After yesterday's US and UK market holidays which resulted in a session of unchanged global stocks, US futures are largely where they left off Friday, up fractionally, and just under 2,100. Bonds fell as the Federal Reserve moves closer to raising interest rates amid signs inflation is picking up. Oil headed for its longest run of monthly gains in five years, while stocks declined in Europe. Treasuries retreated in the first full day of trading since Yellen said late Friday that the improving economy meant a rate increase would probably be in order "in the coming months." European shares dropped for the first time in six days as Volkswagen AG led carmakers lower after reporting a slide in profit at its namesake brand. In China, stocks climbed even after a flash crash in index futures with the Shanghai gauge jumping the most in almost three months. Gold rose for the first time in 10 days. The recent monthly outperformance of TSYs over stocks is shown below. Boosting expectations that the Fed may hike over the next few months is confirmation that the data are beating analysts’ forecasts by the most in about 16 months, according to the Bloomberg ECO U.S. Surprise Index. The Fed’s rate outlook is occupying investors as futures show odds of a hike in July at more than 50 percent while gains in commodity prices from crude to crops bolster prospects for inflation.

Topics:

Tyler Durden considers the following as important: Apple, Aussie, Australia, B+, Beige Book, BLS, Bond, Brazil, Case-Shiller, China, Consumer Confidence, Consumer Prices, Copper, CPI, creditors, Crude, Crude Oil, Dallas Fed, Deutsche Bank, Dow Jones Industrial Average, Economic Calendar, Equity Markets, Eurozone, Federal Reserve, France, Germany, Google, Greece, Hong Kong, Initial Jobless Claims, Japan, Jim Reid, Money Supply, Monsanto, New York Post, Nikkei, OPEC, Payroll Data, Personal Income, Precious Metals, Price Action, RANSquawk, recovery, Redstone, Reuters, St Louis Fed, Toyota, Unemployment, Verizon, Volkswagen, White House, Yen, Yuan, Zurich

This could be interesting, too:

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Marc Chandler writes Geopolitics Roil Capital Markets

Marc Chandler writes Fragile and Consolidative Tone Starts the Week in FX

Marc Chandler writes FX and Rates Unwind Yesterday’s Powell Effect, US Index Futures Slide

After yesterday's US and UK market holidays which resulted in a session of unchanged global stocks, US futures are largely where they left off Friday, up fractionally, and just under 2,100. Bonds fell as the Federal Reserve moves closer to raising interest rates amid signs inflation is picking up. Oil headed for its longest run of monthly gains in five years, while stocks declined in Europe.

Treasuries retreated in the first full day of trading since Yellen said late Friday that the improving economy meant a rate increase would probably be in order "in the coming months." European shares dropped for the first time in six days as Volkswagen AG led carmakers lower after reporting a slide in profit at its namesake brand. In China, stocks climbed even after a flash crash in index futures with the Shanghai gauge jumping the most in almost three months. Gold rose for the first time in 10 days.

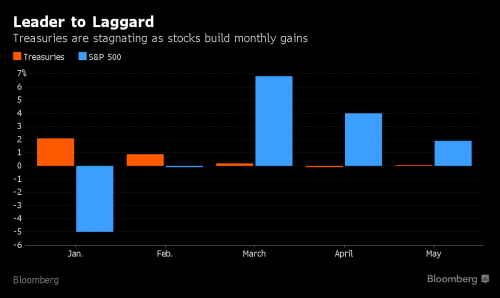

The recent monthly outperformance of TSYs over stocks is shown below.

Boosting expectations that the Fed may hike over the next few months is confirmation that the data are beating analysts’ forecasts by the most in about 16 months, according to the Bloomberg ECO U.S. Surprise Index.

The Fed’s rate outlook is occupying investors as futures show odds of a hike in July at more than 50 percent while gains in commodity prices from crude to crops bolster prospects for inflation. With officials emphasizing policy tightening is dependent on economic improvement, investors will be scrutinizing payrolls and personal income data due this week.

