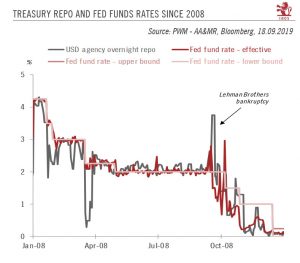

Following this week’s sharp movement in the USD overnight repurchase agreement (repo) rate, people are wondering what the US Federal Reserve (Fed) can do to counter a similar event in the future.One measure of the USD overnight repo rate (there exist several) spiked to 6% on Tuesday 17 September, probably due a scarcity of bank reserves at the Fed at a time when US corporates needed cash to pay their taxes as did investors/banks (probably to absorb strong US Treasury issuance. Hence, cash became dearer, and its scarcity led to a spike in the overnight repo rate. It is unusual to see such a spike in September, although it is quite normal at the end of each calendar year. There was a similar sharp rise in September 2008, coinciding with the Lehman Brothers collapse. At this stage we do not

Read More »Articles by Laureline Chatelain

T-bond yields trending down, but beware inflationary surprises

September 4, 2019The downward tilt to bond yields means we have revised down our year-end forecast for the 10-year US Treasury yield.The impressive 52 basis points fall in the US 10-year Treasury yield to 1.5% made August a remarkable month.Unsurprisingly, the fall owed much to the fear that additional US tariffs on Chinese imports could prolong the global manufacturing recession, thereby increasing the risk of contagion to the services sector and hence sparking a general US slowdown. It seems that market participants see the escalation in trade tensions as the main risk for US economic growth, although so far the main impact has been on the manufacturing sector, which represents only a small part of the US economy.The Fed’s concerns about the global manufacturing slowdown and the economic impact of the

Read More »Emerging market sovereign debt update: yields are falling

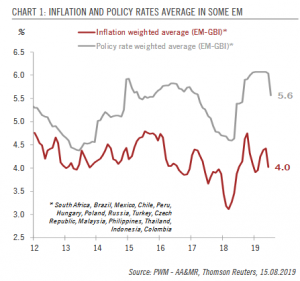

August 19, 2019Yields have fallen significantly in the EM sovereign bond space in local currency; USD movements will be key to watch for going forward.Yields have fallen impressively in the emerging market (EM) sovereign bond space in local currency, reaching 5.3% on 16 August, near their all-time low of 5.2% (in May 2013). This downward movement has been partly driven by the recent policy rate cuts of some EM central banks. The stabilisation of inflationary pressures thanks to a lower oil price and less weak EM currencies against the US dollar this year than in 2018 gave room for a reversal of previous tightening.Without surprise, the year-to-date total return of EM debt in local currency has been strong at 9.7%, thanks to the 116-bp fall in yield and the high coupon (6.1%). As risks of further

Read More »Emerging market sovereign debt update: yields are falling

August 19, 2019Yields have fallen significantly in the EM sovereign bond space in local currency; USD movements will be key to watch for going forward.

Yields have fallen impressively in the emerging market (EM) sovereign bond space in local currency, reaching 5.3% on 16 August, near their all-time low of 5.2% (in May 2013). This downward movement has been partly driven by the recent policy rate cuts of some EM central banks. The stabilisation of inflationary pressures thanks to a lower oil price and less weak EM currencies against the US dollar this year than in 2018 gave room for a reversal of previous tightening.

Without surprise, the year-to-date total return of EM debt in local currency has been strong at 9.7%, thanks to the 116-bp fall in yield and the high coupon

BREXIT UNCERTAINTY TO WEIGH ON YIELDS

July 26, 2019We expect the BoE to cut rates in November, even if a Brexit deal is reached by October.

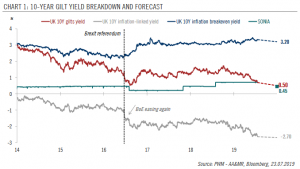

UK sovereign bond (gilts) yields have fallen this year, with the 10-year yield dropping by 59 basis points (bps) to 0.69%1, in concert with other core sovereign bond yields. The Brexit saga, along with the global slowdown forcing many central banks to turn dovish, are the main factors behind this steep fall.

