While we expect the ECB to remain on hold at its next policy meeting on April 21, a number of issues are coming steadily into focus Read the full report here The ECB is facing a complex, albeit not completely negative, macro-financial environment following its impressive policy package announcement on 10 March. Nevertheless, barring some new shock, beyond some fine-tuning measures, the ECB should remain on hold at its next policy meeting on 21 April. Instead, we expect different aspects of the ECB’s existing policies to be in focus in the coming days and weeks. Policy guidance: April 21 is not the right moment for any new policy action, but following the guidance it gave when it cut rates on 10 March, the ECB is likely to re-emphasise its forward guidance which was strengthened in March (post rate cuts) by repeating that “policy rates will remain at present or lower levels for an extended period of time, and well past the horizon of [ECB’s] net asset purchases”. Broader economic assessment: The ECB should sound confident enough that its latest measures will continue to feed through to financial markets and the real economy, reducing the risks of second-round effects on inflation. Business surveys have rebounded for March, consistent with resilient growth momentum. Headline inflation was zero in March, but core inflation was a touch stronger than expected.

Topics:

Frederik Ducrozet considers the following as important: April 21 meeting, ECB, Helicopter Money, inflation, Macroview, Monetary Policy

This could be interesting, too:

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes US-China Exchange Export Restrictions, Yuan is Sold to New Lows for the Year, while the Greenback Extends Waller’s Inspired Losses

Marc Chandler writes Yen Jumps on Rate Hike Speculation

Marc Chandler writes Markets do Cartwheels in Response to Traditional Pick for US Treasury Secretary

While we expect the ECB to remain on hold at its next policy meeting on April 21, a number of issues are coming steadily into focus

The ECB is facing a complex, albeit not completely negative, macro-financial environment following its impressive policy package announcement on 10 March. Nevertheless, barring some new shock, beyond some fine-tuning measures, the ECB should remain on hold at its next policy meeting on 21 April. Instead, we expect different aspects of the ECB’s existing policies to be in focus in the coming days and weeks.

Policy guidance: April 21 is not the right moment for any new policy action, but following the guidance it gave when it cut rates on 10 March, the ECB is likely to re-emphasise its forward guidance which was strengthened in March (post rate cuts) by repeating that “policy rates will remain at present or lower levels for an extended period of time, and well past the horizon of [ECB’s] net asset purchases”.

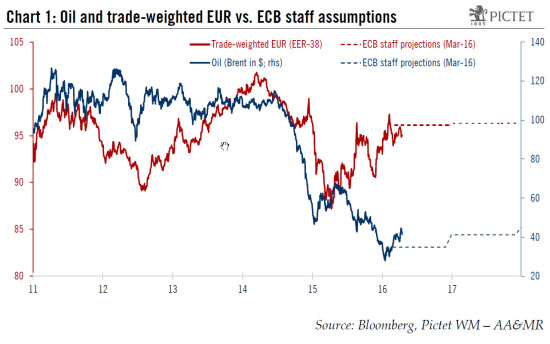

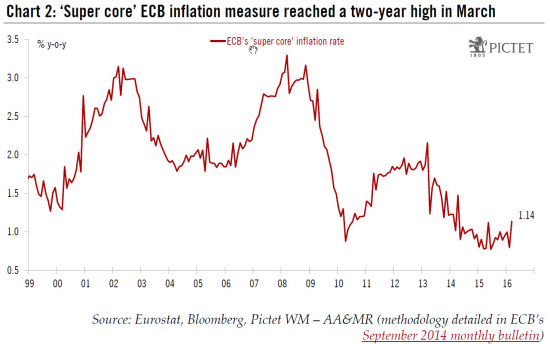

Broader economic assessment: The ECB should sound confident enough that its latest measures will continue to feed through to financial markets and the real economy, reducing the risks of second-round effects on inflation. Business surveys have rebounded for March, consistent with resilient growth momentum. Headline inflation was zero in March, but core inflation was a touch stronger than expected. While calendar effects will likely push core prices down in April, it is worth mentioning that the ‘super core’ inflation measures the ECB looks at have rebounded to a two-year high. Furthermore, bank credit, which arguably remains at the core of the ECB’s reflationary strategy, has rebounded. Overall, we retain our constructive assessment of the ECB’s global package, including its new Targeted Longer-Term Refinancing Operations (TLTRO II).

QE and TLTRO implementation: The ECB will hopefully communicate more details about its Corporate Sector Purchase Programme (CSPP) as well as TLTRO II. There could be some short-term disappointment if enough detail is not provided on Thursday, but with the programme set to begin “towards the end of the second quarter” and the next ECB meeting scheduled on 2 June, there should not be too long to wait.

Italian banks: We would expect ECB President Mario Draghi to make the following observations at the Thursday press conference: 1) the recently established Atlante rescue funds should be viewed as another step in the right direction, complementing previous initiatives such as the establishment of the Italian bad bank (GACS) and reforms to the cooperative bank sector; 2) the macroeconomic context in Italy is different, and hopefully more favourable than it was in Spain in 2010-2012. Crucially, Italian banks’ NPL ratios started to stabilise earlier this year; 3) one should not expect an immediate fix to the issues facing Italy’s banking sector, but rather a gradual improvement over the next couple of years. In Italy itself, bankruptcy reform currently winding its way through parliament could be an important element in solving Italian banks’ NPL problems.

ECB’s independence, Helicopter Money, and other German nightmares: Following unprecedentedly strong criticism from German Finance Minister Wolfgang Schäuble directly aimed at Mario Draghi, Bundesbank President Jens Weidmann responded in the FT by defending ECB independence. This should make Draghi’s position easier to defend, in our view. What is not helping (at least in Germany) is the on-going discussion about more radical policy measures, including so-called “helicopter money”. However, even in the most adverse scenario, we still believe that the ECB would consider several other options first, including the purchases of bank loans, bank debt or equities—all highly sensitive measures in themselves.