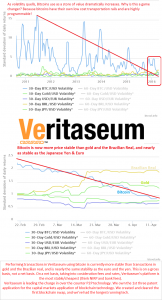

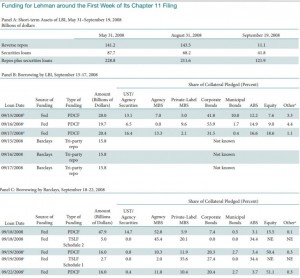

During the months of March and April of 2016 we released a series of proprietary research reports indicating signficant weakneses that we found in the European banking system and released it for sale through the blockchain (reference The First Bank Likely to Fall in the Great European Banking Crisis). This was performed by the same macro forensic and fundamental analysis team that first warned about the pan-European sovereign debt crisis in 2009 and 2010 (reference Pan-European sovereign debt crisis) as well as Bear Stearns and Lehman Brothers (Is this the Breaking of the Bear? January 2008).

Today, Reuters released news vindicating our position in spades, leading any institution that took a position via our blockchain-based Veritaseum trading platform or today’s legacy system with 14% cash gains or 50% to 100+% leveraged gains in the short time period in question, to wit: Tumbling Banco Popolare leads Italian bank shares lower

Banco Popolare shares fall 14 pct to record low

Bank booked writedowns ahead of merger with Popolare Milano

Italian banking shares dogged by concerns over bad loans (Recasts with details)

MILAN, May 11 Shares in Banco Popolare plunged 14 percent on Wednesday after a surprise first-quarter loss driven by loan writedowns — the main focus of investor concerns over Italian banks.

Read More »