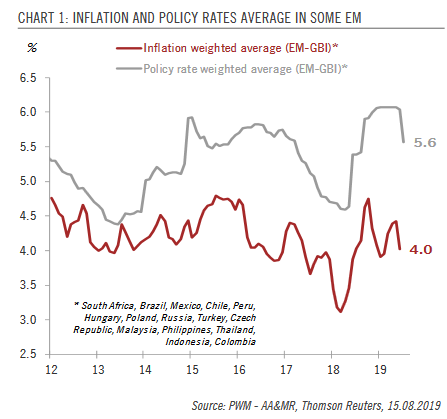

Yields have fallen significantly in the EM sovereign bond space in local currency; USD movements will be key to watch for going forward. Yields have fallen impressively in the emerging market (EM) sovereign bond space in local currency, reaching 5.3% on 16 August, near their all-time low of 5.2% (in May 2013). This downward movement has been partly driven by the recent policy rate cuts of some EM central banks. The stabilisation of inflationary pressures thanks to a lower oil price and less weak EM currencies against the US dollar this year than in 2018 gave room for a reversal of previous tightening. Without surprise, the year-to-date total return of EM debt in local currency has been strong at 9.7%, thanks to the 116-bp fall in yield and the high coupon

Topics:

Laureline Chatelain considers the following as important: 2.) Pictet Macro Analysis, 2) Swiss and European Macro, EM debt, emerging debt, Featured, Macroview, newsletter, yield

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

Yields have fallen significantly in the EM sovereign bond space in local currency; USD movements will be key to watch for going forward. Yields have fallen impressively in the emerging market (EM) sovereign bond space in local currency, reaching 5.3% on 16 August, near their all-time low of 5.2% (in May 2013). This downward movement has been partly driven by the recent policy rate cuts of some EM central banks. The stabilisation of inflationary pressures thanks to a lower oil price and less weak EM currencies against the US dollar this year than in 2018 gave room for a reversal of previous tightening. Without surprise, the year-to-date total return of EM debt in local currency has been strong at 9.7%, thanks to the 116-bp fall in yield and the high coupon (6.1%). As risks of further financial market turmoil and global recession increase, EM currencies could weaken against the US dollar (they are usually considered as risky assets and the latter as a safe-haven), thereby limiting the room for further monetary easing by EM central banks (in our negative scenario, 35% probability). In our central scenario we expect EM currencies to remain broadly stable against the US dollar until year-end, except for a few idiosyncratic stories (negative or positive). Overall, we remain overweight EM sovereign debt in local currency, and in our central scenario we expect yields to fall slightly more (towards 5.0% by year-end) as EM central banks continue to cut their policy rates, bearing in mind that most of the rate cuts seem already priced in. |

Inflation and Policy Rates Average in Some EM, 2012-2019 |

Tags: EM debt,emerging debt,Featured,Macroview,newsletter,yield