It looks like BoJ Governor, Haruhiko Kuroda’s, minions are getting out and about to brief the financial news services that the biggest stimulator of all the central banks might reduce stimulus earlier than expected. The recipient of the unofficial briefings by BoJ officials is Reuters, which has this to say. The Bank of Japan is dropping subtle, yet intentional, hints that it could edge away from crisis-mode stimulus earlier than expected, through a future hike in its yield target,...

Read More »SNB: It’s A Bonfire Of The Absurdities

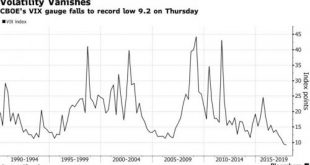

Authored by John Mauldin via MauldinEconomics.com, “Vanity of vanities, saith the Preacher, vanity of vanities; all is vanity.” – Ecclesiastes 1:2, King James Version (attributed to King Solomon in his old age) This week’s letter will take a look at the growing number of ridiculous, inane, and otherwise nonsensical absurdities that fill the daily economic headlines. I have gone from the occasional smile to scratching my...

Read More »SNB: It’s A Bonfire Of The Absurdities

Authored by John Mauldin via MauldinEconomics.com, “Vanity of vanities, saith the Preacher, vanity of vanities; all is vanity.” – Ecclesiastes 1:2, King James Version (attributed to King Solomon in his old age) This week’s letter will take a look at the growing number of ridiculous, inane, and otherwise nonsensical absurdities that fill the daily economic headlines. I have gone from the occasional smile to scratching my...

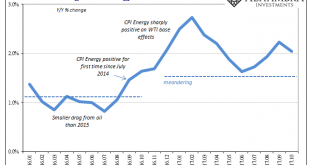

Read More »Can’t Hide From The CPI

On the vital matter of missing symmetry, consumer price indices across the world keep suggesting there remains none. Recoveries were called “V” shaped for a reason. Any economy knocked down would be as intense in getting back up, normal cyclical forces creating momentum for that to (only) happen. In the context of the past three years, symmetry is still nowhere to be found. It’s confounding even central bankers who up...

Read More »Conference on “Aggregate and Distributive Effects of Unconventional Monetary Policies” at the Study Center Gerzensee

Jointly with the Council on Economic Policies and the Swiss National Bank, the Study Center Gerzensee organized a conference on Aggregate and Distributive Effects of Unconventional Monetary Policies. The program can be viewed here.

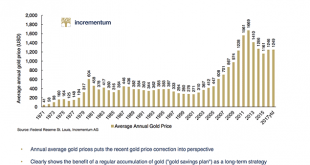

Read More »Key Charts: Gold is Cheap and US Recession May Be Closer Than Think

by Dominic Frisby of Money Week Every year, Ronald-Peter Stoeferle and Mark J Valek of investment and asset management company Incrementum put together the report In Gold We Trust – 160-plus pages of charts and thoughts, mostly gold-related, on the state of the world’s finances. There’s so much to look at and consider. It’s a sort of digital equivalent of a coffee-table book. Yesterday I got an email from them, containing a “best of” – a compendium of some of the best...

Read More »Is This The Best Way To Bet On The Fed Losing Control Of The Bond Market?

Lately, one of my biggest duds of a call has been for the yield curve to steepen. Sure, I have all sorts of fancy reasons why it should steepen, but reality glares back at me in black and white on my P&L run. Sometimes fighting with the market is an exercise in futility. Now I know many of your eyes glaze over when I start talking about different parts of the yield curve flattening or steepening, but I urge you to...

Read More »Why Small States Are Better

Andreas Marquart and Philipp Bagus (see their mises.org author pages here and here) were recently interviewed about their new book by the Austrian Economics Center. Unfortunately for English-language readers, the book is only available in German. Nevertheless, the interview offers some valuable insights. Mr. Marquart, Mr. Bagus, you have released your new book „Wir schaffen das – alleine!” (“We can do it – alone!”)...

Read More »Dollar Surge Continues Ahead Of Jobs Report; Europe Dips As Catalan Fears Return

World stocks eased back from record highs and fell for the first time in eight days, as jitters about Catalonia’s independence push returned while bets on higher U.S. interest rates sent the dollar to its highest since mid August; S&P 500 futures were modestly in the red – as they have been every day this week before levitating to record highs – ahead of hurricane-distorted nonfarm payrolls data (full preview here)....

Read More »US: Reflation Check

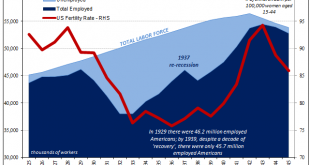

There is a difference between reflation and recovery. The terms are similar and relate to the same things, but in many ways the latter requires first the former. To get to recovery, the economy must reflate if in contraction it was beaten down in money as well as cyclical forces. In the Great Crash of 1929 and after, reflation was required because of the wholesale devastation of the money supply. By pumping up new...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org