The Bank of Japan and the ECB are assisting me in teaching the world's savers, banking clients and corporations about the benefits of blockchain-based finance for the masses. How? Today, the Wall Street Journal published "Negative Rates: How One Swiss Bank Learned to Live in a Subzero World": Alternative Bank Schweiz AG late last year became Switzerland’s first bank to comprehensively pass along negative rates to all of its customers. Violating an almost religious precept in the financial world, ABS informed its clients that they would have to pay a charge of at least 0.125% to maintain their accounts at the bank starting in 2016. This is the first time that I know of that a retail commercial bank is charging its customers to borrow their money. Wait, it gets better... In the first two full months after ABS’s October negative-rate announcement, 1,797 clients had left the bank, but 1,830 new accounts had been opened—for a net gain of 33. Fresher data for January and February, the most recent available, showed that ABS was still net positive on accounts, with its gain expanded to 59. That's right, thus far the bank has had a slight net gain in depositors - or people that are willing to pay a bank to lend the bank their hard earned cash.

Topics:

Reggie Middleton considers the following as important: Bank of Japan, Bitcoin, Commercial Paper, Credit Default Swaps, default, European Central Bank, Germany, Japan, Monetary Policy, Swiss Banks, Swiss National Bank, Switzerland, Unemployment, Wall Street Journal, Yen, Zurich

This could be interesting, too:

investrends.ch writes Bitcoin nach Kurseinbruch mit fulminantem Comeback

investrends.ch writes Welche Rolle spielen gehebelte Produkte beim jüngsten Einbruch der Krypto-Währungen?

investrends.ch writes «Die Nerven liegen derzeit blank»

investrends.ch writes Bitcoin fällt unter 90 000 US-Dollar

The Bank of Japan and the ECB are assisting me in teaching the world's savers, banking clients and corporations about the benefits of blockchain-based finance for the masses. How? Today, the Wall Street Journal published "Negative Rates: How One Swiss Bank Learned to Live in a Subzero World":

Alternative Bank Schweiz AG late last year became Switzerland’s first bank to comprehensively pass along negative rates to all of its customers. Violating an almost religious precept in the financial world, ABS informed its clients that they would have to pay a charge of at least 0.125% to maintain their accounts at the bank starting in 2016.

This is the first time that I know of that a retail commercial bank is charging its customers to borrow their money. Wait, it gets better...

In the first two full months after ABS’s October negative-rate announcement, 1,797 clients had left the bank, but 1,830 new accounts had been opened—for a net gain of 33. Fresher data for January and February, the most recent available, showed that ABS was still net positive on accounts, with its gain expanded to 59.

That's right, thus far the bank has had a slight net gain in depositors - or people that are willing to pay a bank to lend the bank their hard earned cash.Now this banks caters to a decided lower than national average clientele (I'm assuming this because it is located in a economically disadvantaged area), but I'm quite sure the banks clientele can count. This is exactly how it went down...

At ABS, total account balances fell by 4%, or 54 million Swiss francs ($56.5 million), between last October’s negative-rate announcement and February, as clients shifted money from cash holdings at the bank into investments. However, overall assets under management remained steady, ABS said.

This implies that the savers were forced out of their savings accounts due to being charged to put their money there, thus ran to investment accounts where they summarily lost their money anyway. You know 100% plus 4% should equal 104%, but came out to flat ~100%.

ABS is charging its clients because their its central bank, the Swiss National Bank, brought rates negative rates in 2014, currently -0.75%, with the risk of moving lower (reference Monetizing The Spear That The Swiss National Bank Hurled At Swiss Banks and Insurers). The European Central Bank went NIRP in 2014, and then went double NIRP recently, slashing rates to -0.4% in an apparently ineffective attempt to create inflation without organic economic demand. The ECB and Switzerland are joined by Denmark, Sweden and Japan in the NIRP (negative interest rate policy)parade, reference Stab, er... I Mean... Beggar Thy Neighbor - It's ALL OUT (Currency) WAR! Pt 2. This of course, puts material profit margin pressure on banks, reference The Next European Banking Crisis Looks to Be Upon Us and As I Promised, the Nordic States' Central Bank QE Program Slides Backwards and Starts To Collapse.

