Tornado Cash, a decentralized smart contract protocol built on the Ethereum blockchain, was sanctioned in 2022 by the US Treasury’s Office of Foreign Assets Control (OFAC) for its role in laundering over US billion worth of illicit funds since 2019. The sanctions initially led to a drop in Tornado Cash use, weakening its ability to provide anonymity. However, transactions on the platform continue, reflecting the mixed effectiveness of sanctions on decentralized networks and highlighting the challenges in regulating these systems, a new research paper by the Swiss National Bank (SNB) says. The SNB working paper, released in August 2024, assesses the impact of OFAC sanctions on Ethereum communities and actors, with a particular focus on Tornado Cash. Tornado Cash

Topics:

Fintechnews Switzerland considers the following as important: 6c.) Fintechnews, Blockchain, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Tornado Cash, a decentralized smart contract protocol built on the Ethereum blockchain, was sanctioned in 2022 by the US Treasury’s Office of Foreign Assets Control (OFAC) for its role in laundering over US$7 billion worth of illicit funds since 2019.

The sanctions initially led to a drop in Tornado Cash use, weakening its ability to provide anonymity. However, transactions on the platform continue, reflecting the mixed effectiveness of sanctions on decentralized networks and highlighting the challenges in regulating these systems, a new research paper by the Swiss National Bank (SNB) says.

The SNB working paper, released in August 2024, assesses the impact of OFAC sanctions on Ethereum communities and actors, with a particular focus on Tornado Cash.

Tornado Cash is a cryptocurrency mixer operating on the Ethereum blockchain that facilitates anonymous transactions by obscuring the origins, destinations, and counterparties of funds, without attempting to identify their source. The service receives various transactions, mixes them, and then transmits them to their intended recipients. While its primary purpose is to enhance privacy, it has also been used by illicit actors to launder stolen funds.

In August 2022, Tornado Cash was sanctioned by the US OFAC for money laundering. This includes over US$455 million stolen by the Lazarus Group, a North Korea state-sponsored hacking group. These sanctions were significant because they marked the first time a decentralized, non-custodial entity had been targeted, raising questions about the effectiveness of such regulatory actions.

The SNB study analyzed the immediate and lasting impact of these sanctions on Tornado Cash, noting a sharp decline in the value of its governance token, TORN, which dropped by 60% within the few days of the announcements.

