With the faltering in euro area business sentiment since February, the Italy-led sell-off of risk assets at the end of May and the European Central Bank’s (ECB) dovish meeting in June, we are revising our year-end forecast for the German 10-year Bund yield from 0.9% to 0.6%, as we hinted we might do in a previous note. Euro area business cycle slowdown After a very strong end to 2017, euro area economic growth has been falling short of strong expectations, coming in at only 0.4% in Q1 2018 (quarter on quarter, q-o-q) against 0.7% in Q4 2017. Moreover, leading indicators such as the euro area composite purchasing managers’ index (PMI) signal that moderation is continuing, consistent with growth again coming in at

Topics:

Laureline Chatelain considers the following as important: 2) Swiss and European Macro, Bund forecast, Bund yield forecast, Bund yields, Featured, German government bonds, Macroview, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

With the faltering in euro area business sentiment since February, the Italy-led sell-off of risk assets at the end of May and the European Central Bank’s (ECB) dovish meeting in June, we are revising our year-end forecast for the German 10-year Bund yield from 0.9% to 0.6%, as we hinted we might do in a previous note.

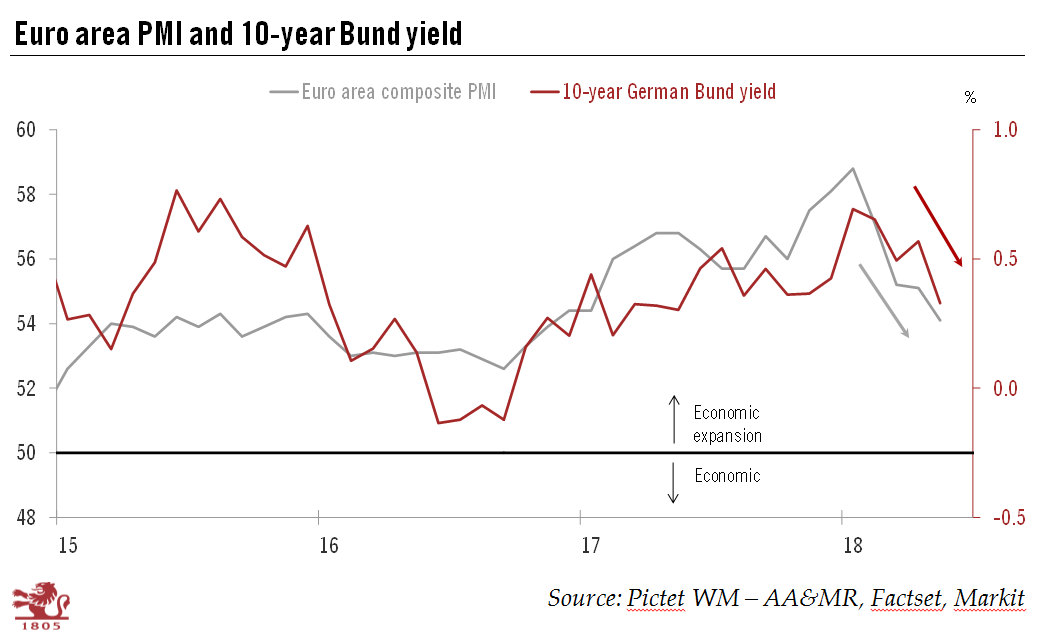

Euro area business cycle slowdownAfter a very strong end to 2017, euro area economic growth has been falling short of strong expectations, coming in at only 0.4% in Q1 2018 (quarter on quarter, q-o-q) against 0.7% in Q4 2017. Moreover, leading indicators such as the euro area composite purchasing managers’ index (PMI) signal that moderation is continuing, consistent with growth again coming in at only 0.4% in Q2. For now, our economists are maintaining their 2018 euro area GDP forecast of 2.3% year-on-year (y-o-y), but the risks have moved to the downside and growth could drop further below the 2.5% rate seen in 2017 (see “Hawkish moderation”, or worse?). The introduction of import tariffs on European cars and parts by the Trump administration would increase these risks even further, but we still see them as just a threat. The slowdown in growth momentum, as reflected in the euro area PMI, explains in part why the German 10-year Bund yield has been falling again after a strong rise at the start of the year (see Chart 1). A mixture of soft data, a change of government in Italy and a dovish ECB exit from quantitative easing mean we are revising downward our year-end forecast for the 10-year Bund yield. |

