The global economy struggled through a difficult year in 2015, leaving a range of challenges for policymakers hoping to avoid a third leg of the financial crisis, panelists at the Credit Suisse 2016 Asian Investment Conference (AIC) said. The Federal Reserve’s moderation in monetary tightening is crucial to sustaining fragile global economic growth in 2016, while structural reforms in China, India, and other countries are essential if struggling emerging economies are to regain their...

Read More »ECB policy meeting: different things to worry about

While we expect the ECB to remain on hold at its next policy meeting on April 21, a number of issues are coming steadily into focus Read the full report here The ECB is facing a complex, albeit not completely negative, macro-financial environment following its impressive policy package announcement on 10 March. Nevertheless, barring some new shock, beyond some fine-tuning measures, the ECB should remain on hold at its next policy meeting on 21 April. Instead, we expect different aspects...

Read More »A Take On How Negative Interest Rates Hurt Banks That You Will Not See Anywhere Else

The Bank of Japan and the ECB are assisting me in teaching the world’s savers, banking clients and corporations about the benefits of blockchain-based finance for the masses. How? Today, the Wall Street Journal published “Negative Rates: How One Swiss Bank Learned to Live in a Subzero World“: Alternative Bank Schweiz AG late last year became Switzerland’s first bank to comprehensively pass along negative rates to all of its customers. Violating an almost religious precept in the financial...

Read More »A Take On How Negative Interest Rates Hurt Banks That You Will Not See Anywhere Else

The Bank of Japan and the ECB are assisting me in teaching the world's savers, banking clients and corporations about the benefits of blockchain-based finance for the masses. How? Today, the Wall Street Journal published "Negative Rates: How One Swiss Bank Learned to Live in a Subzero World": Alternative Bank Schweiz AG late last year became Switzerland’s first bank to comprehensively pass along negative rates to all of its customers. Violating an almost religious precept in the financial...

Read More »U.S. Futures Flat After Oil Erases Overnight Losses; Dollar In The Driver’s Seat

In another quiet overnight session, the biggest - and unexpected - macro news was the surprise monetary easing by Singapore which as previously reported moved to a 2008 crisis policy response when it adopted a "zero currency appreciation" stance as a result of its trade-based economy grinding to a halt. As Richard Breslow accurately put it, "If you need yet another stark example of the fantasy storytelling we amuse ourselves with, juxtapose today’s Monetary Authority of Singapore policy...

Read More »Bank Of America Reveals “The Next Big Trade”

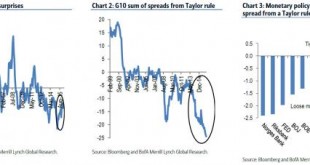

Markets have stopped focusing on what central banks are doing and are "positioning for what they believe central banks may or may not do," according to BofA's Athanasios Vamvakidis as he tells FX traders to "prepare to fight the central banks," as the market reaction to central bank policies this year reflects transition to a new regime, in which investors start speculating which central bank will have to give up easing policies first. The market has started testing the central banks In...

Read More »Futures Jump On Chinese Trade Data; Oil Declines; Global Stocks Turn Green For 2016

With oil losing some of its euphoric oomph overnight, following the API report of a surge in US oil inventories, and a subsequent report that Iran's oil minister would skip the Doha OPEC meeting altogether, the global stock rally needed another catalyst to maintain the levitation. It got that courtesy of the return of USDJPY levitation, which has pushed the pair back above 109, the highest in over a week, as well as a boost in sentiment from the previously reported Chinese trade data where...

Read More »Helicopter Drops of Money

In his blog, Ben Bernanke discusses the merits of “helicopter drops” as a monetary policy tool. [A] “helicopter drop” of money is an expansionary fiscal policy—an increase in public spending or a tax cut—financed by a permanent increase in the money stock. … the Fed credits the Treasury … in the Treasury’s “checking account” at the central bank, and those funds are used to pay for the new spending and the tax rebate. … it should influence the economy through a number of channels, making it...

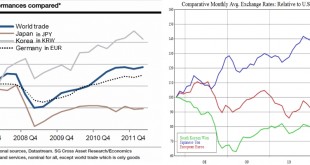

Read More »History of Bank of Japan Interventions

We show the history of Japanese FX interventions. The Japanese only intervened when the USD/JPY was under 80. Therefore the 2016 FX intervention threads at 108 are ridiculous.As opposed to the Swiss National Bank, the Japanese only talk, they do not fight. 2016 Japanese interventions thread Once the Fed finally reduced rate expections, the USD/JPY depreciated from 120 to 108 in a single quarter. (via Reuters and investing.com) Gains for stock markets and a warning of the chances of...

Read More »The Forex Rigging Irony

While Forex banks, traders, and other institutions are being blamed for market rigging, the Swiss National Bank can publish reports about its own market rigging, but instead of being a scandal, it's economic data. That's because the vast majority don't understand how the Forex markets work. It's not insulting - it's a fact. Currently there are hundreds of pending litigation cases against a plethora of Forex banks, traders, and other institutions - but none against a central bank. Of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org