“The payroll data is probably the key figure that will shape the Fed decision," said Otto Waser, chief investment officer of R&A Group Research & Asset Management in Zurich. “If the payroll data is weaker than what is now expected, it will raise the chance they won’t hike." This is an all too real probability, because as we reported yesterday, as a result of the Verizon strike which even the BLS has noticed, the consensus print of +160,000 may be trimmed by as much as 35,000 jobs.

The potential for higher U.S. yields helped send a gauge of the dollar versus major peers to its biggest monthly gain since September 2014. “Yellen’s speech Friday afternoon was the key focus and people had the long weekend to ponder,” said Veronika Pechlaner, who helps oversee $10 billion at Ashburton Investments, part of FirstRand Group. “It would be a positive sign if we could stabilize and keep these levels, but we’ll see whether people take money off the table ahead of rate action. The market sold off after the last rate hike and we’re not in a much stronger position this time. That said, 25 basis points shouldn’t really do much.”

U.S. stock-index futures were little changed before data that may indicate how ready the economy is for higher interest rates that could come as soon as next month. Celator Pharmaceuticals Inc. soared 73 percent in early New York trading after agreeing to a $1.5 billion takeover offer from Jazz Pharmaceuticals Plc. Frontline Ltd. jumped 1.7 percent after the oil-tanker company posted better-than-estimated first-quarter net income.

Contracts on the S&P 500 expiring in June rose less than 0.1 percent to 2,098.25 at 6:04 a.m. in New York. The benchmark equity index advanced Friday, capping its best week since March. Dow Jones Industrial Average futures added 26 points, or 0.2 percent, to 17,875 today. U.S. markets were closed on Monday for the Memorial Day holiday.

Market Wrap

- S&P 500 futures up less than 0.1% to 2097.75

- Stoxx 600 down 0.2% to 350

- FTSE 100 down 0.2% to 6260

- DAX down 0.3% to 10306

- S&P GSCI Index up less than 0.1% to 372

- MSCI Asia Pacific up 0.7% to 129

- Nikkei 225 up 1% to 17235

- Hang Seng up 0.9% to 20815

- Shanghai Composite up 3.3% to 2917

- S&P/ASX 200 down 0.5% to 5379

- US 10-yr yield up 2bps to 1.87%

- German 10Yr yield up less than 1bp to 0.18%

- Italian 10Yr yield up 2bps to 1.38%

- Spanish 10Yr yield up 1bp to 1.5%

- Dollar Index up 0.25% to 95.76

- WTI Crude futures up 0.2% to $49.45

- Brent Futures down 0.7% to $49.43

- Gold spot up 0.5% to $1,211

- Silver spot up 0.6% to $16.09

Top Global News

- Verizon and Unions Reach an Agreement on Contract Ending Strike: 39,000 landline workers return to jobs Wednesday; 1,300 new call-center jobs, 70 wireless employees part of pact

- U.S. Treasury Eyes Deutsche Bank in Auction Probe: New York Post; Deutsche Bank emerged as a focus of a probe into whether traders rigged auctions for U.S. government debt, NYP reports

- Euro-Area Inflation Rate Remains Negative as ECB Ponders Outlook: consumer prices fell 0.1% in May, in line with median estimate

- Volkswagen’s Emissions Cheating Hits Profit at Biggest Brand: profit at Volkswagen brand dropped 86% in 1Q; co. plans to unveil strategy through 2025 next month

- TransDigm Group to Replace Baxalta in S&P 500: TransDigm to enter S&P 500 after close of trading June 2

- Viacom Directors Vow to Fight Any Board Removals, Leader Says: independent directors will contest any possible effort by founder Sumner Redstone to remove board members from co.

- Apple Likely to Take 3 Yrs Between iPhone Model Changes: Nikkei; Apple will likely take 3 years between full-model changes of its iPhone devices, Nikkei reports

- Toyota Seen Close to Buying Google’s Boston Dynamics: Tech Insider; Toyota is closing in on a deal to acquire Google robotics division Boston Dynamics, Tech Insider reports

- CIT Group Said to Start Commercial Air Unit Sale: Reuters; co. started sale of aircraft leasing assets by inviting more than dozen entities to consider bidding, Reuters reports