Taking stock of this context, we now expect the Bank of England (BoE) to cut rates by 25 bps at its November meeting in our central scenario, where a no-deal Brexit is avoided in October. As market participants are only pricing in 5 bps of cuts by the end of this year, we expect the UK 10-year inflation-linked yield to

BREXIT UNCERTAINTY TO WEIGH ON YIELDS

July 25, 2019We expect the BoE to cut rates in November, even if a Brexit deal is reached by October.UK sovereign bond (gilts) yields have fallen this year, with the 10-year yield dropping by 59 basis points (bps) to 0.69%1, in concert with other core sovereign bond yields. The Brexit saga, along with the global slowdown forcing many central banks to turn dovish, are the main factors behind this steep fall.Taking stock of this context, we now expect the Bank of England (BoE) to cut rates by 25 bps at its November meeting in our central scenario, where a no-deal Brexit is avoided in October. As market participants are only pricing in 5 bps of cuts by the end of this year, we expect the UK 10-year inflation-linked yield to continue falling towards -2.7%.Headline inflation has come down in the UK in

Read More »DM credit caught between opposing forces

July 24, 2019Despite the impressive year-to-date performance of corporate credit, we remain prudent about prospects in the remainder of 2019.

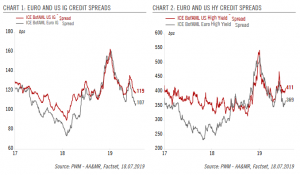

Corporate bonds have posted stellar total returns year to date, thanks to the positive combination of lower sovereign yields and tighter credit spreads. While high yield (HY) bonds have performed slightly better than investment grade (IG) ones on both sides of the Atlantic, the additional return from taking more risk remains thin.

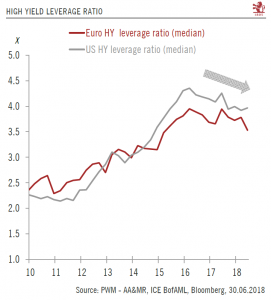

As cracks continue to appear in both the US and Europe, with the manufacturing sector facing a global slowdown, it becomes all the more important to look at corporate fundamentals. In this regard, one notes a rise in the leverage ratio across the board from

DM credit caught between opposing forces

July 22, 2019Despite the impressive year-to-date performance of corporate credit, we remain prudent about prospects in the remainder of 2019.Corporate bonds have posted stellar total returns year to date, thanks to the positive combination of lower sovereign yields and tighter credit spreads. While high yield (HY) bonds have performed slightly better than investment grade (IG) ones on both sides of the Atlantic, the additional return from taking more risk remains thin.As cracks continue to appear in both the US and Europe, with the manufacturing sector facing a global slowdown, it becomes all the more important to look at corporate fundamentals. In this regard, one notes a rise in the leverage ratio across the board from already high levels in Q1 2019. It remains to be seen whether the Q2 earnings

Read More »The ECB moves to keep euro bond yields down

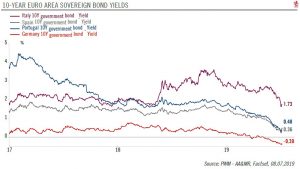

July 10, 2019Prospects of more ECB easing has contributed to an across-the-board rally in euro sovereign bonds yields and could help limit volatility in peripheral bonds.Since Mario Draghi in June signalled the European Central Bank’s (ECB) readiness to embark on more easing should the euro area economy fail to regain speed, euro sovereign bonds yields have fallen across the board, with the 10-year Bund yield briefly moving below -0.4% (the same level as the deposit rate) in intraday trading on July 4.We now expect the ECB to announce a second asset-purchasing programme (“QE 2”) later this year and to cut the deposit rate by 10 bps. This should maintain the 10-year Bund yield in negative territory for the rest of 2019: we have a year-end target of -0.2%, up from the current level due to a slight rise

Read More »The ECB moves to keep euro bond yields down

July 10, 2019Prospects of more ECB easing has contributed to an across-the-board rally in euro sovereign bonds yields and could help limit volatility in peripheral bonds.

