We remain underweight peripheral euro area bonds in general due to continued political uncertainty, which will feed volatility. On April 28, Spain held its third general election in less than four years. As was expected, the centre-left Socialists (PSOE) emerged the largest party, but it does not have an absolute majority, so negotiations with other parties will be needed. But the political fog in Spain is unlikely to lift much before the regional and European elections on May 26. The misty political outlook is likely to have only a limited economic impact, at least initially. Although down from 2.5%, we expect the Spanish economy to grow by 2.1% this year, placing it among the top performers in the euro area. Since

Topics:

Laureline Chatelain considers the following as important: 2) Swiss and European Macro, Featured, Macroview, newsletter, Peripheral bond spreads, Peripheral euro area bonds, Pictet Macro Analysis, Spanish bonds, Spanish elections

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| We remain underweight peripheral euro area bonds in general due to continued political uncertainty, which will feed volatility.

On April 28, Spain held its third general election in less than four years. As was expected, the centre-left Socialists (PSOE) emerged the largest party, but it does not have an absolute majority, so negotiations with other parties will be needed. But the political fog in Spain is unlikely to lift much before the regional and European elections on May 26. The misty political outlook is likely to have only a limited economic impact, at least initially. Although down from 2.5%, we expect the Spanish economy to grow by 2.1% this year, placing it among the top performers in the euro area. Since the beginning of 2019, peripheral spreads have remained range bound—between 240-270 bps for Italian government bonds and 100-120 bps for Spanish ones. Relatively stable spreads along with the fall in the 10-year Bund yield have contributed to good total returns year-to-date. Yet politics remain crucial for ten-year peripheral sovereign spreads over Bunds, be it in or in Italy, where European Parliament elections in late May could upset the balance of the current governing coalition of populist parties. |

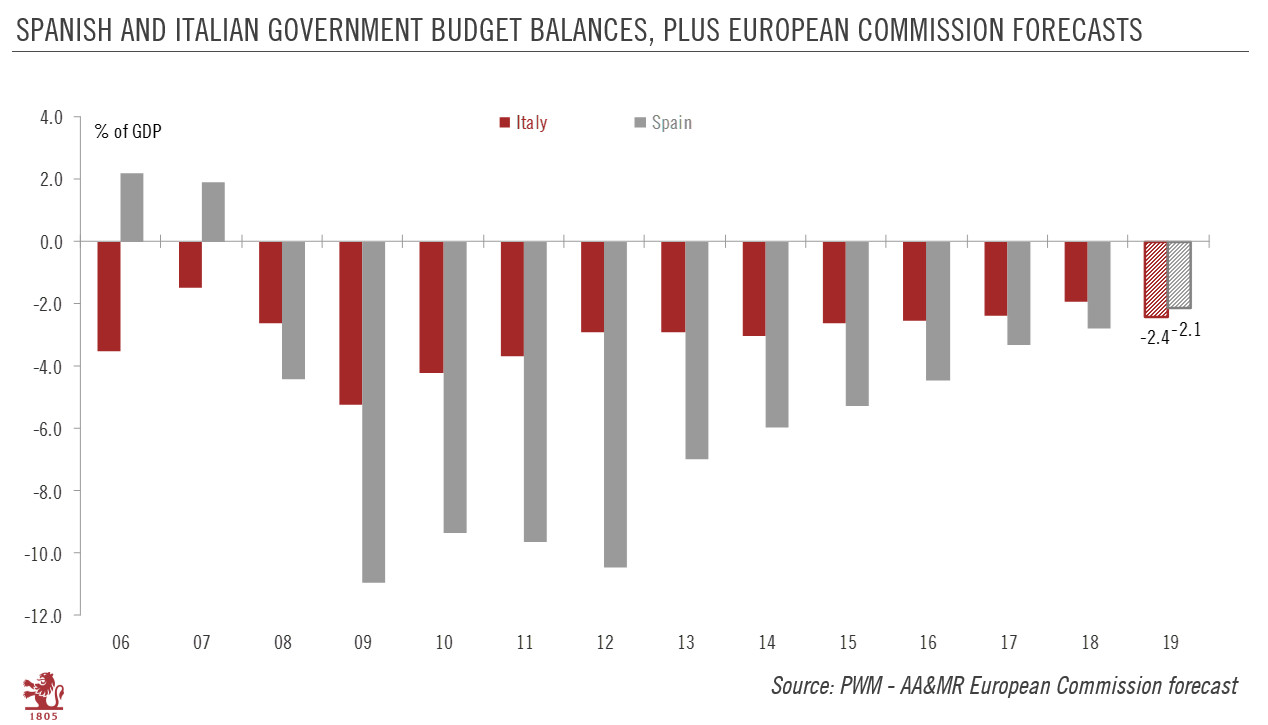

Spanish and Italian Government Budget Balances, 2006-2019 |

The most likely scenario in Spain at this stage seems a leftist coalition between the PSOE and Podemos, with small regional parties lending support. Such an arrangement would make it difficult to pursue a stable political agenda that concentrates on reforms rather than angry debate over Catalonia. In such a scenario, fiscal consolidation would not be a priority. Strong growth and low interest rates have helped mask the lack of structural consolidation of public finances in the past five years. But in an environment of decelerating growth, the focus is likely to move back to Spanish fiscal policy, notably when the 2020 budget is discussed with Brussels in October.

Since the populist coalition was formed between the League and the Five Star Movement in May last year, the 10-year Italian sovereign spread has jumped far higher than its Spanish counterpart. But even if the contagion to Spain has been limited, both sovereign spreads remain tightly correlated. The evolving situation in Italy will be a key driver of Spanish spreads.

Overall, in our central scenario, while we expect spreads to stay within their recent range both in Italy and Spain, we remain underweight peripheral euro area sovereign bonds due to continued political uncertainty. We maintain our year-end target of 250 bps for the 10-year Italian spread over Bunds and of 130 bps for its Spanish counterpart. But should a new Spanish government maintain fiscal rigour and sustain business and consumers’ confidence, the 10-year Spanish spread could tighten below 100 bps again (excluding renewed Italian turmoil).

Tags: Featured,Macroview,newsletter,Peripheral bond spreads,Peripheral euro area bonds,Spanish bonds,Spanish elections