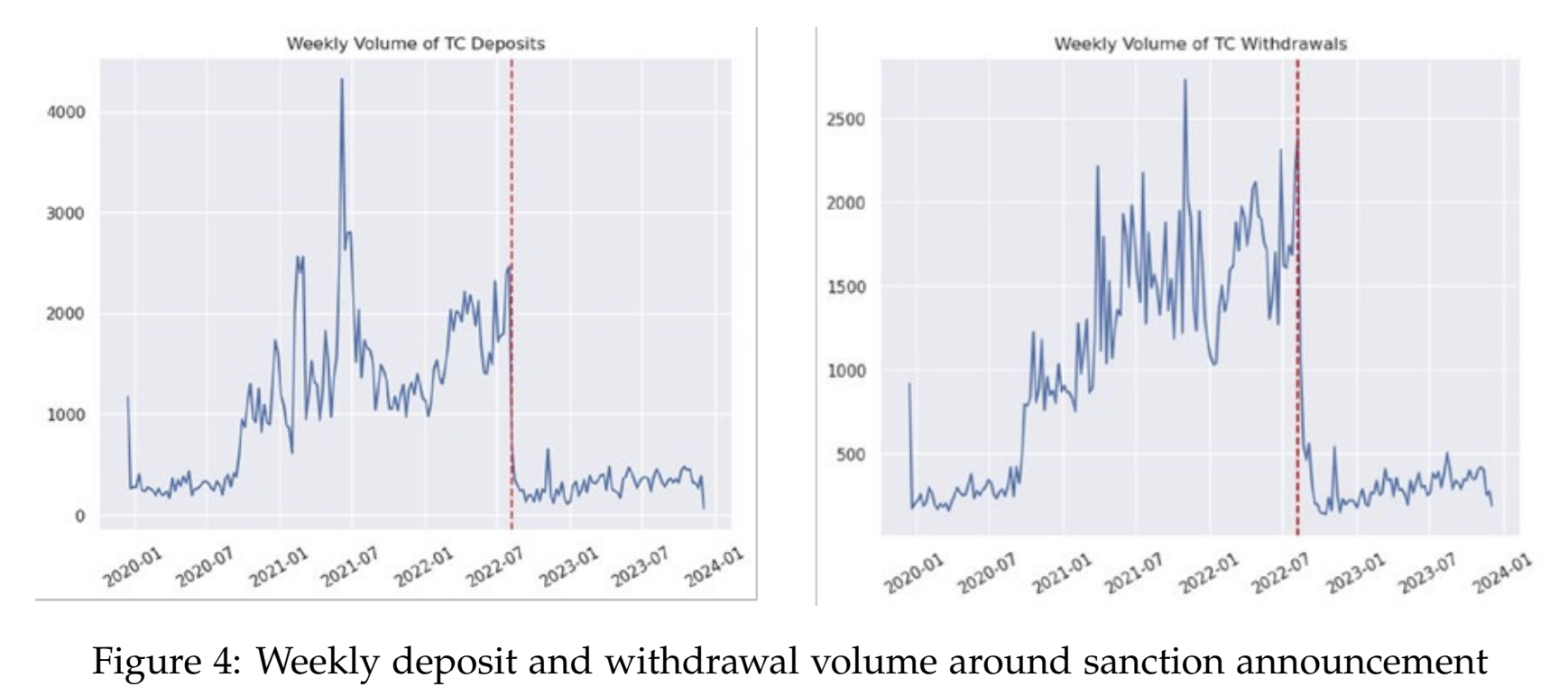

There was also a significant decrease in Tornado Cash’s transaction volumes post-sanctions, with a drop in average weekly transactions by 72%.

Deposit volumes fell by 74%, from an average of 1,184 weekly deposits before the sanctions to approximately 307 weekly deposits afterward. Similarly, withdrawal volumes declined by 69%, from an average of 1,093 weekly withdrawals to about 341 weekly withdrawals. These reductions a significant decline in user engagement.

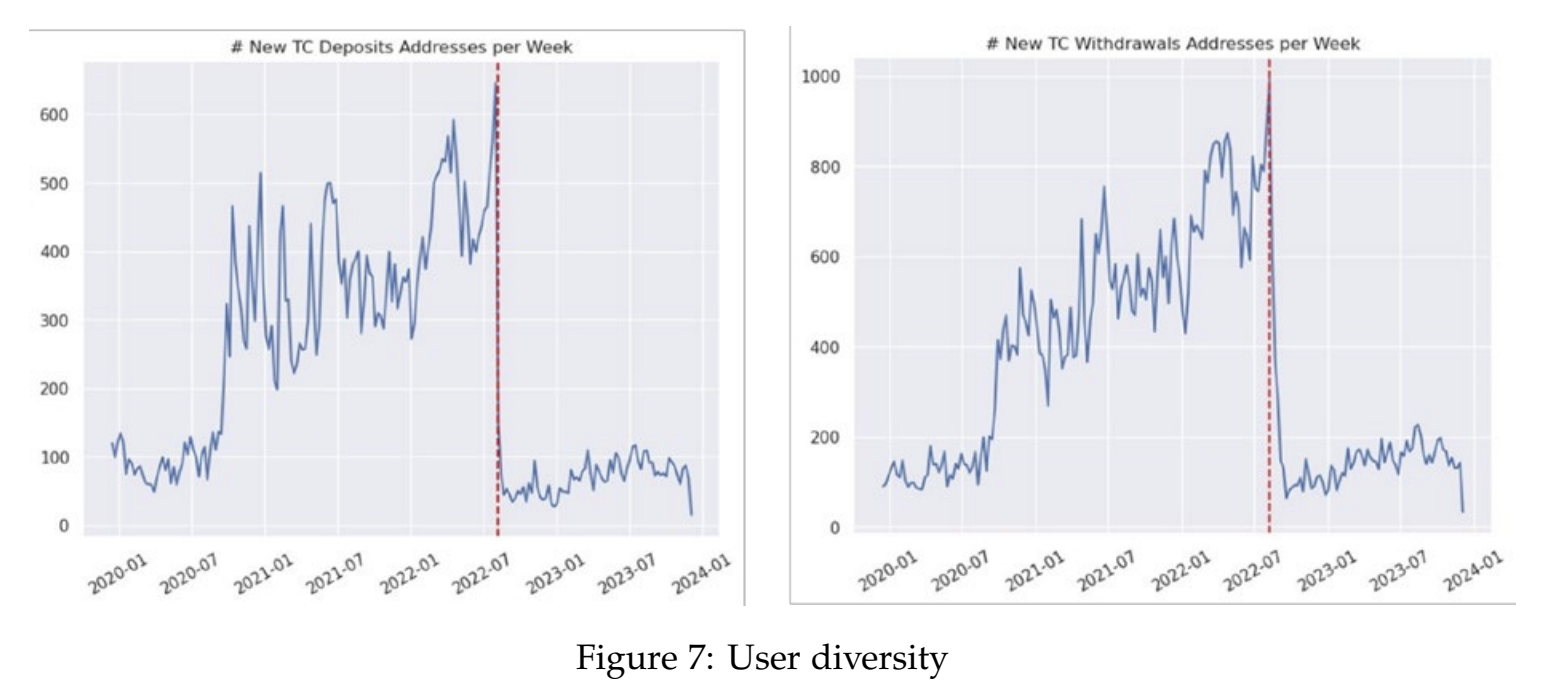

User diversity, measured by the number of unique addresses interacting with Tornado Cash, also dropped significantly, following patterns observed with transaction volumes. This suggests a lasting impact on the protocol’s usage and the privacy it offers.

