It’s all about the European Central Bank’s hiking cycle.In our central scenario, we expect the 10-year Bund yield to rise gradually to 0.8% by the end of next year from 0.26% on 17 December. Underpinning this upward movement is our expectation of a cumulative deposit rate hike of 40 basis points (bps) by the ECB, against current market expectations of only 10 bps.The euro area economic activity has been decelerating this year and the latest prints are not showing encouraging signs going into next year. Should it worsen more than we expect, the ECB could be forced to delay or even cancel its planned lift-off, thereby limiting the upside potential of the 10-year Bund yield. The delayed lift-off of the deposit rate to 0.0% priced in by market participants is clearly rising possibility, and

Topics:

Laureline Chatelain considers the following as important: ECB, euro area, European Central Bank, Macroview

This could be interesting, too:

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes US-China Exchange Export Restrictions, Yuan is Sold to New Lows for the Year, while the Greenback Extends Waller’s Inspired Losses

Marc Chandler writes Markets do Cartwheels in Response to Traditional Pick for US Treasury Secretary

Marc Chandler writes FX Becalmed Ahead of the Weekend and Next Week’s Big Events

It’s all about the European Central Bank’s hiking cycle.

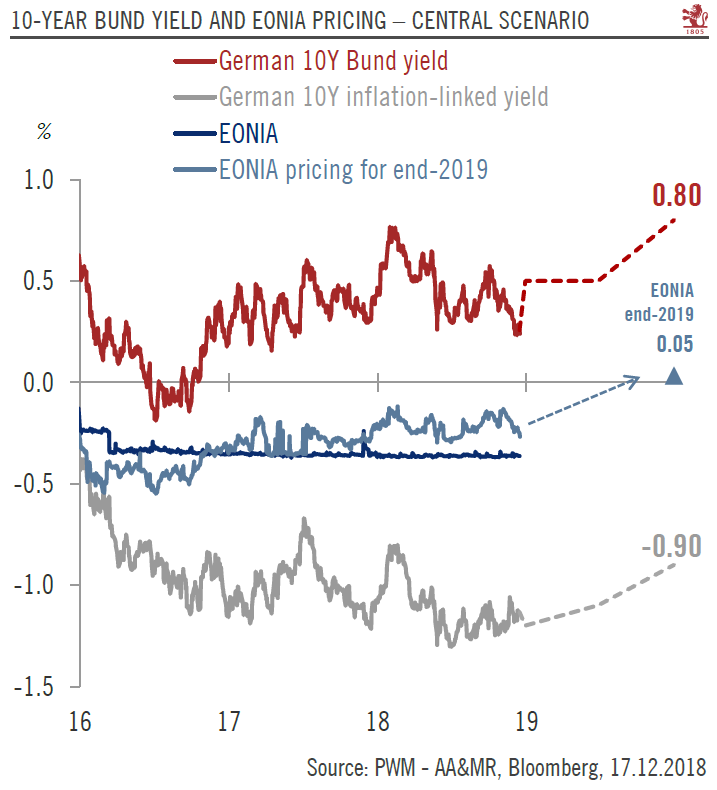

In our central scenario, we expect the 10-year Bund yield to rise gradually to 0.8% by the end of next year from 0.26% on 17 December. Underpinning this upward movement is our expectation of a cumulative deposit rate hike of 40 basis points (bps) by the ECB, against current market expectations of only 10 bps.

The euro area economic activity has been decelerating this year and the latest prints are not showing encouraging signs going into next year. Should it worsen more than we expect, the ECB could be forced to delay or even cancel its planned lift-off, thereby limiting the upside potential of the 10-year Bund yield. The delayed lift-off of the deposit rate to 0.0% priced in by market participants is clearly rising possibility, and would push the 10-year Bund only slightly upward.

The packed political agenda in Europe, along with the US protectionism, could also bring some unwelcomed surprises next year, underlining the still valid safe-haven status of the Bund. In 2018, the 10-year Bund’s status as a safe-haven asset was brought into the spotlight, as the formation of a populist government in Italy and the global stock-market sell-off caused concern for market participants. We expect uncertainties to remain significant next year, with upcoming European Parliament elections, potential early elections in Spain and Italy, ongoing Brexit negotiations as well as the threat of further import tariffs from the US administration. In that regard, the upward movement in the 10-year Bund yield towards 0.8% that we anticipate by year-end could be derailed should any of these risks turn for the worst.

Despite rising probabilities of a delayed ECB hiking cycle and the Bund safe-haven status, Pictet Wealth Management has recently turned underweight on core euro sovereign bonds, as the extremely low level of yields offer little prospect of attractive returns over the coming year.