The reversal of accommodative lending conditions and rising volatility mean we will stick to quality.While the US economy continues to grow, knowledge that we are late in the cycle means we are closely watching two developments of significance to credit markets: US corporate leverage and US Federal Reserve (Fed) rate hikes.Many indicators are pointing to rising leverage among US companies, be it the non-financial corporate debt-to-GDP ratio (which reached an all-time high of 46% in 2018), or company data (which also shows a trend toward higher leverage). Admittedly, however, our expectation that US-listed companies will deliver at least single-digit earnings growth in 2019 should avoid a surge in leverage ratios.Another source of concern has been the rising cost of debt to US companies

Topics:

Laureline Chatelain considers the following as important: credit cycle, Macroview, US corporate profits, US economic activity

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The reversal of accommodative lending conditions and rising volatility mean we will stick to quality.

While the US economy continues to grow, knowledge that we are late in the cycle means we are closely watching two developments of significance to credit markets: US corporate leverage and US Federal Reserve (Fed) rate hikes.

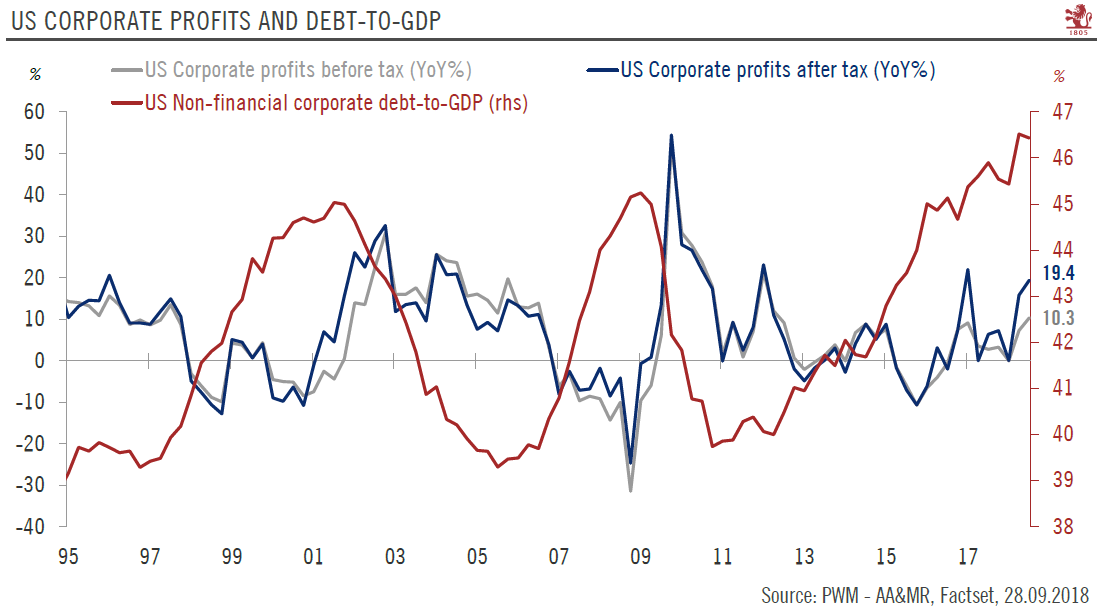

Many indicators are pointing to rising leverage among US companies, be it the non-financial corporate debt-to-GDP ratio (which reached an all-time high of 46% in 2018), or company data (which also shows a trend toward higher leverage). Admittedly, however, our expectation that US-listed companies will deliver at least single-digit earnings growth in 2019 should avoid a surge in leverage ratios.

Another source of concern has been the rising cost of debt to US companies since the Fed began its hiking cycle in 2015. US company data show that until Q3 2018, profit rises outweighed the increased cost of funding, leading to a rise in the median interest coverage ratio (EBIT over interest expenses), for investment grade (IG) and high yield (HY) companies alike. US credit yields that remained low by historical standards due to tight credit spreads also helped. However, the recent equities sell-off has caused US credit spreads to widen, especially for HY. Should credit spreads continue to rise sharply, life could get difficult for highly leveraged companies.

In this environment, Pictet Wealth Management has recently turned to an underweight stance on US credit. In our central scenario (55% probability), we expect a slowdown in profit growth that should lead to further, but limited, US credit spread widening. However, a negative scenario (30% probability), in which signs of a US recession start to appear in 2019, could lead spreads to widen back to at least early-2016 levels.

In our central scenario, we expect the US economy to remain robust in 2019, supporting single-digit percentage growth in US company profits, with risks of a recession pushed back to 2020. However, recent economic data disappointments, high (geo)political uncertainty and the current market volatility mean that we prefer sticking to quality in US credit, thereby limiting exposure to high yield and the lowest-rated segment of US investment grade (BBB) credits.