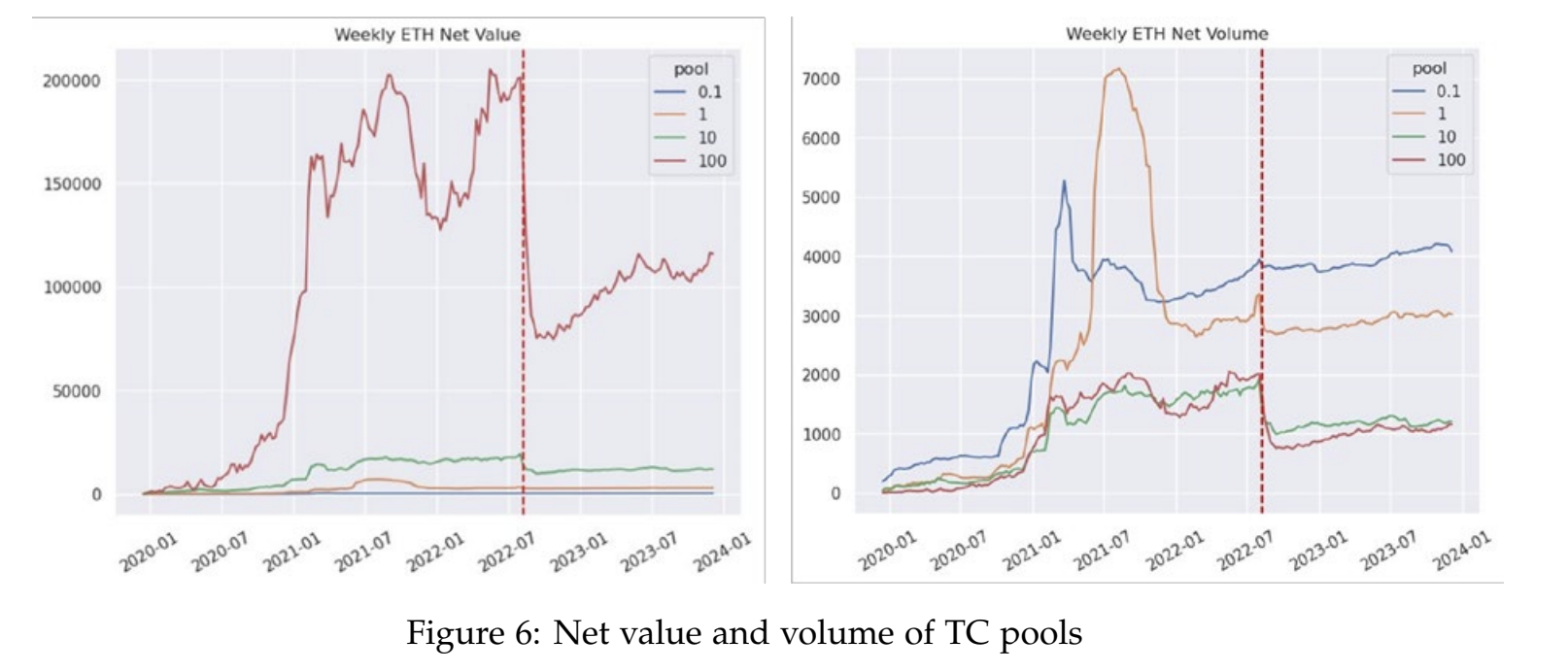

Despite the initial decline, the SNB paper notes that the net flows into Tornado Cash contracts eventually recovered, with the number of Ethereum blocks containing Tornado Cash transactions increasing over time. Moreover, the proportion of non-cooperative blocks (those including Tornado Cash transactions) generally rose over time, suggesting continued support from network participants.

This is despite the fact that priority fees (extra fees paid by users to prioritize their transactions) are consistently lower for non-cooperative blocks compared to cooperative ones. This indicates that economic motives are not the primary driver behind the decision to cooperate with sanctions and that non-cooperation is often motivated by philosophical beliefs.

Decentralized blockchain-based crypto mixers like Tornado Cash present unique challenges for regulatory enforcement. These services use smart contracts that autonomously run on the blockchain, providing high levels of anonymity and privacy, and their global accessibility and distributed infrastructure make them resilient to enforcement efforts.

