Unlike its euro counterpart, spreads on US high yield have held in well this year so far. However, with the default rate stalling and trade tensions rising, we think this could change.US high yield (HY) is one of the few segments in the fixed income space that has posted a positive total return since the beginning of the year. Thanks to lower duration, US HY has so far suffered less from the surge in US Treasury yields than its investment-grade counterpart. Moreover, some index-heavy sectors have rallied for different reasons. In particular, the energy sector has been helped by the rise in oil prices, while company-specific factors have benefited telecom and healthcare issuers. In addition, US high yield has been helped by efforts by the lowest-rated parts of the universe to deleverage.By

Topics:

Laureline Chatelain considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Unlike its euro counterpart, spreads on US high yield have held in well this year so far. However, with the default rate stalling and trade tensions rising, we think this could change.

US high yield (HY) is one of the few segments in the fixed income space that has posted a positive total return since the beginning of the year. Thanks to lower duration, US HY has so far suffered less from the surge in US Treasury yields than its investment-grade counterpart. Moreover, some index-heavy sectors have rallied for different reasons. In particular, the energy sector has been helped by the rise in oil prices, while company-specific factors have benefited telecom and healthcare issuers. In addition, US high yield has been helped by efforts by the lowest-rated parts of the universe to deleverage.

By contrast, euro high yield has put in a negative performance so far this year, largely because Italian issuers were caught by the fallout from political instability in their home country in May. On top of that, the European Central Bank announced the closure of its quantitative easing (QE) programme for the end of this year, hurting sentiment.

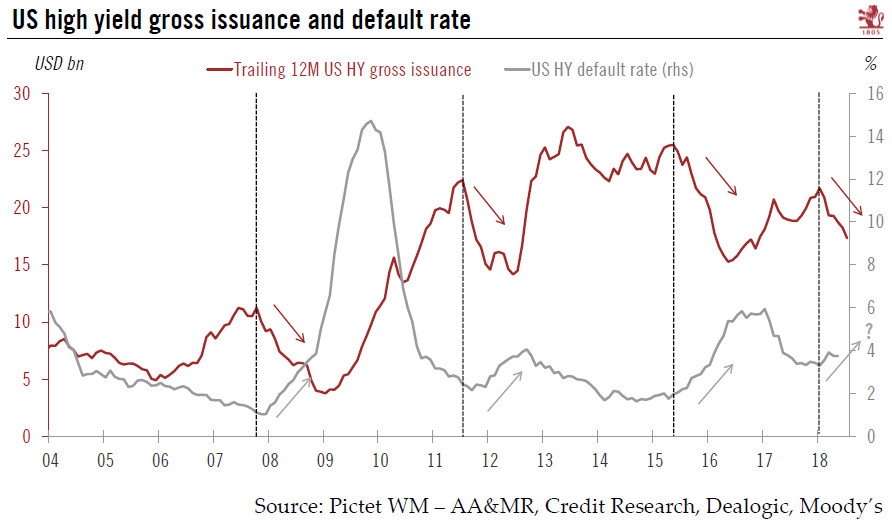

However, we expect US high yield to replicate the underperformance of its euro counterpart in the months ahead. There are three main reasons for our bearishness: monetary policy is becoming less accommodative; trade tensions could impact the business cycle and risk appetite; and the special factors that have pushed US HY spreads tighter are now fading. After falling regularly since 2016, the US default rate has recently stalled at 3.7%. As the US business cycle continues to mature, we expect to see the default rate to start to pick up and investor risk appetite to diminish (especially if we have a trade war).

All in all, on the heels of euro HY, we have turned bearish on US high yield. We expect HY in general to underperform in the coming three-to-six months.