The stated purpose of NIRP is to drive down the desirability of keeping funds in safe(r) investments, with the hope of forcing them into riskier investments (ex. stocks) and into the consumer economy (ex. forcing people to spend their savings on stuff). Of course, if you aren't comfortable spending your savings on stuff, chances are you are not going to do it. This 4th grade revelation seems to be lost on many central bankers.

The WSJ says the big boys in Switzerland, such as UBS Group AG, are also charging negative rates on to large clients.

WSJ further reports:

Mr. Rohner said ABS had a spirited internal debate about its decision. He and his management team considered whether or not passing on negative rates was fair to clients, and if it might spur a flood of complaints. Yet, the significant amount of deposits held at ABS (and, in turn, parked by ABS at the central bank), relative to its loans and investments, meant that not making the move could have wiped out profits.

Let's not forget one of my favorite titles - "Fu$k the Fundamentals!": Negative Rates In EU Will Absolutely Wreck the Very System the ECB Sought to Save.

Martin Janssen, a professor emeritus of finance at the University of Zurich, thinks it’s a matter of time until more banks—with a less clearly defined ideology and client base than ABS—have to start following suit. “If the negative interest rates persist for two or three years, many banks will go that way,” he said.

How asinine can negative rates get? Well, we don't know yet, but the progress thus far is rather promising, no?

In Denmark, Some Get Paid to Have a Mortgage:

AALBORG, Denmark— Hans Peter Christensen got some unusual news when he opened his most recent mortgage statement. His quarterly interest payment was negative 249 Danish kroner. Instead of paying interest on the loan he got a decade ago to buy a house in this northern Denmark city, his bank paid him the equivalent of $38 in interest for the quarter. As of Dec. 31, his mortgage rate, excluding fees, stood at negative 0.0562%.

Germany: Where Negative Rates Are Lethal

German regulators are so concerned about the impact of negative interest rates on the country’s life insurers that they have said they can only be sure the sector is safe through 2018. Even today, half the industry would be short of capital without the help of special measures. ...The German life industry is particularly badly affected by very low or negative interest rates because companies have historically offered what now look like high levels of guaranteed returns over very long periods. Some insurers need to earn a continuing investment yield of more than 5% to meet guarantees to their policyholders, a report from Germany’s central bank found in 2014. In a world where 10-year German government bonds yield less than one-quarter of 1%, that looks very hard to achieve.

Falling interest rates also increase the size of the liabilities on insurers’ balance sheets, which can reduce their capital if assets don’t increase in valuation enough to match.

Large European insurers such as Allianz, AXA, Assicurazioni Generali SpA and Munich Re all have big German life businesses, but regulatory concerns are more immediately focused on smaller insurers mainly unknown outside of the country. German life insurers earned gross written premiums of €89.9 billion ($102 billion) in 2014, according to the most recent statistics from German financial regulator BaFin.

Munich Re, whose unit Ergo Leben is Germany’s seventh-largest life insurer with €3 billion in gross written premiums, is watching monetary policy “with great concern,” said CEO Nikolaus von Bomhard.

“What is dangerous is that the return on many investments is no longer reflective of the underlying risk involved,” Mr. von Bomhard told The Wall Street Journal. “Many investors feel forced into taking higher risks.”

Exactly! This is what I have coined "Return-free Risk"!

Some policyholders are already losing out on money they should be getting, according to an association representing customers, because of the regulator’s efforts to bolster the companies’ balance sheets and survival prospects.

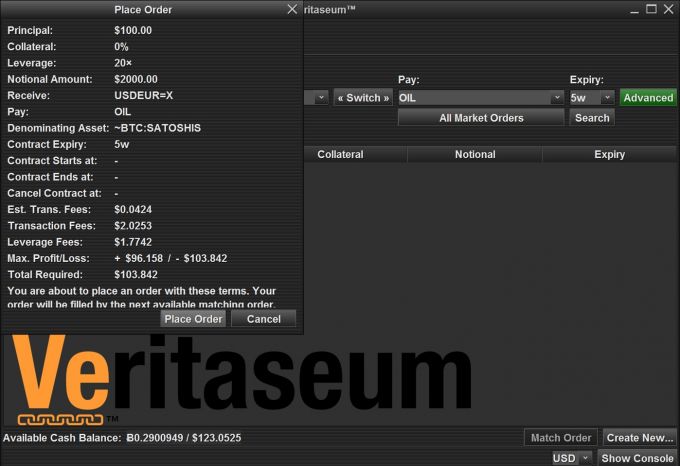

So, what does this have to do with Veritaseum and blockchain-based finance? In the comment section of one of the articles that I wrote yesterday, someone asked me what the difference was between Ethereum and Bitcoin, and which was better. The differences are myriad, but in a nutshell:

- Ethereum is more programmable (with a built-in full turing programming language), theoretically more scalable and smaller confirmation times.

