BA course at the University of Bern. Time: Monday, 10:15–12:00. Location: H4, 106. Uni Bern’s official course page. This course is aimed at students interested in macro finance who have completed their mandatory training in microeconomics, macroeconomics, and mathematics. Macro finance focuses on the pricing of securities and other assets. Using the Euler equation as a basis, we derive the fundamental pricing relationships. The course then explores a range of applications, including...

Read More »“Fiscal and Monetary Policies,” Bern, Spring 2025

MA course at the University of Bern. Lecture: Monday, 12.15 – 14.00, UniS A027.Session: Tuesday, 12.15 – 14.00, UniS A017, on 4 Mar, 18 Mar, 25 Mar, 15 Apr, 29 Apr, 20 May. Some lecture and session dates may be swapped. Uni Bern’s official course page. Problem sets and solutions can be found here. The course covers macroeconomic theories of fiscal policy (including tax and debt policy) and the interaction between fiscal and monetary policy. Participants should be familiar with the...

Read More »Does the US Administration Prohibit the Use of Reserves?

An executive order issued on January 23, 2025, aims at protecting “Americans from the risks of Central Bank Digital Currencies (CBDCs), which threaten the stability of the financial system, individual privacy, and the sovereignty of the United States, including by prohibiting the establishment, issuance, circulation, and use of a CBDC within the jurisdiction of the United States.” The executive order defines CBDC as “a form of digital money or monetary value, denominated in the national...

Read More »“Pricing Liquidity Support: A PLB for Switzerland” (with Cyril Monnet and Remo Taudien), UniBe DP, 2025

With Cyril Monnet and Remo Taudien. University of Bern Discussion Paper 25.01, January 2025. PDF. The proposed revision of the Swiss Banking Act introduces a public liquidity backstop (PLB) for distressed systemically important banks (SIBs), in part to facilitate resolution. We examine the impact of the PLB on fiscal balances, societal welfare, and the incentives of bank shareholders and management. A PLB, like too-big-to-fail (TBTF) status, acts as a subsidy for non-convertible...

Read More »“Report by the Parliamentary Investigation Committee on the Conduct of the Authorities in the Context of the Emergency Takeover of Credit Suisse”

The report (in German). From the press release: The Parliamentary Investigation Committee (PInC) attributes the Credit Suisse crisis to years of mismanagement at the bank. It is critical of FINMA’s relaxation of capital requirements and regrets the lack of effectiveness of its banking supervision. The PInC also criticises the hesitant development of the TBTF legislation and identifies shortcomings in the flow of information between authorities. It does not find any misconduct on the part...

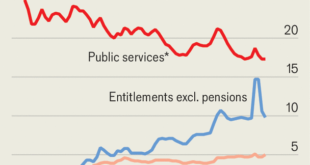

Read More »“Governments are bigger than ever. They are also more useless”

Says The Economist. The authors argue that falling state capacity, incompetence, corruption, and transfer/entitlement spending, which crowds out public investment and services, are to blame. Update: Related, in VoxEU, Martin Larch and Wouter van der Wielen argue that [g]overnments lamenting a stifling effect of fiscal rules on public investment are often those that have a poor compliance record and, as a result, high debt. They tend to deviate from rules not to increase public investment...

Read More »The New Keynesian Model and Reality

To analyze the transmission from interest rate policies to output and inflation, many academics and central bank economists use the basic New Keynesian (NK) ‘three-equation model’ and its various extensions. A key factor responsible for the model’s success is the seeming alignment with conventional wisdom—some of the model features can be framed in the language of familiar business cycle narratives, as found in newspapers, central bank communication, or introductory macroeconomics...

Read More »Urban Roadway in America: Land Value

In a CEPR discussion paper, Erick Guerra, Gilles Duranton, and Xinyu Ma estimate the cost of land use for roads in the U.S.

Read More »“Macroeconomics II,” Bern, Fall 2024

MA course at the University of Bern. Time: Monday 10:15-12:00. Location: A-126 UniS. Uni Bern’s official course page. Course assistant: Stefano Corbellini. The course introduces Master students to modern macroeconomic theory. Building on the analysis of the consumption-saving tradeoff and on concepts from general equilibrium theory, the course covers workhorse general equilibrium models of modern macroeconomics, including the representative agent framework, the overlapping generations...

Read More »“Makroökonomie I (Macroeconomics I),” Bern, Fall 2024

BA course at the University of Bern, taught in German. Time: Monday 14:15-16:00. Location: Audimax. Uni Bern’s official course page. Course assistant: Sally Dubach. Course description: Die Vorlesung vermittelt einen ersten Einblick in die moderne Makroökonomie. Sie baut auf der Veranstaltung „Einführung in die Makroökonomie“ des Einführungsstudiums auf und betont sowohl die Mikrofundierung als auch dynamische Aspekte. Das heisst, sie interpretiert makroökonomische Entwicklungen als das...

Read More » Dirk Niepelt

Dirk Niepelt