- Bayer May Table Improved Monsanto Bid This Week: Sunday Times; improved proposal likely as early as this week after weekend meetings of Bayer’s top bosses, Sunday Times reports

- “X-Men” Outdraws “Alice” Sequel as Fox Film Tops Disney’s: “X-Men: Apocalypse” led the North American box office this weekend

Looking at regional markets, Asia stocks recovered from early losses to trade mostly higher with optimism in Chinese markets bolstering sentiment. Nikkei 225 (+1.0%) shrugged off discouraging Industrial Production data as JPY weakness underpinned exporters, while ASX 200 (-0.5%) underperformed following weakness in energy and retail names. China spearheaded the region's ascent with both the Hang Seng (+0.9%) and Shanghai Comp (+3.3%) ignored a 12% flash crash in CSI-300 futures, edging firm on gains with financials underpinned after the PBoC upped its liquidity injection and reports Bank of China is to realise a HKD 30Bn profit from sale of one of its units, while prospects of MSCI inclusion further adding to the upbeat tone. 10yr JGBs traded flat despite the risk-on sentiment in the region and a than 2 year JGB auction with a better than prior b/c.

Asia Top News

- Hong Kong Property Seen Enduring Deep Slump Before Curbs Go: Prices may need to plunge 19% before easing, analysts estimate

- Scientist Turned Hedge Fund Founder Cuts Profitable Aussie Short: AE Capital gained about 6% in first four months of 2016

- Aso Falls Into Line With Supporters of Japan Tax-Hike Delay: Finance minister’s backing of postponement is about-face

- 1MDB Scandal Strains World’s Longest Bull Run as Selloff Deepens: Stock suffered biggest outflow of foreign funds in eight months

- One-Minute Plunge Sends Chinese Stock Futures Down by 10% Limit: Unexplained drop follows similar move in Hong Kong this month

European equities trade lower this morning with the Euro Stoxx 50 (-0.3%) modestly in the red after failing to take the impetus from the positive Asia-Pacific session with some participants eyeing the possibility of a nearing Fed rate hike. In terms of stock specific developments, the DAX has been hampered by weakness in auto names led by Volkswagen (-2.7%) after their earnings report showed profits declined 20%. Additionally, some of the downside in equities has also been attributed to the slip in crude prices with Brent briefly dipping below USD 50.00/bbl.

Despite modest risk-averse sentiment, Bunds were initially under pressure with some desks noting stops being tripped at through yesterday's low at 163.53, however German paper staged somewhat of a pull back to trade relatively flat as equities failed to make any substantial recovery. Also of note, periphery bonds have underperformed with Portuguese bonds yet again at the forefront.

European Top News

- Alliance Trust Says Rothschild’s RIT Made Informal Approach: Alliance Trust says not certain transaction will take place; approach comes as Alliance Trust conducts strategic review

- German Unemployment Rate Falls to Record Low Before ECB Meeting: number of jobless fell by 11,000 in May vs est. 5,000; unemployment rate drops to 6.1%, lowest since reunification

- Rosatom Aims for 20% of U.S. Nuclear Fuel Supply After GE Deal:

In FX, The yen was little changed at 111.07 per dollar. The dollar took a breather, with the Bloomberg Dollar Spot Index, a gauge of the greenback against 10 major peers, also little changed. The index is still up 3.6 percent in May, after retreating over the previous three months, leading to two consecutive devaluations in the Yuan that sent it to lows not seen since February 2011. Cable has seen a bout of softness against some of its major counterparts with some desks touting month-end flows in EUR/GBP as a catalyst. Subsequently, GBP/USD made a firm break below 1.4600 and yesterday's low residing at 1.4592. Elsewhere, the USD gained some ground against its major counterparts in early trade before stabilising heading into the North American crossover with some desks noting that potential month-end flows could lead to USD selling by foreign investors in order to re-balance their books. AUD continues to remain supported as participants digest the overnight slew of upbeat data points from Australia which has dampened some expectations for further immediate reaction by the RBA. Elsewhere, EUR remains relatively unfazed by the latest Eurozone CPI report which saw a modest pick-up in inflation as forecast by analysts.

