Overview: The Bank of Japan Governor Ueda hinted the world's third-largest economy may exit negative interest rates before the end of the year. This sparked the strongest gain in the yen in a couple of months and lifted the 10-year yield to nearly 0.70%. In an uncoordinated fashion, Chinese officials stepped their rhetoric and indicated that corporate orders to sell $50 mln or more will need authorization. This helped arrest the yuan's slide. The Australian dollar...

Read More »THE WAR ON CASH: A CLOSER LOOK AT ITS FAR-REACHING IMPLICATIONS – PART II

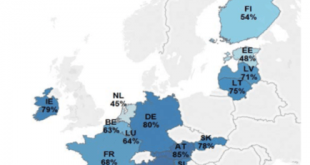

Economic, social and human cost Beyond privacy, there is also widespread concern over the economic impact of a fully cashless system. For one thing, as citizens slowly become exclusively dependent on big banks and card companies the systemic risk to the wider economy spikes. But it goes further than that too. Without the option to keep some cash outside the banking system and retain some degree of financial flexibility, banks have the potential to essentially keep their clients hostage....

Read More »Nine Years of Greek Debt Crisis

In the NZZ, René Höltschi reviews the Greek debt crisis since October 2009.

Read More »Nine Years of Greek Debt Crisis

In the NZZ, René Höltschi reviews the Greek debt crisis since October 2009.

Read More »Price Effects of Purchases of Greek Sovereign Debt by the ECB

In a CEPR discussion paper, Christoph Trebesch and Jeromin Zettelmeyer argue that ECB bond buying had a large impact on the price of short and medium maturity bonds … However, the effects were limited to those sovereign bonds actually bought. We find little evidence for positive effects on market quality, or spillovers to close substitute bonds, CDS markets, or corporate bonds. A multiple equilibria view of the crisis would probably suggest otherwise.

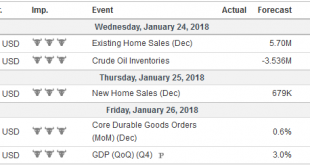

Read More »FX Weekly Preview: ECB and BOJ Meetings Could be Key to Dollar Direction

The US dollar has been marked lower since the middle of last month. It flies in the face strong growth, rising inflation expectations, and greater conviction that the Fed will continue to raise interest rates this year. Moreover, an oft-cited knock on the dollar, the widening current account, may be offset this year by the impact from US corporations repatriating earnings that have been kept offshore. Another weight on...

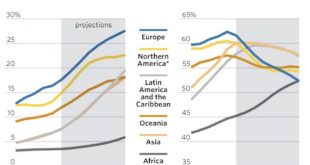

Read More »“This May Be The End Of Europe As We Know It”: The Pension Storm Is Coming

Authored by John Mauldin via MauldinEconomics.com, I’ve written a lot about US public pension funds lately. Many of them are underfunded and will never be able to pay workers the promised benefits – at least without dumping a huge and unwelcome bill on taxpayers. And since taxpayers are generally voters, it’s not at all clear they will pay that bill. Readers outside the US might have felt safe reading those stories....

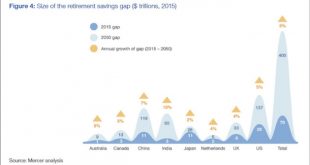

Read More »“This Is A Crisis Greater Than Any Government Can Handle”: The $400 Trillion Global Retirement Gap

Today we’ll continue to size up the bull market in governmental promises. As we do so, keep an old trader’s slogan in mind: “That which cannot go on forever, won’t.” Or we could say it differently: An unsustainable trend must eventually stop. Lately I have focused on the trend in US public pension funds, many of which are woefully underfunded and will never be able to pay workers the promised benefits, at least without...

Read More »Forget Tulips & Bitcoin – Here’s The Real Bubble

While the broader market for Swiss stocks has risen modestly this year, one ‘entity’ has outperformed its peers by such a staggering margin, it has left bamboozled market experts struggling for an explanation. And that company is…the Swiss National Bank. The price of a share in Swiss National Bank in August rose above 3,000 francs ($3,143) for the first time, more than double the level of a year ago, and up 50% since...

Read More »Forget Tulips & Bitcoin – Here’s The Real Bubble

While the broader market for Swiss stocks has risen modestly this year, one 'entity' has outperformed its peers by such a staggering margin, it has left bamboozled market experts struggling for an explanation. And that company is…the Swiss National Bank. The price of a share in Swiss National Bank in August rose above 3,000 francs ($3,143) for the first time, more than double the level of a year ago, and up 50% since mid-July, as the Financial Times noted in a story about its...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org