With global recession risks on the rise and the US treasury yield curve still threatening to invert, we remain neutral on US Treasuries.Since our December note on the 2019 outlook for US Treasuries, the environment for US bonds has shifted dramatically. The 10-year US Treasury yield reached a low of 2.56% on 3 January, the day before Jay Powell, chairman of the US Federal Reserve (Fed), made a U-turn from a hawkish to a dovish stance. Taking note of this regime shift, we are revising our year-end target downward, from 3.4% to 3.1%. We expect the 10-year yield to move gradually up to 3.0% by mid-year, plateauing towards the end of 2019.In this central scenario, the Fed would pause its rate hiking cycle and the upward yield move would come mainly from rising inflation expectations due to a

Topics:

Laureline Chatelain considers the following as important: Macroview, US Treasuries, US Treasury yield

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

With global recession risks on the rise and the US treasury yield curve still threatening to invert, we remain neutral on US Treasuries.

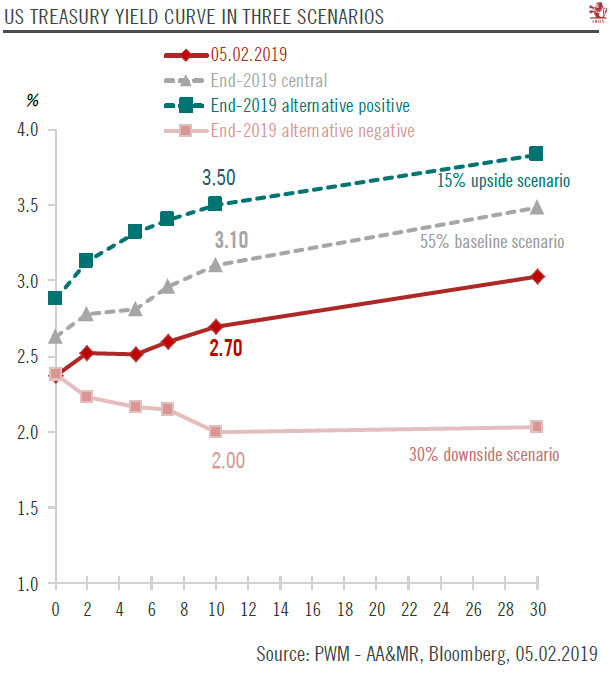

Since our December note on the 2019 outlook for US Treasuries, the environment for US bonds has shifted dramatically. The 10-year US Treasury yield reached a low of 2.56% on 3 January, the day before Jay Powell, chairman of the US Federal Reserve (Fed), made a U-turn from a hawkish to a dovish stance. Taking note of this regime shift, we are revising our year-end target downward, from 3.4% to 3.1%. We expect the 10-year yield to move gradually up to 3.0% by mid-year, plateauing towards the end of 2019.

In this central scenario, the Fed would pause its rate hiking cycle and the upward yield move would come mainly from rising inflation expectations due to a further oil price increase and an acceleration of US core inflation. Moreover, we foresee a revival of the term premium (i.e., a steepening of the US yield curve), brought on by a pause in Fed rate hikes, by continued Fed balance sheet shrinkage and by a rising supply of US Treasuries on the mid-to-long end of the curve.

However, global recession risks have been rising and we are aware that the curve could invert, with the 10-year yield falling to 2.0% should this risk materialise (our negative scenario). For this reason, we are remaining neutral on US Treasuries in general, favouring the mid-part of the curve.