We are adjusting downward our year-end targets for the 10-year US Treasury and Bund yields. Taking hold of two important changes to our central macroeconomic scenarios, we are adjusting downward our year-end target for the 10-year US Treasury yield from 3.0% to 2.8% and the Bund yield from 0.5% to 0.3%. The drivers behind this include lower inflation expectations, rising US-China trade tensions against a constant monetary policy backdrop. Four consecutive disappointing US inflation prints have led us to revise down our US core personal consumption expenditure target for 2019. As such, we see limited upside for the 10-year inflation breakeven rate and revise our year-end target from 2.2% to 2.0%. Along with subdued

Topics:

Laureline Chatelain considers the following as important: 5) Global Macro, Bund yields, Featured, Macroview, newsletter, sovereign bonds, US Treasury yield

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

We are adjusting downward our year-end targets for the 10-year US Treasury and Bund yields.

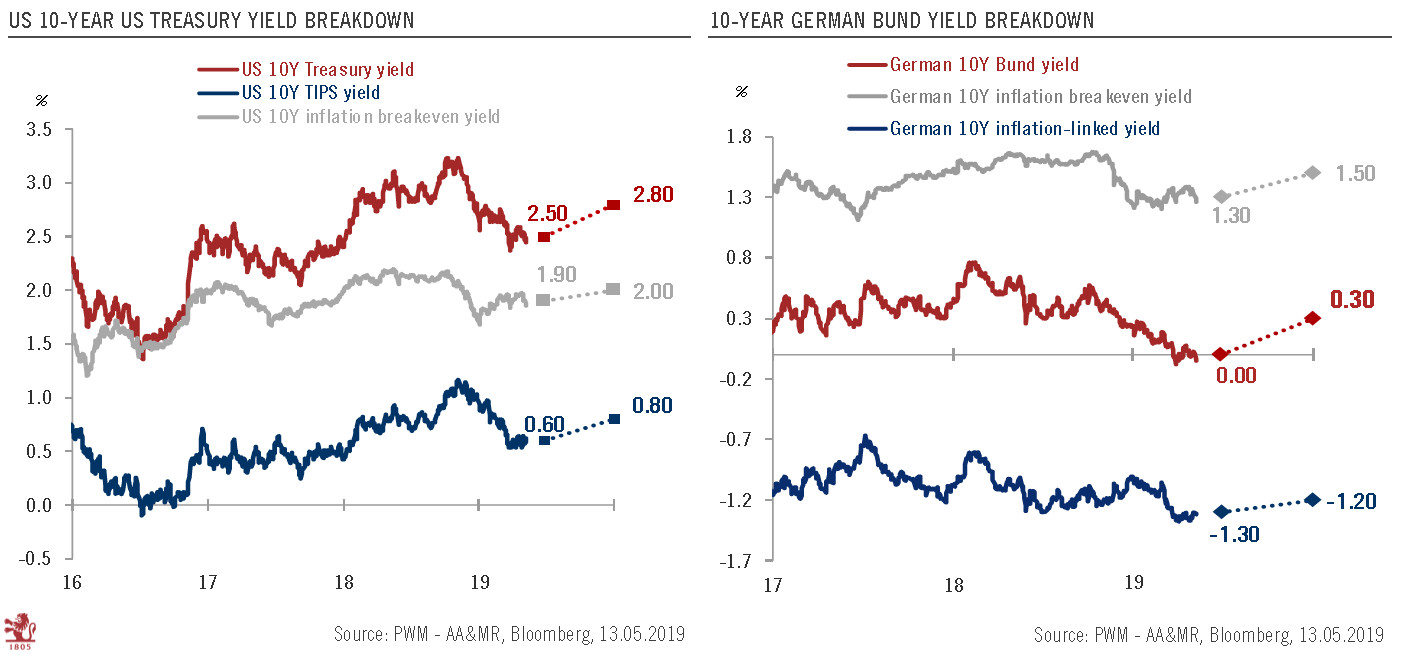

Taking hold of two important changes to our central macroeconomic scenarios, we are adjusting downward our year-end target for the 10-year US Treasury yield from 3.0% to 2.8% and the Bund yield from 0.5% to 0.3%. The drivers behind this include lower inflation expectations, rising US-China trade tensions against a constant monetary policy backdrop.

| Four consecutive disappointing US inflation prints have led us to revise down our US core personal consumption expenditure target for 2019. As such, we see limited upside for the 10-year inflation breakeven rate and revise our year-end target from 2.2% to 2.0%. Along with subdued core inflation, falling inflation expectations in the euro area will probably prolong market participants’ doubt regarding the European Central Bank’s hiking cycle. As a result, we have revised our 10-year German inflation-linked yield target lower, from -1.0% to -1.2% for year-end.

Meanwhile, renewed US-China trade tensions will probably increase financial market volatility in the coming months. As both the 10-year US Treasury and Bund continue to act as safe-haven assets, downward pressure on yields will mount at each risky asset sell-off. We continue to expect no rate cut from the US Federal Reserve this year (against a 30 basis point cut priced in) and a first deposit rate hike of 15 basis points by the ECB in March 2020 (against end-2021 for the market). We do not expect a recession in the US or the euro area this year or next. Should a recession in 2020 become more likely, we would revise the 10-year US Treasury yield to 2.0% and the Bund yield to -0.3%. |

10-Year Yield, 2016-2019 |

Tags: bund yields,Featured,Macroview,newsletter,sovereign bonds,US Treasury yield