Euro Area Composite PMI and Germany 10-year Bund Yield, 2015 - 2018 |

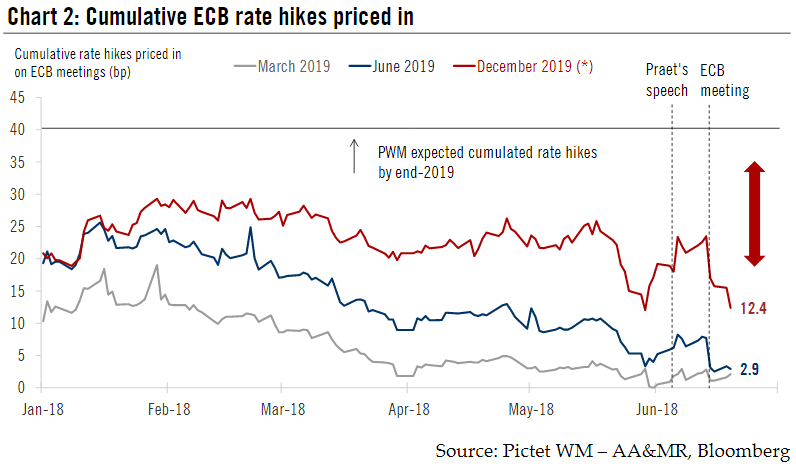

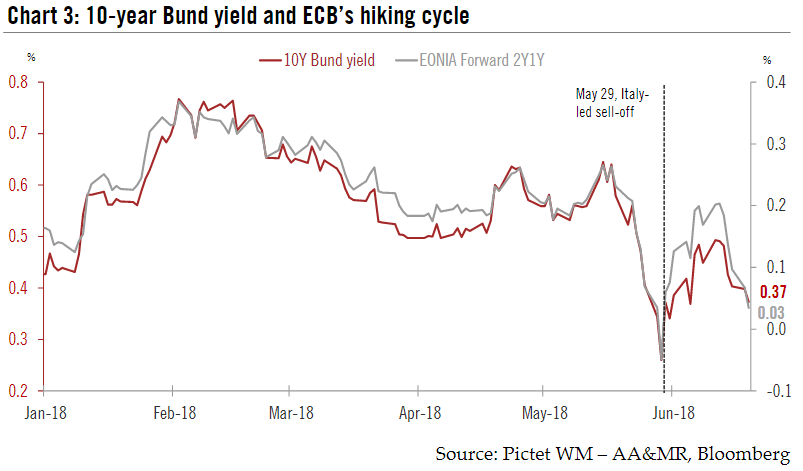

ECB’s dovish QE exitAs widely anticipated after Peter Praet’s speech on June 6, the ECB announced at its June meeting that it intends to end QE. The central bank’s bond purchases should stop at the end of 2018 except for reinvestments of maturing bonds, which will continue into 2019. Along with other sweeteners regarding flexibility and the exit from QE being conditional on hard data, the dovish surprise came from ECB’s pre-commitment regarding rate hikes. The ECB committed to maintaining policy rates at their present extremely low levels “at least through the summer of 2019”, thereby eliminating a rate hike in H1 2019 (see The ECB turns Odyssean). Market reaction to the ECB’s dovish signal on interest rates has been strong: the cumulative rate hike priced in for the June 2019 meeting tumbled from a high of 25% at the beginning of the year to virtually zero (see Chart 2 ). Furthermore, the market now anticipates a rise of only about 12 bps in the ECB’s deposit rate by the end of 2019, down from a peak of 30 bps. This downward repricing of rate projections looks excessive, with our central scenario still seeing a cumulative 40 bps rise in rates between September 2019 (when we think the ECB will begin to raise rates) and the end of next year.However, the slide in market expectations had pushed the 10-year Bund yield down to 0.37% on June 19 from a peak at 0.77% on February 2 (see Chart 3). |

Cumulative Rate Hikes, Praet speech, ECB meeting, Jan - Jun 2018 |

Systemic risks make a come-backThe 10-year Bund’s safe-haven status has lately come back into focus, with the yield dropping to a year-to-date low of 0.26% on May 29 at the height of Italy-led market sell-off (see Chart 3). A questioning of Italy’s fundamental debt sustainability by investors (and the accompanying risk-off move) is not in our central scenario, but the 2019 budget negotiations with the European Commission due this autumn could still be arduous and resurrect market volatility (see Italian public debt sustainability). We expect its safe-haven status will cap the rise in the Bund yield as long as uncertainties surrounding Italy’s upcoming budget and risks of a US-China trade war prevail. Between euro area GDP growth slowdown since the beginning of the year, the ECB’s reluctance to abandon its dovish bias and the safe-haven status of the Bund, further upside for the 10-year Bund yield seems limited until the end of year. This is well illustrated by the 1-year EONIA two-year forward, which is used as a proxy for the path of ECB’s rate hikes (see Chart 3).It shows clearly that investors expect that the ECB will have difficulty embarking on the kind of rate hiking cycle ECB hawks have been demanding. For all these reasons, we are revising downward our year-end target for the 10-year Bund yield from 0.9% to 0.6%. |

Germany 10-year Bund Yield and ECB Hiking Cycle |

The slowdown in growth momentum, as reflected in the euro area PMI, explains in part why the German 10-year Bund yield has been falling again after a strong rise at the start of the year (see Chart). The 10-year Bund’s safe-haven status has lately come back into focus, with the yield dropping to a year-to-date low of 0.26% on May 29 at the height of Italy-led market sell-off

In addition, along with other sweeteners regarding flexibility and the exit from QE being conditional on hard data, the ECB at its 14 June meeting sprung a dovish surprise by committing to maintaining policy rates at their present extremely low levels “at least through the summer of 2019”, thereby eliminating a rate hike in H1 2019. As a result, the market now anticipates a rise of only about 12 bps in the ECB’s deposit rate by the end of 2019, down from a peak of 30 bps. The slide in market expectations had pushed the 10-year Bund yield down to 0.37% on June 19 from a peak at 0.77% on February 2.

But the downward repricing of rate projections looks excessive, with our central scenario still seeing a cumulative 40 bps rise in rates between September 2019 (when we think the ECB will begin to raise rates) and the end of next year.

However, we expect markets to move more into line with our own scenario (thus adding about 28 bps to current expectations) towards the end of the year when core euro area inflation should reach 1.3-1.4% in our view. Such a repricing underpins our expectations of a rebound of the Bund yield from 0.37% to 0.6% by the end of 2018.

Tags: Bund forecast,Bund yield forecast,bund yields,Featured,German government bonds,Macroview,newsletter