In commodities, West Texas Intermediate crude was up 0.3 percent from Friday’s close in the U.S., to $49.49 a barrel, as traders await Thursday’s meeting of OPEC suppliers. WTI has climbed 7.8 percent in May, its fourth straight monthly advance and the longest stretch of gains since 2011. Militant attacks have cut Nigerian oil supply to the lowest level in more than two decades while Canadian output is still stabilizing after sliding amid wildfires. Libya’s Petroleum Facilities Guard captured a town near the Es Sider and Ras Lanuf oil-loading terminals after fierce clashes with Islamic State militants. Soybeans were set for a third monthly gain amid speculation that reduced supply from South America will spur increased demand from the U.S. Soybeans for July rose 0.3 percent to $10.89 3/4 a bushel on the Chicago Board of Trade. The contract is up 5.8 percent this month and 26 percent this year. Raw sugar for July advances to highest since November 2014 amid congestion at ports in Brazil, the world’s biggest sugar grower and producer. Sugar futures rose 0.5 percent in the fourth straight day of gains on ICE Futures U.S. in New York. Gold for immediate delivery jumped 0.5 percent to $1,210.93 an ounce, after sliding almost 6 percent over the previous nine days as the prospect of a U.S. rate hike diminished the precious metal’s appeal. Copper declined 0.9 percent and lead was down 0.5 percent as the London Metals Exchange started trading for the week, while nickel surged 1 percent.

On today's busy US economic calendar, the April core and deflator PCE’s as well as personal spending and income data are all due. There will be more regional manufacturing data in the form of the Chicago and Dallas Fed reports, while the S&P/Case-Shiller house price index is also set to be released. Consumer confidence for May is also released.

Bulletin Headline Summary from RanSquawk and Bloomberg

- European equities enter the North American crossover in modest negative territory as softness in auto names and Fed-speculation guides price action

- EUR/GBP has been supported throughout the morning alongside touted month-end demand while AUD trades higher in the wake of upbeat domestic data

- Looking ahead, highlights include US Personal Income, PCE, Chicago PM! and Canadian GDP

- Treasuries lower in overnight trading as Yellen comments concern investors, global equities mostly lower, precious metals rally; home prices and PCE core today kick off this week’s busy economic calendar.

- Euro-area consumer prices fell 0.1% in May from a year earlier, the fourth consecutive month without an increase, highlighting policy makers’ struggle to stoke inflation despite multiple rounds of stimulus

- The ECB will keep using all instruments at its disposal to counter the risk of low inflation in the euro region, Governing Council member Ignazio Visco said

- German unemployment declined more than economists estimated, pushing the jobless rate to the lowest level since reunification. The number of people out of work fell by a seasonally adjusted 11,000 to 2.695 million in May

- Italy’s unemployment rate rose to 11.7% in April from a revised 11.5% in March amid weakening business and household expectations for recovery in the euro region’s third-biggest economy

- Chinese residents pumped a record amount of money into Hong Kong insurance in the first quarter even as the mainland government tightened restrictions on the purchases, which serve as a popular tool for skirting the nation’s capital controls

- Chinese corporate local bond sales only just exceeded maturities this month, providing a narrow escape for many companies that are relying on selling new debt to pay off old liabilities

- Australian lending to businesses is growing at the quickest pace since the global financial crisis, loans to companies climbed 7.4% in April from a year earlier, the most since January 2009, according to the Reserve Bank of Australia

- Deutsche Bank AG has emerged as a focus of a probe into whether traders rigged auctions for U.S. government debt, the New York Post reported, citing unidentified people familiar with the matter

- Sovereign 10Y yields mixed; European, Asian equities mostly lower; U.S. equity-index futures rise; WTI crude oil, precious metals rally

US Event Calendar

- 8:30am: Personal Income, April, est. 0.4% (prior 0.4%)

- Personal Spending, April, est. 0.7% (prior 0.1%)

- Real Personal Spending, est. 0.4% (prior 0%)

- PCE Deflator m/m, April, est. 0.3% (prior 0.1%)

- PCE Deflator y/y, April, est. 1.1% (prior 0.8%)

- PCE Core m/m, April, est. 0.2% (prior 0.1%)

- PCE Core y/y, April, est. 1.6% (prior 1.6%)

