanging by a Thread: “Very skeptical” judge – a former FBI/SEC official, eyes London Gold and Silver Fix lawsuits

By Allan Flynn, Guest Post at BullionStar.com Five months have lapsed without decision, since London gold and silver benchmark-rigging class action lawsuits received a cool response in a Manhattan court. Transcripts from April hearings show, in the absence of direct evidence, the claims dissected by a “very skeptical” judge, and criticized by defendants for lack of facts suggesting collusion, among other things. Judge Valerie E. Caproni, former white-collar...

Read More »US To Seize $1 Billion In Embezzled Malaysian Assets Which Goldman Sachs Helped Buy

The last time we wrote about the long-running saga of the scandalous collapse and constant corruption at the Malaysian state wealth fund, 1MDB, which also happened to be an unconfirmed slush fund for president Najib, was a month ago when we learned that the NY bank regulator was looking into fundraising by the fund’s favorite bank, Goldman Sachs. Then overnight, the story which already seemed like it has every possible...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org