Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe – Real inflation in Zimbabwe is 313 percent annually and 112 percent on a monthly basis – Venezuela’s new 100,000-bolivar note is worth less oday thehan USD 2.50 – Maduro announces plans to eliminate all physical cash – Gold rises in response to ongoing crises One Hundred Trillion Dollars Zimbabwe - Click to enlarge A military coup-de-grace in Zimbabwe...

Read More »Dollar & Stocks Jump; Bonds & Bullion Dump In Lowest Volatility September Ever

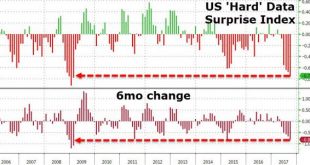

It has now been 318 trading days since the S&P 500 suffered a 5% drawdown – the 4th-longest streak since 1928… So everything is awesome… [embedded content] BUT…US ‘hard’ economic data has not been this weak (and seen the biggest drop) since Feb 2009… US Data Surprise Index, 2006 - 2017 - Click to enlarge Q3 Was a Roller-Coaster… Q3 was the 8th straight quarterly gain in a row for The Dow – the longest streak...

Read More »Gold Hedges Against Currency Devaluation and Cost Of Fuel, Food, Beer and Housing

Gold Hedges Against Currency Devaluation and Cost Of Fuel, Food, Beer and Housing - Gold hedge against currency devaluation - cost of fuel, food, housing- True inflation figures reflect impact on household spending- Household items climbed by average 964%- Pint of beer sees biggest increase in basket of goods - rise of 2464%- Bread rises 836%, butter by 1023% and fuel (diesel) up by 1375%- Gold rises 2672% and hold's its value over 40 years- Savings eaten away by money creation and...

Read More »Futures Flat, Gold Rises On Weaker Dollar As Traders Focus On OPEC, Payrolls

After yesterday's US and UK market holidays which resulted in a session of unchanged global stocks, US futures are largely where they left off Friday, up fractionally, and just under 2,100. Bonds fell as the Federal Reserve moves closer to raising interest rates amid signs inflation is picking up. Oil headed for its longest run of monthly gains in five years, while stocks declined in Europe. Treasuries retreated in the first full day of trading since Yellen said late Friday that the improving...

Read More »Another Fed “Policy Error”? Dollar And Yields Tumble, Stocks Slide, Gold Jumps

Yesterday when summarizing the Fed's action we said that in its latest dovish announcement which has sent the USD to a five month low, the Fed clearly sided with China which desperately wants a weaker dollar to which it is pegged (reflected promptly in the Yuan's stronger fixing overnight) at the expense of Europe and Japan, both of which want the USD much stronger. ECB, BOJ don't want a weak dollar; China does not want a strong dollarFed sides with China for now — zerohedge (@zerohedge)...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org