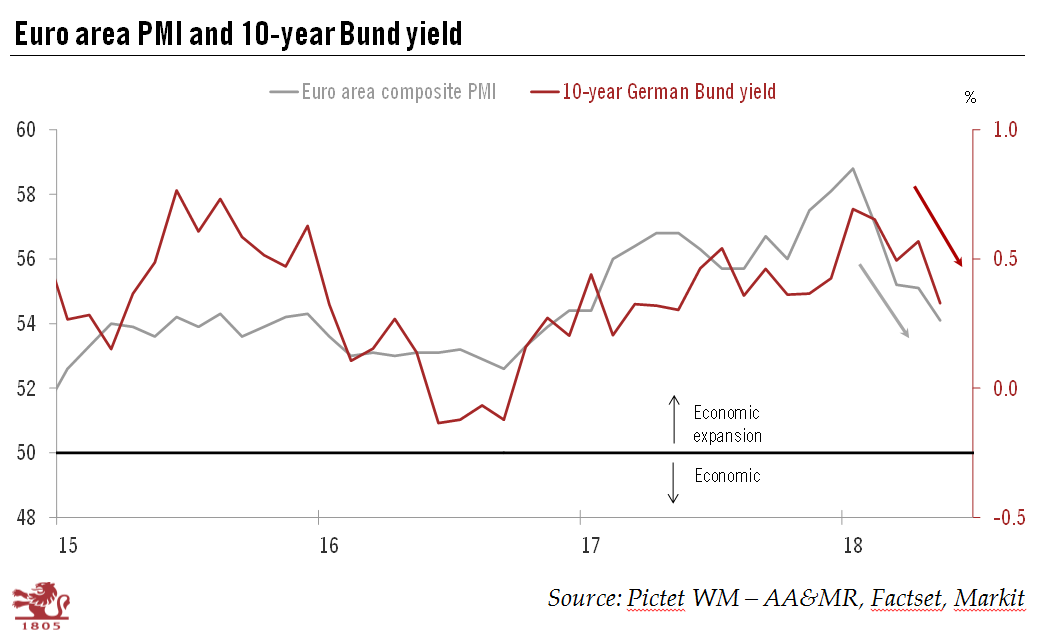

A mixture of soft data, a change of government in Italy and a dovish ECB exit from quantitative easing mean we are revising downward our year-end forecast for the 10-year Bund yield.With the faltering in euro area business sentiment since February, the Italy-led sell-off of risk assets at the end of May and the European Central Bank’s (ECB) dovish meeting in June, we are revising our year-end forecast for the German 10-year Bund yield from 0.9% to 0.6%, as we hinted we might do in a previous note.The slowdown in growth momentum, as reflected in the euro area PMI, explains in part why the German 10-year Bund yield has been falling again after a strong rise at the start of the year (see Chart). The 10-year Bund’s safe-haven status has lately come back into focus, with the yield dropping to

Topics:

Laureline Chatelain considers the following as important: Bund forecast, Bund yield forecast, Bund yields, German government bonds, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

A mixture of soft data, a change of government in Italy and a dovish ECB exit from quantitative easing mean we are revising downward our year-end forecast for the 10-year Bund yield.

With the faltering in euro area business sentiment since February, the Italy-led sell-off of risk assets at the end of May and the European Central Bank’s (ECB) dovish meeting in June, we are revising our year-end forecast for the German 10-year Bund yield from 0.9% to 0.6%, as we hinted we might do in a previous note.

The slowdown in growth momentum, as reflected in the euro area PMI, explains in part why the German 10-year Bund yield has been falling again after a strong rise at the start of the year (see Chart). The 10-year Bund’s safe-haven status has lately come back into focus, with the yield dropping to a year-to-date low of 0.26% on May 29 at the height of Italy-led market sell-off

In addition, along with other sweeteners regarding flexibility and the exit from QE being conditional on hard data, the ECB at its 14 June meeting sprung a dovish surprise by committing to maintaining policy rates at their present extremely low levels “at least through the summer of 2019”, thereby eliminating a rate hike in H1 2019. As a result, the market now anticipates a rise of only about 12 bps in the ECB’s deposit rate by the end of 2019, down from a peak of 30 bps. The slide in market expectations had pushed the 10-year Bund yield down to 0.37% on June 19 from a peak at 0.77% on February 2.

But the downward repricing of rate projections looks excessive, with our central scenario still seeing a cumulative 40 bps rise in rates between September 2019 (when we think the ECB will begin to raise rates) and the end of next year.

However, we expect markets to move more into line with our own scenario (thus adding about 28 bps to current expectations) towards the end of the year when core euro area inflation should reach 1.3-1.4% in our view. Such a repricing underpins our expectations of a rebound of the Bund yield from 0.37% to 0.6% by the end of 2018.