Since Mario Draghi in June signalled the European Central Bank’s (ECB) readiness to embark on more easing should the euro area economy fail to regain speed, euro sovereign bonds yields have fallen across the board, with the 10-year Bund yield briefly moving below -0.4% (the same level as the deposit rate) in intraday trading on July 4.

We now expect the ECB to announce a second asset-purchasing programme (“QE 2”) later this year and to cut the deposit rate by 10 bps. This should maintain the 10-year Bund yield in negative territory for the rest of 2019: we have

Bund yields-Heading further down?

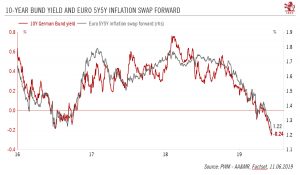

June 14, 2019Our central forecast is for Bund yields to rise (feebly) into positive territory by the end of this year, although risks are tilting to the downside.

Four main factors have been driving down the 10-year Bund yield, which reached an all-time low of -0.26% on June 7. Considering changing circumstances, we have lowered our year-end target for the 10-year Bund yield from 0.3% to 0.1% and expect it to remain in negative territory until at least October in our central scenario (55% probability). As such, we remain underweight core euro sovereign bonds.

.

Our central scenario is for the 10-year Bund yield to move back into positive territory toward the end of 2019 for a number of reasons. First, in contrast with market

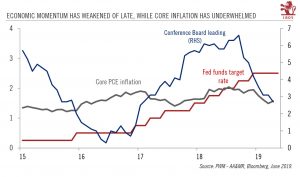

A dovish Fed could become even more so

June 6, 2019Trade, inflation expectations and economic data could well spark ‘insurance’ rate cuts by the Fed in the coming months.

We now believe that the Federal Reserve (Fed) could deliver two ‘insurance’ rate cuts of 25bps in coming months (up to now, we expected rates to be on hold in 2019-2020). We see three drivers that could dictate the exact timing of these cuts: 1) a continuation of President Trump’s pro-tariff stance (with the risk of dampening business sentiment and therefore investment); 2) confirmation from data in coming months that business investment is indeed slowing; and 3) broader financial conditions, including the crucial role of inflation expectations.

With these considerations in mind, the Fed Open

US-China trade update

May 17, 2019Reasoning suggests China will not use US treasuries or the RMB as trade weapons.Trade tensions between the US and China have risen sharply but we believe the situation would need to escalate much further before China resorts to the extreme weapons of currency devaluation and/or selling down its US Treasuries.The fundamental reason for this argument is that such strategies do not serve China’s own interests. On the contrary, they could cause severe damage to the Chinese economy.Should markets amplify that fear and price-in some of that worst-case scenario, it would probably coincide with an extremely weak context in local Asian currencies against the US dollar.Read full report here

Read More »Core sovereign bond yields – update

May 17, 2019We are adjusting downward our year-end targets for the 10-year US Treasury and Bund yields.

Taking hold of two important changes to our central macroeconomic scenarios, we are adjusting downward our year-end target for the 10-year US Treasury yield from 3.0% to 2.8% and the Bund yield from 0.5% to 0.3%. The drivers behind this include lower inflation expectations, rising US-China trade tensions against a constant monetary policy backdrop.

Four consecutive disappointing US inflation prints have led us to revise down our US core personal consumption expenditure target for 2019. As such, we see limited upside for the 10-year inflation breakeven rate and revise our year-end target from 2.2% to 2.0%. Along with subdued

Read More »Core sovereign bond yields – update

May 15, 2019We are adjusting downward our year-end targets for the 10-year US Treasury and Bund yields.Taking hold of two important changes to our central macroeconomic scenarios, we are adjusting downward our year-end target for the 10-year US Treasury yield from 3.0% to 2.8% and the Bund yield from 0.5% to 0.3%. The drivers behind this include lower inflation expectations, rising US-China trade tensions against a constant monetary policy backdrop.Four consecutive disappointing US inflation prints have led us to revise down our US core personal consumption expenditure target for 2019. As such, we see limited upside for the 10-year inflation breakeven rate and revise our year-end target from 2.2% to 2.0%. Along with subdued core inflation, falling inflation expectations in the euro area will probably

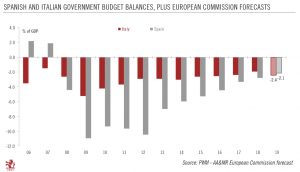

Read More »Peripheral bonds after the Spanish election

May 1, 2019We remain underweight peripheral euro area bonds in general due to continued political uncertainty, which will feed volatility.

