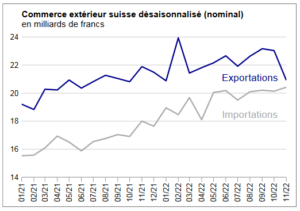

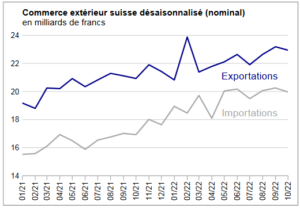

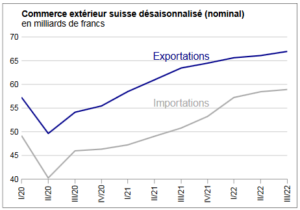

2024 vs 2020 same time vs 2020 final

Time 05:32 UTC

2024 Nov6 05:36 UTC

Nov 4, 2020 05:32

2024 near Final (Nov 18)

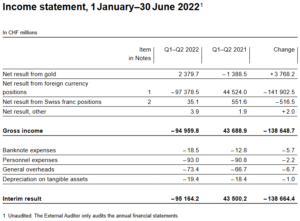

Overall (image from Foxnews)

Overall

Harris: 59,248,216 votes

Trump: 63,797,332 votes

Biden: 60,995,579 votes (49.8%)

Trump: 59,639,660 votes (48.6%)

Biden: 79,308,019 votes (51%)

Trump: 73,483,233 votes (47.3%)

Georgia (screen)

Georgia, data

Trump 2,602,408 50.78%Harris 2,483,919 48.47%

Reporting: 93.13%

Trump: 2,209,349 53.11%Biden: 1,899,242 45.66%

Reporting: 83% in

Biden: 2,472,098 49.52%Trump: 2,458,121 49.24%

Reporting: 99% in

Iowa, screenshot

Trump: 897,672 53.23%

Biden: 759,061 45.01%

Reporting: 99% in

Michigan, Screen

Michigan, data

Trump: 1,730,068 52.31%

Harris: 1,518,872 45.92%