High yield bonds are benefiting from improved credit fundamentals and macroeconomic trends.We have just moved from an underweight to a neutral position on US and euro high yield bonds. Several factors underpin this relatively more constructive view.First, in spite of historically low spreads, the carry offered by high yield remains attractive and acts as a cushion at a time of rising government yields. Second, fundamentals remain sound, as the increase in corporate profits has outstripped the rise in debt, leading to a fall in the leverage ratio. Third, the macroeconomic environment in the US and the euro area remains favourable for high-yield bonds. Banks’ lending conditions remain accommodative and should support a further fall in the default rate on both sides of the Atlantic. Finally,

Topics:

Laureline Chatelain considers the following as important: credit cycle, credit spreads, high-yield bonds, Macroview

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: Happy Days Are Here Again!

Joseph Y. Calhoun writes Weekly Market Pulse: The Real Reason The Fed Should Pause

Joseph Y. Calhoun writes Weekly Market Pulse: No News Is…

Joseph Y. Calhoun writes Weekly Market Pulse: Opposite George

High yield bonds are benefiting from improved credit fundamentals and macroeconomic trends.

We have just moved from an underweight to a neutral position on US and euro high yield bonds. Several factors underpin this relatively more constructive view.

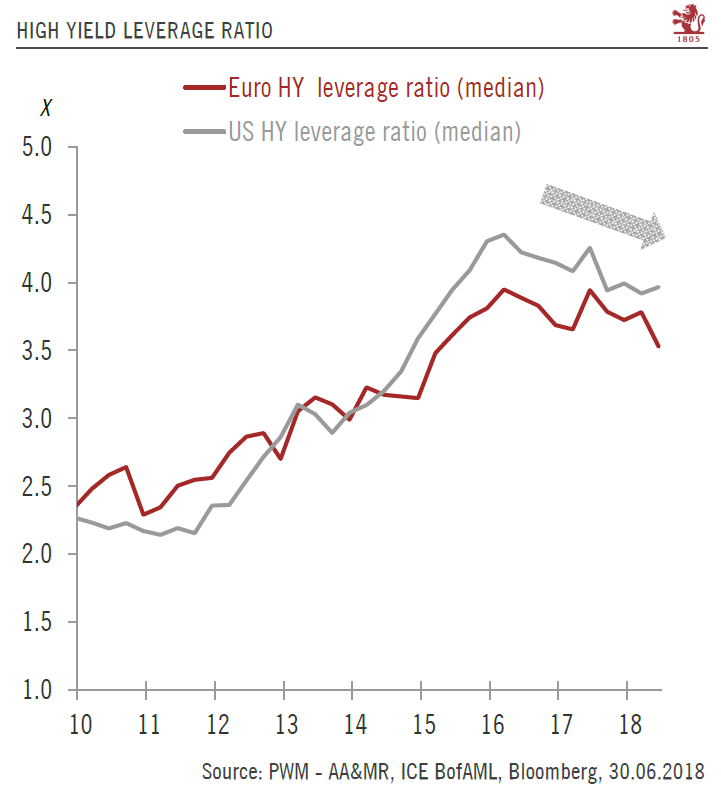

First, in spite of historically low spreads, the carry offered by high yield remains attractive and acts as a cushion at a time of rising government yields. Second, fundamentals remain sound, as the increase in corporate profits has outstripped the rise in debt, leading to a fall in the leverage ratio. Third, the macroeconomic environment in the US and the euro area remains favourable for high-yield bonds. Banks’ lending conditions remain accommodative and should support a further fall in the default rate on both sides of the Atlantic. Finally, while US high yield could benefit more from a continued rise in the oil price and robust US growth, spreads could tighten in euro high yield should the tensions caused by Italian deficit issues calm down. Despite sharing similar drivers, there are differences between US and euro high yield that have contributed to divergence in their performance this year (BofAML indexes show a total return of about 2.8% for US high yield bonds year to date, while European equivalents are slightly negative). The US high yield market has undergone some credit spread tightening, A large part of this is attributable to the energy sector, which represents 16% of the US high-yield universe and has benefited this year from the rise in oil prices. There has also been significant tightening in other sectors in the US, including media, healthcare and telecom, thanks to positive corporate stories.

On the other hand, euro high yield has been hurt by political uncertainty surrounding Italy. Not only have Italian issues been affected, so have high yield bonds from European banks. Financials contributed more than a quarter of the spread widening seen in euro high yield this year, even though they constitute only 20% of the overall index.