On April 28, Spain held its third general election in less than four years. As was expected, the centre-left Socialists (PSOE) emerged the largest party, but it does not have an absolute majority, so negotiations with other parties will be needed. But the political fog in Spain is unlikely to lift much before the regional and European elections on May 26.

The misty political outlook is likely to have only a limited economic impact, at least initially. Although down from 2.5%, we expect the Spanish economy to grow by 2.1% this year, placing it among the top performers in the euro area.

Since

US and euro investment-grade credits: similar, but different

April 4, 2019We have moved up our stance on euro investment-grade credits to neutral, believing they have better potential than their US peers.US and euro investment grade (IG) indices have posted solid returns year-to-date thanks to a rally in credit spreads and sovereign yields linked to the dovish turn taken by some large central banks.We have turned neutral from underweight on euro IG credit, while retaining our underweight stance on US IG credit. First, euro IG offers an attractive yield pick-up compared with mostly negative core euro sovereign yields. Second, the median leverage ratio of non-financial public companies on the euro credit index seems to be trending down across all ratings grades. In the US, by contrast, only the riskiest segment (high yield (HY)) and the safest ones (bonds rated A

Read More »GERMANY: ECONOMY & SOVEREIGN BOND

February 26, 2019After a difficult second half of 2018, the outlook for Germany’s economy and sovereign bonds turns brighter.

A host of factors weighed on German growth in H2 2018: a sharp slowdown in global demand on the external side and several transitory factors on the domestic side impacted industrial activity. At the same time, the 10-year German Bund yield has been trending downward. The steep fall in the oil price in late 2018, the economic slowdown and the Bund’s safe haven status are all factors behind the German bund’s yield fall.

Based on our central scenario (to which we assign 55% probability), we expect the 10-year Bund yield to rise from its current low level of 0.13% (as on 21 February)to 0.3% by mid-year and 0.5% by

STAYING NEUTRAL ON US TREASURIES

February 7, 2019With global recession risks on the rise and the US treasury yield curve still threatening to invert, we remain neutral on US Treasuries.Since our December note on the 2019 outlook for US Treasuries, the environment for US bonds has shifted dramatically. The 10-year US Treasury yield reached a low of 2.56% on 3 January, the day before Jay Powell, chairman of the US Federal Reserve (Fed), made a U-turn from a hawkish to a dovish stance. Taking note of this regime shift, we are revising our year-end target downward, from 3.4% to 3.1%. We expect the 10-year yield to move gradually up to 3.0% by mid-year, plateauing towards the end of 2019.In this central scenario, the Fed would pause its rate hiking cycle and the upward yield move would come mainly from rising inflation expectations due to a

Read More »Outlook for euro periphery bonds

January 17, 2019Economic fundamentals should come back into focus, but politics still a factor.

After a year when peripheral countries’ old demons made a reappearance, with, in particular, Italy’s public debt back in the spotlight, the focus should shift to economic fundamentals in 2019. Both the Spanish and Italian economies are set to slow down, although the situation is more serious in Italy. In both countries, the political equilibrium remains fragile, with a risk of snap elections in 2019.

With the end of quantitative easing (QE), European Central Bank (ECB) bond purchases are set to have a negligible impact on markets. However, the extent to which the ECB manages to hike rates this year will be key for euro area periphery

Read More »Euro Credit: 2019 Outlook

January 10, 2019After a negative 2018, developments in Italy and indirect ECB support will help define the road ahead for European corporate bonds.