- Bitcoin is proven more secure, less programmable (but still fully programmable with its non-turing scripting language - this is lost on most) and has longer times.

- Bitcoin has a significant lead in its demand side network effect. This is also significantly lost on most.

Most people ask which is better. At such an early stage in each platform's development life cycle, it's really too early to tell. They take different approaches to a problem most didn't even know they had. I'd like to note that while Veritaseum is currently built on the Bitcoin blockchain, it is actually blockchain agnostic. We're not in the business of picking winners on the tech side. While this is an oversimplification, there are two points that are always lost in the debate. Points which the SNB and ECB will likely bring to light as they bring their financial systems towards the brink in their search for this mystical inflationary demand sans the demand - the Purple Unicorn!

- Bitcoin is the most ubiquitous, secure and time tested blockchain-based network in existence, and by a wide margin. That means it is already spread far and wide and has remained 100% hack-proof for 7 years.

- Bitcoin is quite programmable, and advanced smart contracts can be made through the right systems, cue in Veritaseum

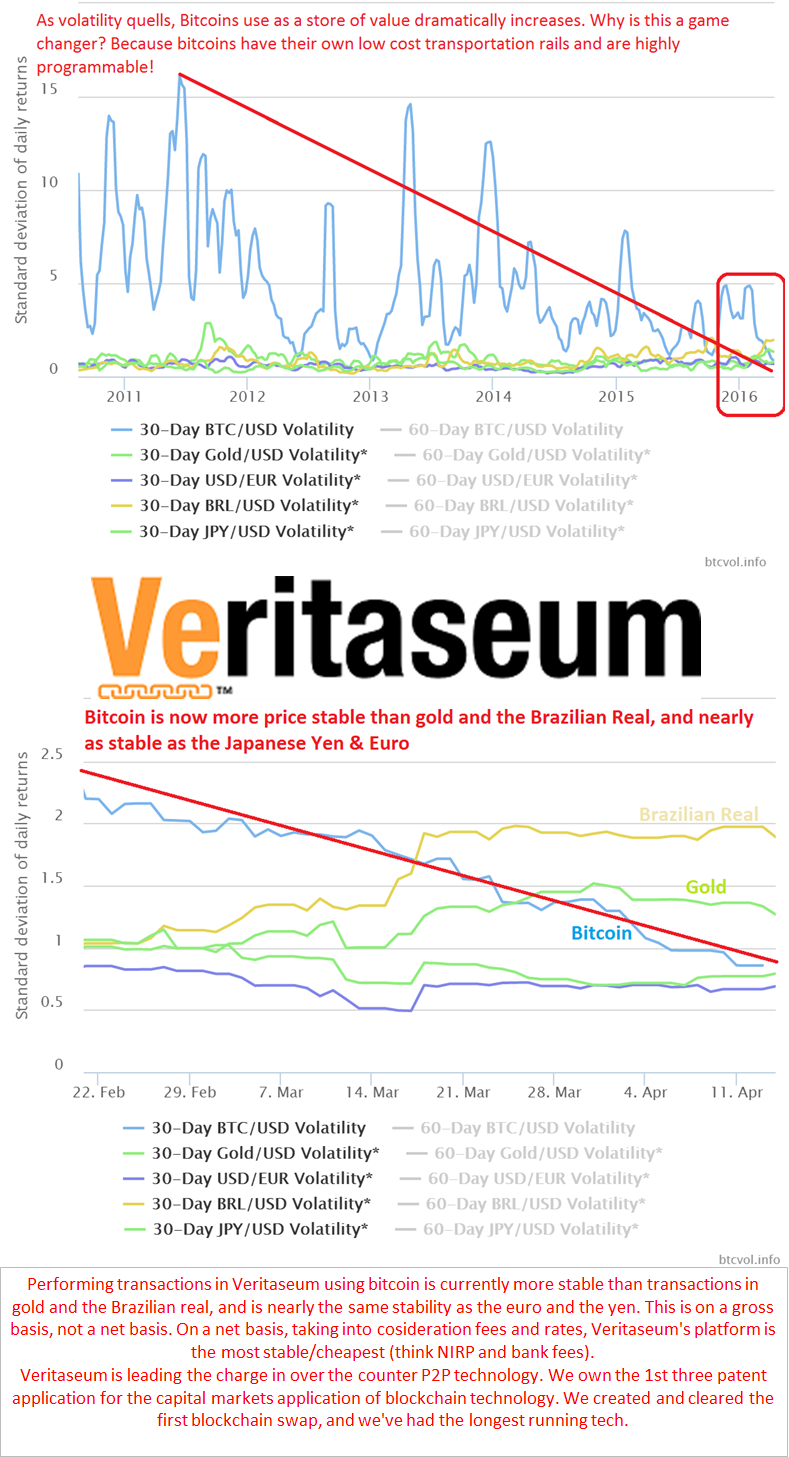

- and number three... Hold your booty hairs... Bitcoin is currently more price stable than the Brazilian real, gold, and from a cost perspective approaches parity to the yen and the euro.

See below...

Now, on a gross basis, the euro is ever so slightly more stable than bitcoin. Alas, if you keep your euro in a bank (ex. a Swiss bank) that actually charges you a negative rate 0.125% and a bank account fee of at least that, we're talking very close to parity to two of the deepest and most liquid currencies (USD is #1) on the planet.

What does this mean? It means BTC is gaining utility as a store of value, while maintaining three of its core attributes:

- Zero trust transactions

- Programmability

- It's very own, built-in, very low cost, transmission network

So, when you create applications out of bitcoin, you don't even need to include a money or currency component. It's already there. As a matter of fact, that money and currency component is getting more and more stable over time (reference the downward sloping chart) as the competing fiat currencies are getting less and less stable over time, reference:

