The sad saga of Navinder Sarao, who on April 20, 2015 became the scapegoat for the May 2010 flash crash and was sentenced to up to 360 years in prison - he will find out later this year the actual length of his prison sentence - got its latest twist today thanks to a fascinating report how in addition to having lost his freedom, Nav also lost all of trading fortune, some $50 million of it. As Bloomberg's Liam Vaughn recounts, "it took Navinder Singh Sarao a long time to accept that he might...

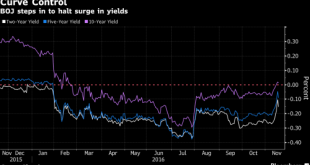

Read More »BOJ “Fires Warning At Bond Market” Sending Global Yields, Dollar Lower; All Eyes On Yellen

Yesterday morning we noted why, in light of the ongoing global bond rout, all eyes would be on the BOJ, and specifically whether Kuroda would engage his "Yield control" operation to stabilize the steepness of the JGB yield curve and implicitly support global bond yields in what DB said would be "full blown helicopter money" where the "BoJ is flying the copter over the US and may be about to become the new US government’s best friend." And sure enough that is precisely what Kuroda did last...

Read More »Negative Rates and The War On Cash, Part 1: “There Is Nowhere To Go But Down”

[unable to retrieve full-text content]As momentum builds in the developing deflationary spiral, we are seeing increasingly desperate measures to keep the global credit ponzi scheme from its inevitable conclusion. Credit bubbles are dynamic — they must grow continually or implode — hence they require ever more money to be lent into existence.

Read More »A Fully Automated Stock Market Blow-Off?

Anecdotal Skepticism vs. Actual Data About one month ago we read that risk parity and volatility targeting funds had record exposure to US equities. It seems unlikely that this has changed – what is likely though is that the exposure of CTAs has in the meantime increased as well, as the recent breakout in the SPX and the Dow Jones Industrial Average to new highs should be delivering the required technical signals. All...

Read More »Janet Yellen’s $200-Trillion Debt Problem

Summary More than $10 trillion of government bonds now trade at negative yields. And another $10 trillion or so worth of U.S. stocks trade well above their long-term average valuations. And there’s more than $200 trillion of debt in the world. All of this sits on the Fed’s financial applecart. Does Janet Yellen dare upset it? Blame “Brexit” BALTIMORE – The U.S. stock market broke its losing streak on Thursday [and...

Read More »A Darwin Award for Capital Allocation

Beyond Human Capacity Distilling down and projecting out the economy’s limitless spectrum of interrelationships is near impossible to do with any regular accuracy. The inputs are too vast. The relationships are too erratic. Quite frankly, keeping tabs on it all is beyond human capacity. This also goes for the federal government. Even with all their data gatherers and number crunchers they are incapable of...

Read More »Futures Flat, Gold Rises On Weaker Dollar As Traders Focus On OPEC, Payrolls

After yesterday's US and UK market holidays which resulted in a session of unchanged global stocks, US futures are largely where they left off Friday, up fractionally, and just under 2,100. Bonds fell as the Federal Reserve moves closer to raising interest rates amid signs inflation is picking up. Oil headed for its longest run of monthly gains in five years, while stocks declined in Europe. Treasuries retreated in the first full day of trading since Yellen said late Friday that the improving...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org