We expect the BoE to cut rates in November, even if a Brexit deal is reached by October. UK sovereign bond (gilts) yields have fallen this year, with the 10-year yield dropping by 59 basis points (bps) to 0.69%1, in concert with other core sovereign bond yields. The Brexit saga, along with the global slowdown forcing many central banks to turn dovish, are the main factors behind this steep fall. Taking stock of this context, we now expect the Bank of England (BoE) to cut rates by 25 bps at its November meeting in our central scenario, where a no-deal Brexit is avoided in October. As market participants are only pricing in 5 bps of cuts by the end of this year, we expect the UK 10-year inflation-linked yield to

Topics:

Laureline Chatelain considers the following as important: 2) Swiss and European Macro, Bank of England, Brexit, Featured, Gilts, Macroview, newsletter, Pictet Macro Analysis, UK sovereign bond

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

We expect the BoE to cut rates in November, even if a Brexit deal is reached by October.

| UK sovereign bond (gilts) yields have fallen this year, with the 10-year yield dropping by 59 basis points (bps) to 0.69%1, in concert with other core sovereign bond yields. The Brexit saga, along with the global slowdown forcing many central banks to turn dovish, are the main factors behind this steep fall.

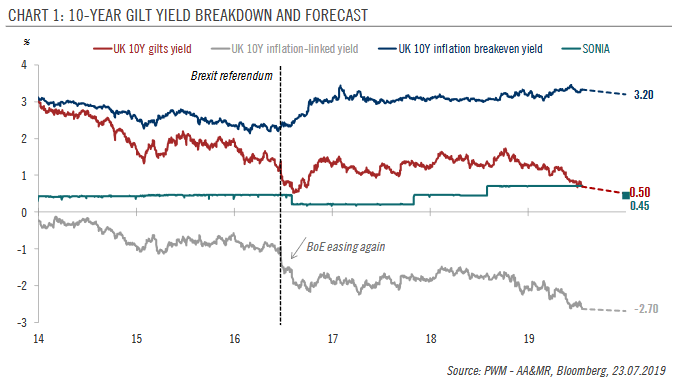

Taking stock of this context, we now expect the Bank of England (BoE) to cut rates by 25 bps at its November meeting in our central scenario, where a no-deal Brexit is avoided in October. As market participants are only pricing in 5 bps of cuts by the end of this year, we expect the UK 10-year inflation-linked yield to continue falling towards -2.7%. Headline inflation has come down in the UK in 2019, printing at 2.0% in June, off the 3.0% level reached at the beginning of 2018. Despite this, the 10-year inflation breakeven yield has remained high at 3.3%2, probably due to sterling’s recent weakness and rising wage growth. Overall, we expect the 10-year gilt yield to fall further towards 0.5% by year-end in our central scenario (50%). Should growth be sufficiently robust for the BoE not to cut rates, it could rise towards 0.8% (10% probability). Should a ‘no-deal’ Brexit take place on October 31 (40% probability), then it could fall towards 0.0%, due to a significant easing package from the BoE and a global safe-haven asset rally, despite a jump in inflation expectations linked to a weaker sterling. |

UK 10-YEAR Gilt Yield Breakdown and Forecast, 2014 - 2019 Source: pictet.com - Click to enlarge |

Tags: Bank of England,Brexit,Featured,Gilts,Macroview,newsletter,UK sovereign bond