- 9am: S&P/Case-Shiller US HPI m/m SA, March (prior 0.41%)

- 9:45am: Chicago Purchasing Manager, May, est. 50.5 (prior 50.4)

- 10am: Consumer Confidence Index, May, est. 96.3 (prior 94.2)

- 10:30am: Dallas Fed Mfg Activity, May, est. -8 (prior -13.9)

DB's Jim Reid concludes the overnight event summary

Enjoy the last day of May. My advice for today is to get rid of all your overdue admin, do your pending compliance training, sort out your expenses, have morale boosting chats with your team mates, finalise that summer holiday and then get home at a decent time tonight and sleep well. June is set to be a very busy month with (in no particular order) the ECB starting to buy corporate bonds and holding a meeting this Thursday, an increasingly important FOMC meeting (June 15th), an under pressure BoJ meeting (June 16th), a Spanish election, results of the 1st new TLTRO auction, and the 'Brexit' referendum. There’s also an OPEC meeting to throw in which could always spark a surprise.

Outside of Brexit, the Fed are perhaps the biggest focal point at the moment. For those who missed it due to the holiday weekend, Yellen’s speech on Friday at Harvard University reaffirmed much of the chatter from her colleagues in recent weeks in that a rate hike ‘in the coming months’ is likely to be appropriate. Yesterday saw the St Louis Fed President Bullard, a notable hawk, add that in his view ‘markets are well prepared for a possible rate increase globally’. Bullard also added that that he doesn’t think that a change in the White House either way will affect the Fed’s policy. Given the holidays in the US and the UK yesterday, price action was largely dominated by currencies, rates and commodities. Indeed the most notable of that bunch was another leg lower for Gold after the precious metal ended -0.61% on the day and so extended its run of losses now to nine consecutive sessions. That’s the joint longest such run since March last year with the precious metal down just shy of 6% in that time. In fact since touching a 15-month high at the end of April, Gold has now tumbled 7% off those highs or about $90/oz with a significant re-pricing of interest rate expectations at the epicentre of that.

Over in FX markets, emerging market currencies were most under pressure in yesterday’s session while the USD index was a touch firmer. The Greenback did break through ¥111 versus the Yen however (which closed -0.73% weaker) following those sales tax delay reports in the Japanese press over the weekend. Treasury futures markets were open meanwhile with the 10y yield closing up just over 3bps higher on the day in reaction to Yellen’s comments. European sovereign bond markets finished with similar moves with 10y Bunds up 3bps by the close at 0.166% although they have in effect just hovered around current levels for nearly a month now.

Elsewhere, European equity markets managed to eke out some small gains albeit with volumes some 50% or so below the usual daily average. The Stoxx 600 finished +0.14%. That means that European equities are on a five-day winning streak now (the joint longest this year) with some improvement in the latest Euro area confidence indicators helping yesterday.

More on that data shortly but now switching over to the latest in Asia this morning where it appears that the bulk of the regional benchmarks are set to finish the month on a high. Indeed its Chinese equities markets which appear to have taken the bull by its horns this morning with the Shanghai Comp and CSI 300 +2.62% and +2.43% respectively. It’s not entirely obvious what’s fuelling that although financial stocks are leading the way with Bloomberg attributing that to a suggestion that MSCI Inc may include yuan-denominated shares in its global benchmark indices as soon as next month. Meanwhile, the Nikkei (+0.78%) is also up and the Yen is little changed after Japan reported a better than expected industrial production reading for April (+0.3% mom vs. -1.5% expected), with the impact from the earthquake mid-through the month less than feared. Elsewhere the Hang Seng is +1.24% and Kospi is +0.54%. Only the ASX (-0.10%) is in the red. US equity index futures are showing moderate gains at the moment while Oil markets are hovering around the $49.50/bbl mark.