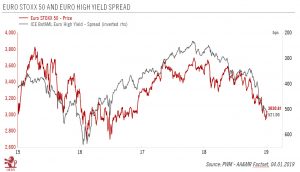

Last year was a difficult one for euro credit, with both the ICE Bank of America Merrill Lynch (ICE BofAML) investment grade (IG) and high yield (HY) indices posting negative total returns. This was entirely due to wider credit spreads, as medium-term German government bonds yields fell slightly. Looking back, policy makers had a major impact on the performance of credit markets—whether the tapering of the European Central Bank’s (ECB) quantitative easing (QE), Italy’s push for fiscal stimulus, or trade tensions.

In 2019, Italian political risk and debt metrics will again be an

Euro credit: 2019 outlook

January 8, 2019After a negative 2018, developments in Italy and indirect ECB support will help define the road ahead for European corporate bonds.Last year was a difficult one for euro credit, with both the ICE Bank of America Merrill Lynch (ICE BofAML) investment grade (IG) and high yield (HY) indices posting negative total returns. This was entirely due to wider credit spreads, as medium-term German government bonds yields fell slightly. Looking back, policy makers had a major impact on the performance of credit markets—whether the tapering of the European Central Bank’s (ECB) quantitative easing (QE), Italy’s push for fiscal stimulus, or trade tensions. In 2019, Italian political risk and debt metrics will again be an important focus for euro corporate bond investors, especially if the Italian

Read More »Core Euro Sovereign Bonds 2019 Outlook

December 23, 2018It’s all about the European Central Bank’s hiking cycle.

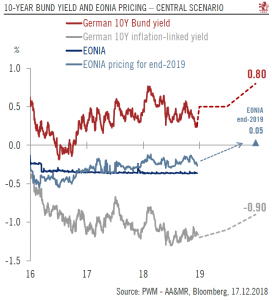

In our central scenario, we expect the 10-year Bund yield to rise gradually to 0.8% by the end of next year from 0.26% on 17 December. Underpinning this upward movement is our expectation of a cumulative deposit rate hike of 40 basis points (bps) by the ECB, against current market expectations of only 10 bps.

The euro area economic activity has been decelerating this year and the latest prints are not showing encouraging signs going into next year. Should it worsen more than we expect, the ECB could be forced to delay or even cancel its planned lift-off, thereby limiting the upside potential of the 10-year Bund yield. The delayed lift-off of the deposit rate to

Core euro sovereign bonds 2019 outlook

December 19, 2018It’s all about the European Central Bank’s hiking cycle.In our central scenario, we expect the 10-year Bund yield to rise gradually to 0.8% by the end of next year from 0.26% on 17 December. Underpinning this upward movement is our expectation of a cumulative deposit rate hike of 40 basis points (bps) by the ECB, against current market expectations of only 10 bps.The euro area economic activity has been decelerating this year and the latest prints are not showing encouraging signs going into next year. Should it worsen more than we expect, the ECB could be forced to delay or even cancel its planned lift-off, thereby limiting the upside potential of the 10-year Bund yield. The delayed lift-off of the deposit rate to 0.0% priced in by market participants is clearly rising possibility, and

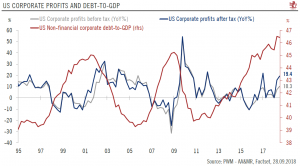

Read More »2019 US credit outlook

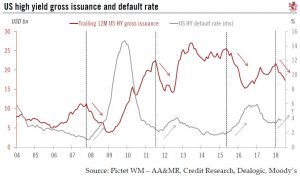

December 13, 2018The reversal of accommodative lending conditions and rising volatility mean we will stick to quality.While the US economy continues to grow, knowledge that we are late in the cycle means we are closely watching two developments of significance to credit markets: US corporate leverage and US Federal Reserve (Fed) rate hikes.Many indicators are pointing to rising leverage among US companies, be it the non-financial corporate debt-to-GDP ratio (which reached an all-time high of 46% in 2018), or company data (which also shows a trend toward higher leverage). Admittedly, however, our expectation that US-listed companies will deliver at least single-digit earnings growth in 2019 should avoid a surge in leverage ratios.Another source of concern has been the rising cost of debt to US companies

