We are waiting for trade-war clouds to become less threatening before adopting a more positive stance on EM debt.In a Flash Note in May, we argued that the rise in yields of emerging market (EM) debt could offer compelling opportunities for investors who had the patience to ride out the storm. EM credit spreads and yields have indeed recently being shown some signs of stabilising after a period of rising yields. The faltering rise in US Treasuries yields, some effective EM rate hikes and the recent relaxation of China central bank policies have provided respite to some EM bonds.Yet we expect trade war rhetoric to heighten over the coming months. If carried out, the threat of a 10% US tariff on an additional USD200bn of imports from China could lead risky assets to underperform given the

Topics:

Laureline Chatelain considers the following as important: EM corporate debt, EM debt, emerging markets, Macroview

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: The Real Reason The Fed Should Pause

Joseph Y. Calhoun writes Weekly Market Pulse: The Dog That Didn’t Bark

Joseph Y. Calhoun writes Weekly Market Pulse: Things That Need To Happen

Joseph Y. Calhoun writes Weekly Market Pulse: Oil Shock

We are waiting for trade-war clouds to become less threatening before adopting a more positive stance on EM debt.

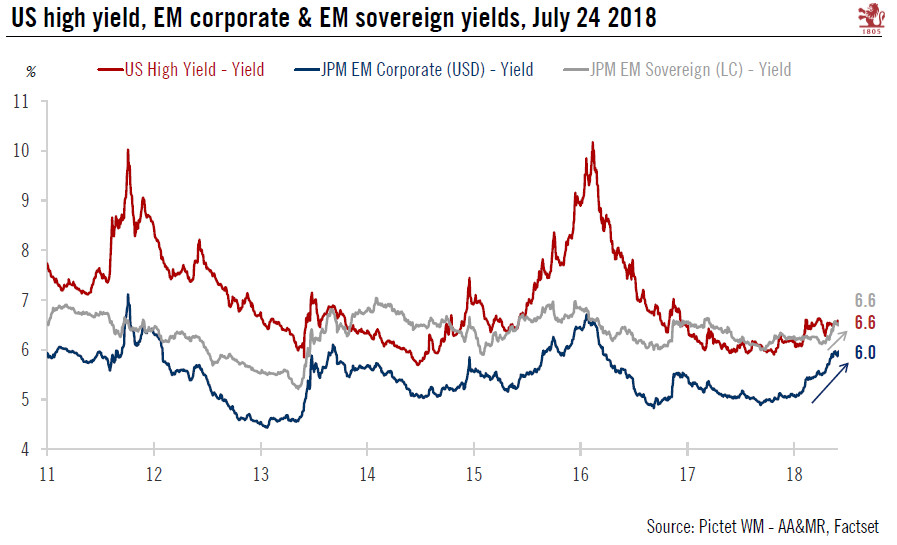

In a Flash Note in May, we argued that the rise in yields of emerging market (EM) debt could offer compelling opportunities for investors who had the patience to ride out the storm. EM credit spreads and yields have indeed recently being shown some signs of stabilising after a period of rising yields. The faltering rise in US Treasuries yields, some effective EM rate hikes and the recent relaxation of China central bank policies have provided respite to some EM bonds.

Yet we expect trade war rhetoric to heighten over the coming months. If carried out, the threat of a 10% US tariff on an additional USD200bn of imports from China could lead risky assets to underperform given the macroeconomic impact (tariffs of this magnitude could knock 0.5% off Chinese 2019 GDP growth and 0.3% off US growth). For this reason, we have a neutral three-to-six month stance on EM corporate debt in US dollars and on EM sovereign debt in local currency.

EM central banks have been hiking rates to defend their currency. Their sensitivity to monetary policy means the rise in base rates also drives local currency sovereign bonds yields higher. All the same, rate hikes in the past two months have been mostly effective in sustaining some EM currencies.

We would avoid local currency sovereign bonds in countries that could be subject to further currency depreciation like Turkey and Brazil, but we would favour countries with better economic prospects and less exposure to international trade. All in all, investors have to be very selective when picking EM bonds.

After the recent sell-off (-2% year-to-date on July 24 for JP Morgan EM corporates), we are waiting for the trade war clouds to lift to adopt a more positive stance on EM corporate bonds. The JP Morgan EM Corporate Bond index is predominantly made up of investment-grade paper, but now yields almost as much as US high yield. We favour companies of quality not overly exposed to US trade or to the Chinese deleveraging story.