There is a lot of evidence which shows some basis for expectations-based monetary policy. Much of what becomes a recession or worse is due to the psychological impacts upon businesses (who invest and hire) as well as workers being consumers (who earn and then spend). Once the snowball of macro contraction begins rolling downhill, rational prudence dictates some degree of caution on all parts (pro-cyclicality). Bathed in the unearned glow of the Great “Moderation”,...

Read More »Writing Rebound in Italian

As the calendar turned to September, the US Centers for Disease Control and Prevention (CDC) issued new guidelines expanding and extending existing moratoriums previously put in place to stop evictions during the pandemic. Families affected by COVID either through the disease or as a result of job loss due to the coronavirus have been protected from landowner actions including eviction as a final means to reclaim rental properties from non-conforming tenants. There...

Read More »ECB Doubles Its QE; Or, The More Central Banks Do The Worse You Know It Will Be

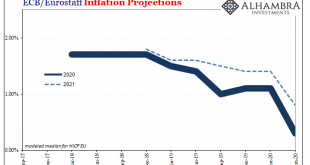

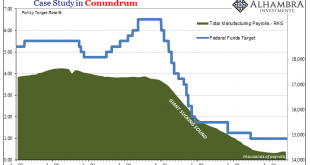

A perpetual motion machine is impossible, but what about a perpetual inflation machine? This is supposed to be the printing press and central banks are, they like to say, putting it to good and heavy use. But never the inflation by which to confirm it. So round and round we go. The printing press necessary to bring about consumer price acceleration, only the lack of consumer price acceleration dictates the need for more of the printing press. It never ends. If you...

Read More »What Did Everyone Think Was Going To Happen?

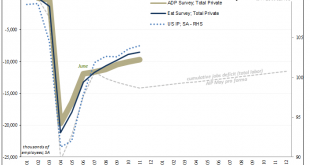

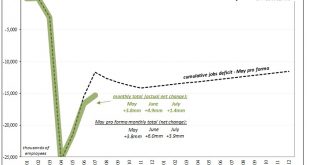

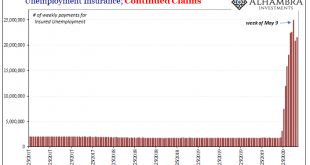

Honestly, what did everyone think was going to happen? I know, I’ve seen the analyst estimates. They were talking like another six or seven perhaps eight million job losses on top of the twenty-plus already gone. Instead, the payroll report (Establishment Survey) blew everything away, coming in both at two and a half million but also sporting a plus sign. The Household Survey was even better, +3.8mm during May 2020. But, again, why wasn’t this expected? All this...

Read More »Stagnation Never Looked So Good: A Peak Ahead

Forward-looking data is starting to trickle in. Germany has been a main area of interest for us right from the beginning, and by beginning I mean Euro$ #4 rather than just COVID-19. What has happened to the German economy has ended up happening everywhere else, a true bellwether especially manufacturing and industry. The latest sentiment figures from ZEW as well as IFO are sobering. Taking the former first, it had been quite buoyant last year on the false...

Read More »Why The Last One Still Matters (IP Revisions)

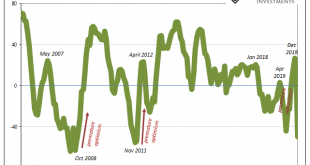

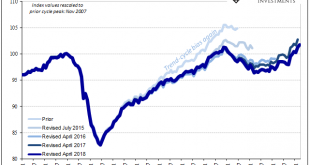

Beginning with its very first issue in May 1915, the Federal Reserve’s Bulletin was the place to find a growing body of statistics on US economic performance. Four years later, monthly data was being put together on the physical volumes of trade. From these, in 1922, the precursor to what we know today as Industrial Production was formed. The index and its components have changed considerably over its near century of...

Read More »Giant Sucking Sound Sucks (Far) More Than US Industry Now

There are two possibilities with regard to stubbornly weak US imports in 2017. The first is the more obvious, meaning that the domestic goods economy despite its upturn last year isn’t actually doing anything positive other than no longer being in contraction. The second would be tremendously helpful given the circumstances of American labor in the whole 21st century so far. In other words, perhaps US consumers really...

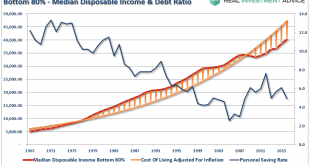

Read More »The Savings Rate Conundrum

The economy is booming. Employment is at decade lows. Unemployment claims are at the lowest levels in 40-years. The stock market is at record highs and climbing. Consumers are more confident than they have been in a decade. Wages are finally showing signs of growth. What’s not to love? I just have one question. If things are so good, then why is America’s saving rate posting such a sharp decline? The answer is not...

Read More »Dollar Surge Continues Ahead Of Jobs Report; Europe Dips As Catalan Fears Return

World stocks eased back from record highs and fell for the first time in eight days, as jitters about Catalonia’s independence push returned while bets on higher U.S. interest rates sent the dollar to its highest since mid August; S&P 500 futures were modestly in the red – as they have been every day this week before levitating to record highs – ahead of hurricane-distorted nonfarm payrolls data (full preview here)....

Read More »When You Are Prevented From Connecting The Dots That You See

In its first run, the Federal Reserve was actually two distinct parts. There were the twelve bank branches scattered throughout the country, each headed by almost always a banker of local character. Often opposed to them was the Board in DC. In those early days the policy establishment in Washington had little active role. Monetary policy was itself a product of the branches, the Discount Rate, for example, often being...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org