Moving on. We wanted to highlight the latest piece from our European equity strategy team where they focus on five key questions they have been discussing with clients over the past weeks – the oil price, the Chinese CNY, the impact of the Brexit referendum, the scope for a rebound in earnings and the outlook for value stocks. A couple of the main highlights are; a) the degree to which the oil price has decoupled from the dollar since the beginning of the month (a linear regression between the USD and the oil price over the past five years would suggest a fair-value oil price of $39/bbl, following the 3% rise in the broad USD TWI, some 20% below current levels). Is the oil price starting to decouple from the dollar?, and b) The CNY has stealthily depreciated by 1.6% against the USD from its April peak, the same depreciation as during the January devaluation episode which shocked asset prices. Intriguingly, European equities have tracked the CNY/USD pretty closely over the past year – but have not yet reacted to the latest move lower in the Chinese currency, pointing to some downside risk for their market.

Staying in Europe and running through the data yesterday in the region. Encouraging was the latest reading for the European Commission’s economic sentiment index which rose 0.7pts in May to 104.7 (vs. 104.4 expected) which puts the index at its best reading since January. Elsewhere the consumer confidence reading for the Euro area was confirmed at -7 for May, while over in Germany the headline CPI figure for May printed in line with expectations at +0.3% mom. That’s had the effect of lifting the YoY rate to +0.1%, an increase of two-tenths. The other data was out of France where the preliminary Q1 GDP report came in a little better than expected at +0.6% qoq (vs. +0.5% expected).

Before we wrap up, one last report of interest yesterday was out of Greece where Greek press are reporting that a disagreement between Athens and its Creditors over the implementation of certain reforms could see a delay in the disbursement of the first tranche of bailout funds. Indeed Ekathimerini is suggesting that Finance Minister Tsakalotos was said to have informed European Commission representatives and also the IMF last week that certain demands could not be fulfilled, referring specifically to a privatisation of the country’s grid operation and freezing the wages of some essential services including the coast guard and police. The article goes on to say that the government may submit its own amendments at some stage tomorrow to Parliament with a Euro Working Group meeting scheduled for Thursday. One to keep an eye on.

With the holiday’s on both sides of the Atlantic yesterday, this morning we’re republishing most of our week ahead recap from yesterday’s EMR. This morning in Europe we start in France with CPI and PPI reports, before we then get German unemployment data and the May CPI report for the Euro area (headline -0.1% yoy reading expected). Euro area money supply data and the unemployment rate will also be released this morning. Over in the US this afternoon it’s set to be a busy session for data. The April core and deflator PCE’s as well as personal spending and income data are all due. There will more regional manufacturing data in the form of the Chicago and Dallas Fed reports, while the S&P/Case-Shiller house price index is also set to be released. Consumer confidence for May is also released in the afternoon. It’s all eyes on China on Wednesday morning with the official manufacturing and non-manufacturing PMI’s for May due out, while in Japan the latest capital spending and company profits numbers are set to be released. In Europe on Wednesday we’ll get the final manufacturing PMI’s for May as well as a first look at those in the periphery, while in the UK mortgage approvals and money and credit aggregates are set to be released. In the US on Wednesday the big focus will be on the ISM manufacturing and new orders figures where the former is expected to decline 0.4pts to 50.4. Construction spending, the final manufacturing PMI revision, vehicles sales for May and the Fed’s Beige Book are also due out. Thursday morning starts in Europe with the latest Euro area PPI data. That’s before the ECB meeting at midday while over in the US we’ll get the ADP employment change print, initial jobless claims and the ISM NY. We close the week on Friday in Asia with a wrap up of the non-official May PMI’s in China and Japan. The European session will also see the final revisions to the services and composite PMI’s (as well as first looks at the periphery) while Euro area retail sales is also due out. Over in the US on Friday afternoon the big focus will be on the May employment report including nonfarm payrolls. As well as that we’ll also get the final revisions to durable and capital goods orders, factory orders and the ISM services print (expected to nudge down 0.3pts to 55.4).

Along with a busy week of data, we’ll also hear comments from the Fed’s Powell and Kaplan on Thursday, as well as Evans and Brainard on Friday. There’s little in the way of chatter out of the ECB this week aside from Draghi’s press conference post ECB. Before we wrap up, the one last event to keep an eye on is this Thursday’s OPEC meeting in Vienna which - while expectations are relatively low for any sort of production freeze - could still be a market sensitive event depending on how much of an additional insight on global production we get.