Read More »Time to be more constructive on high yield

October 4, 2018High yield bonds are benefiting from improved credit fundamentals and macroeconomic trends.We have just moved from an underweight to a neutral position on US and euro high yield bonds. Several factors underpin this relatively more constructive view.First, in spite of historically low spreads, the carry offered by high yield remains attractive and acts as a cushion at a time of rising government yields. Second, fundamentals remain sound, as the increase in corporate profits has outstripped the rise in debt, leading to a fall in the leverage ratio. Third, the macroeconomic environment in the US and the euro area remains favourable for high-yield bonds. Banks’ lending conditions remain accommodative and should support a further fall in the default rate on both sides of the Atlantic. Finally,

Read More »EM storm is subsiding, but clouds remain

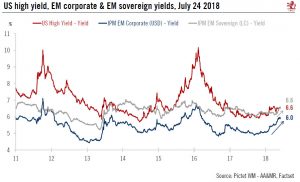

July 25, 2018We are waiting for trade-war clouds to become less threatening before adopting a more positive stance on EM debt.In a Flash Note in May, we argued that the rise in yields of emerging market (EM) debt could offer compelling opportunities for investors who had the patience to ride out the storm. EM credit spreads and yields have indeed recently being shown some signs of stabilising after a period of rising yields. The faltering rise in US Treasuries yields, some effective EM rate hikes and the recent relaxation of China central bank policies have provided respite to some EM bonds.Yet we expect trade war rhetoric to heighten over the coming months. If carried out, the threat of a 10% US tariff on an additional USD200bn of imports from China could lead risky assets to underperform given the

Read More »US high yield is looking suspect

July 13, 2018Unlike its euro counterpart, spreads on US high yield have held in well this year so far. However, with the default rate stalling and trade tensions rising, we think this could change.US high yield (HY) is one of the few segments in the fixed income space that has posted a positive total return since the beginning of the year. Thanks to lower duration, US HY has so far suffered less from the surge in US Treasury yields than its investment-grade counterpart. Moreover, some index-heavy sectors have rallied for different reasons. In particular, the energy sector has been helped by the rise in oil prices, while company-specific factors have benefited telecom and healthcare issuers. In addition, US high yield has been helped by efforts by the lowest-rated parts of the universe to deleverage.By

Read More »Rise in Bund yield will be limited

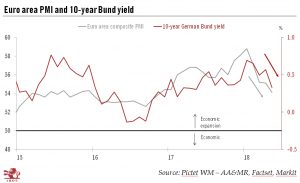

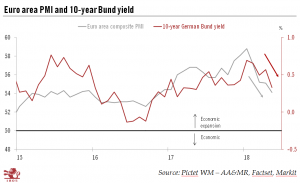

June 22, 2018With the faltering in euro area business sentiment since February, the Italy-led sell-off of risk assets at the end of May and the European Central Bank’s (ECB) dovish meeting in June, we are revising our year-end forecast for the German 10-year Bund yield from 0.9% to 0.6%, as we hinted we might do in a previous note.

Euro area business cycle slowdown

After a very strong end to 2017, euro area economic growth has been falling short of strong expectations, coming in at only 0.4% in Q1 2018 (quarter on quarter, q-o-q) against 0.7% in Q4 2017. Moreover, leading indicators such as the euro area composite purchasing managers’ index (PMI) signal that moderation is continuing, consistent with growth again coming in at

Read More »Rise in Bund yield will be limited

June 20, 2018A mixture of soft data, a change of government in Italy and a dovish ECB exit from quantitative easing mean we are revising downward our year-end forecast for the 10-year Bund yield.With the faltering in euro area business sentiment since February, the Italy-led sell-off of risk assets at the end of May and the European Central Bank’s (ECB) dovish meeting in June, we are revising our year-end forecast for the German 10-year Bund yield from 0.9% to 0.6%, as we hinted we might do in a previous note.The slowdown in growth momentum, as reflected in the euro area PMI, explains in part why the German 10-year Bund yield has been falling again after a strong rise at the start of the year (see Chart). The 10-year Bund’s safe-haven status has lately come back into focus, with the yield dropping to

Read More »