To this day, Tornado Cash remains operational and continues to be used for money laundering, experts report. According to blockchain analytics firm Elliptic, more than US$100 million in ether from the HTX/HECO heist of November 2023 has been laundered through the platform since March 13, 2024. Elliptic attributes this theft to the Lazarus Group, based on various attributes of the hack and the subsequent movement of funds.

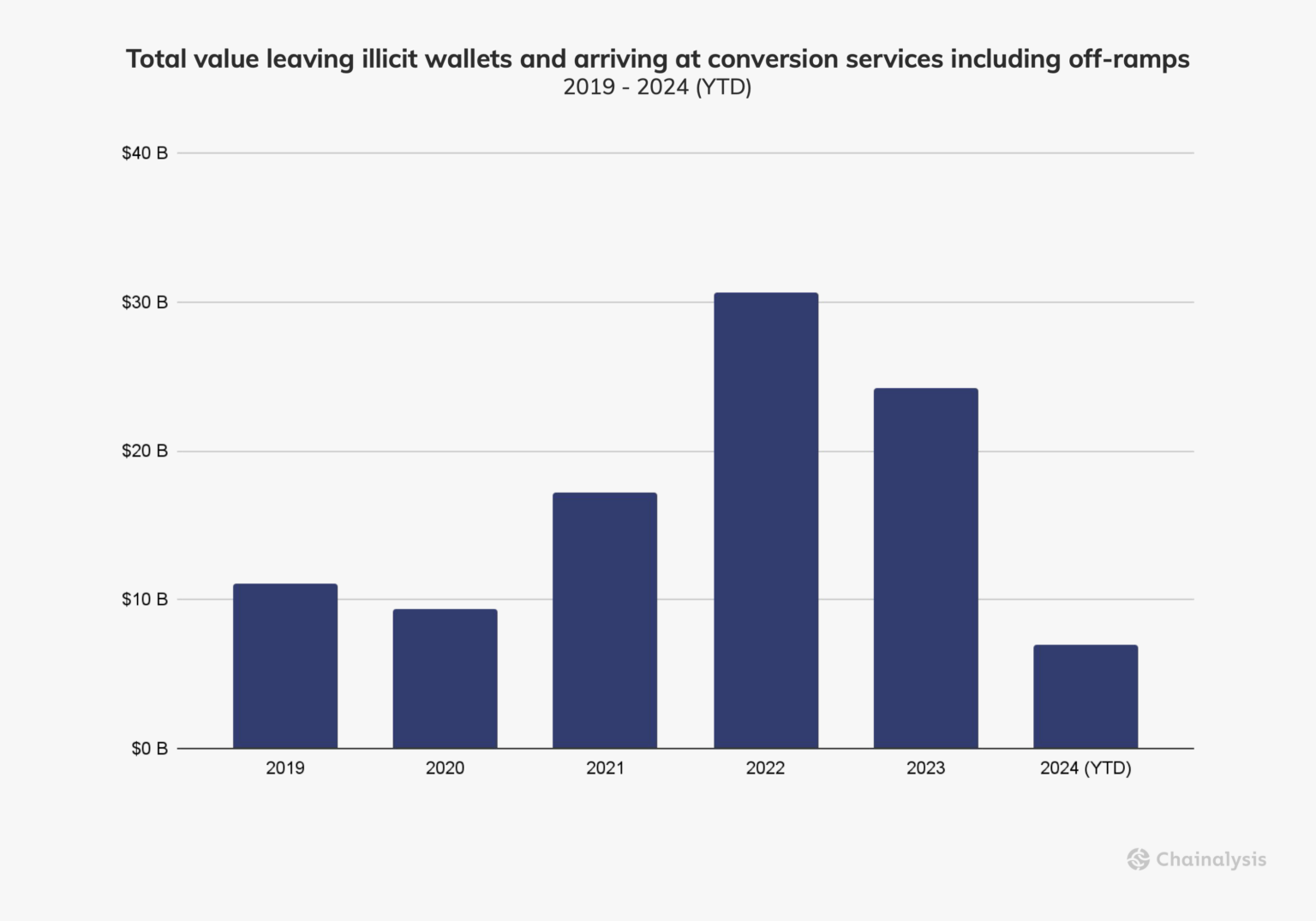

Cryptocurrencies are increasingly being used to obscure the origins and movement of illicitly obtained funds. Blockchain analysis firm Chainalysis estimates that nearly US$100 billion has been transferred from known illicit wallets to conversion services since 2019. The highest amount recorded was in 2022, with US$30 billion identified.

Featured image credit: edited from freepik

The post SNB Study: Tornado Cash Case Highlights the Challenge of Regulating Decentralized Services appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Tags: Blockchain,Featured,newsletter