While Forex banks, traders, and other institutions are being blamed for market rigging, the Swiss National Bank can publish reports about its own market rigging, but instead of being a scandal, it’s economic data. That’s because the vast majority don’t understand how the Forex markets work. It’s not insulting – it’s a fact. Currently there are hundreds of pending litigation cases against a plethora of Forex banks, traders, and other institutions – but none against a central bank....

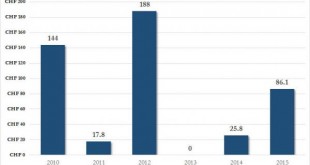

Read More »Swiss National Bank Admits It Spent $470 Billion On Currency Manipulation Since 2010

By now it is common knowledge that when it comes to massive, taxpayer-backed hedge funds, few are quite as big as the Swiss National Bank, whose roughly $100 billion in equity holdings have been extensively profiled on these pages, including its woefully investments in Valeant and the spike in its buying of AAPL stock at its all time high. But while the SNB's stock holdings are updated every quarter courtesy of its informative SEC-filed 13F (we wish the Fed would also disclose the equities...

Read More »Swiss monetary policy and the central bank’s options with regards to the CHF

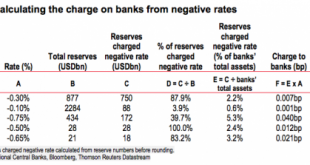

At its quarterly policy assessment, the Swiss National Bank (SNB) decided to leave its monetary policy unchanged. The SNB could afford not to cut its reference rate after last week’s ECB stimulus failed to have much impact on the Swiss franc versus the euro. The target range for the 3-month Libor was kept between -1.25% and -0.25%; the interest rate on sight deposits with the SNB was maintained at a record low of -0.75%; and the SNB reiterated its willingness to intervene on the foreign...

Read More »Another Fed “Policy Error”? Dollar And Yields Tumble, Stocks Slide, Gold Jumps

Yesterday when summarizing the Fed's action we said that in its latest dovish announcement which has sent the USD to a five month low, the Fed clearly sided with China which desperately wants a weaker dollar to which it is pegged (reflected promptly in the Yuan's stronger fixing overnight) at the expense of Europe and Japan, both of which want the USD much stronger. ECB, BOJ don't want a weak dollar; China does not want a strong dollarFed sides with China for now — zerohedge (@zerohedge)...

Read More »Euro area: quantifying ECB’s stimulus – an extra 0.3% boost to inflation

In this post, we provide a rough assessment of the reflationary impact of the newly-announced ECB’s measures through a simple framework. Ahead of the December 2015 meeting, we used a simple method based on the ECB’s leaked models in the German press in order to guestimate the impact of QE on inflation, and thus the potential for additional easing based on the ECB’s own forecasts. We use the same framework to assess the potential macro impact of the new measures announced by the ECB last...

Read More »Central Banks Shiny New Tool: Cash-Escape-Inhibitors

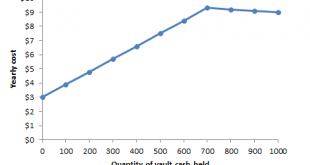

Submitted by JP Koning via Moneyness blog, Negative interests rates are the shiny new thing that everyone wants to talk about. I hate to ruin a good plot line, but they're actually kind of boring; just conventional monetary policy except in negative rate space. Same old tool, different sign. What about the tiering mechanisms that have been introduced by the Bank of Japan, Swiss National Bank, and Danmarks Nationalbank? Aren't they new? The SNB, for instance, provides an exemption...

Read More »Central Banks Shiny New Tool: Cash-Escape-Inhibitors

Submitted by JP Koning via Moneyness blog, Negative interests rates are the shiny new thing that everyone wants to talk about. I hate to ruin a good plot line, but they're actually kind of boring; just conventional monetary policy except in negative rate space. Same old tool, different sign. What about the tiering mechanisms that have been introduced by the Bank of Japan, Swiss National Bank, and Danmarks Nationalbank? Aren't they new? The SNB, for instance, provides an exemption...

Read More »HSBC Looks At “Life Below Zero,” Says “Helicopter Money” May Be The Only Savior

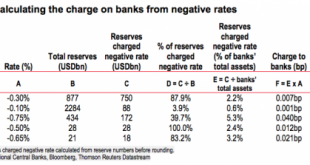

In many ways, 2016 has been the year that the world woke up to how far down Krugman’s rabbit hole (trademark) DM central bankers have plunged in a largely futile effort to resuscitate global growth. For whatever reason, Haruhiko Kuroda’s move into NIRP seemed to spark a heretofore unseen level of public debate about the drawbacks of negative rates. Indeed, NIRP became so prevalent in the public consciousness that celebrities began to discuss central bank policy on Twitter. When we say “for...

Read More »HSBC Looks At “Life Below Zero,” Says “Helicopter Money” May Be The Only Savior

In many ways, 2016 has been the year that the world woke up to how far down Krugman’s rabbit hole (trademark) DM central bankers have plunged in a largely futile effort to resuscitate global growth. For whatever reason, Haruhiko Kuroda’s move into NIRP seemed to spark a heretofore unseen level of public debate about the drawbacks of negative rates. Indeed, NIRP became so prevalent in the public consciousness that celebrities began to discuss central bank policy on Twitter. When we say “for...

Read More »HSBC Looks At “Life Below Zero,” Says “Helicopter Money” May Be The Only Savior

In many ways, 2016 has been the year that the world woke up to how far down Krugman’s rabbit hole (trademark) DM central bankers have plunged in a largely futile effort to resuscitate global growth. For whatever reason, Haruhiko Kuroda’s move into NIRP seemed to spark a heretofore unseen level of public debate about the drawbacks of negative rates. Indeed, NIRP became so prevalent in the public consciousness that celebrities began to discuss central bank policy on Twitter. When we say “for...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org