Economic fundamentals should come back into focus, but politics still a factor. After a year when peripheral countries’ old demons made a reappearance, with, in particular, Italy’s public debt back in the spotlight, the focus should shift to economic fundamentals in 2019. Both the Spanish and Italian economies are set to slow down, although the situation is more serious in Italy. In both countries, the political equilibrium remains fragile, with a risk of snap elections in 2019. With the end of quantitative easing (QE), European Central Bank (ECB) bond purchases are set to have a negligible impact on markets. However, the extent to which the ECB manages to hike rates this year will be key for euro area periphery

Topics:

Laureline Chatelain considers the following as important: 2) Swiss and European Macro, euro area bonds, Featured, Italian bonds, Macroview, newsletter, Pictet Macro Analysis

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Economic fundamentals should come back into focus, but politics still a factor.

After a year when peripheral countries’ old demons made a reappearance, with, in particular, Italy’s public debt back in the spotlight, the focus should shift to economic fundamentals in 2019. Both the Spanish and Italian economies are set to slow down, although the situation is more serious in Italy. In both countries, the political equilibrium remains fragile, with a risk of snap elections in 2019.

| With the end of quantitative easing (QE), European Central Bank (ECB) bond purchases are set to have a negligible impact on markets. However, the extent to which the ECB manages to hike rates this year will be key for euro area periphery bonds. In our central scenario, we still expect rate increases in the second half of this year, but, given disappointing euro area data, the possibility of seeing no rate rise at all in 2019 has increased significantly in recent months. In any case, the ECB’s policy normalisation will likely be very gradual, thereby limiting the upward pressure on sovereign yields.

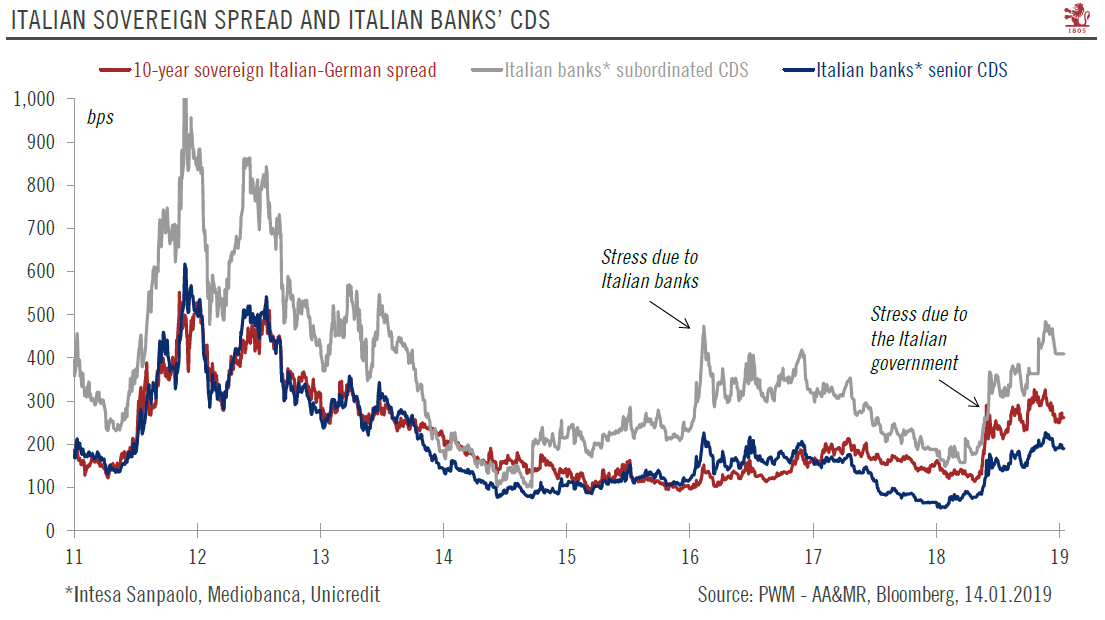

Economic slowdown, political uncertainty and the potential for fresh confrontation between Italy and Europe will keep the environment volatile for peripheral bonds. We are underweight peripheral sovereign debt, and will likely remain so at least until we have reassurance on the economic and political front. In our central scenario (to which we assign only a 55% probability), we expect the 10-year Italian spread versus the Bund to remain in a range of 250-300 bps this year — but a more drastic economic deceleration and/or an early general election could push spreads above these ranges again, with the spectre of a ratings downgrade again driving spreads above 300 bps. Although there is also a certain lack of political visibility in Spain, we expect Spanish spreads to rise only slightly, averaging 130-150 bps over the Bund. |

Italian Sovereign Spread and Italian Banks CDS 2011-2019 |

Tags: euro area bonds,Featured,Italian bonds,Macroview,newsletter