- Despite What You Don't Hear In The Media, It's ALL OUT (Currency) WAR! Pt. 1

- Stab, er... I Mean... Beggar Thy Neighbor - It's ALL OUT (Currency) WAR! Pt 2

- As US Companies Report, Signs of Imported Unemployment/Deflation Appear: It's ALL OUT (Currency) WAR! Pt. 2.5

- How to Blow a Trillion Dollars and Look Like You (Don't) Know What You're Doing While Blowing It

- It's All Out War, Pt 3: Is the Danish Krone Peg to Euro More Fragile Than Glass Beads? The Danish National Bank Infers So!

So, why isn't everybody moving to the bitcoin blockchain platform? I truly believe they don't know what it's capable of. Keep in mind that the biggest banks in the world have come together to collaborate on this technology - reference:

- 40 Banks Trial Commercial Paper Trading in Latest R3 Blockchain Test

- 10 Stock and Commodities Exchanges Investigating Blockchain Tech

- and 7 Wall Street Firms Test Blockchain for Credit Default Swaps of which the CFTC Commissioner praised: Credit Default Swap Test ‘Proves Merit’ of Blockchain.

What do all of these examples of Wall Street's use of the tech have in common? For one, they are all still highly centralized yet attempt to use the peer-to-peer attributes of the bitcoin blockchain tech. Secondly, despite having a lot of capital and fanfare in the media, they are relatively late to the party. Veritaseum cleared its first swap through the blockchain in 2013, and has patent applications on the tech filed years before these announcements were made.

Hey, I've even done swaps directly on ZeroHedge in the past..

Most importantly, the very need and existence of the entities doing the tests using blockchain technology is called into question by the mere fact that the blockchain technology actually works. If you can successfully use P2P technology to make your back-end infrastructure work more smoothly to charge your clients for services, why should your clients utilize you instead of the P2P technology directly?

Therein lies the rub. The currency is now becoming stable (expect some bumps in the road, though). The infrastructure is being proved, and the platform is truly programmable.

Anyone interested in knowing more should contact me directly (reggie AT veritaseum.com. We have a lot to talk about.