We expect the ECB to remain on hold at the 21 January meeting, but the combination of market stress, lower oil prices and renewed concerns about global growth is likely to force the Governing Council to consider easing policy again by the Spring. Two weeks into 2016, six weeks after easing policy at the December meeting, here we are again: the ECB is under pressure to do more. Investors continue to react to a number of related concerns, including the uninterrupted fall in oil prices,...

Read More »The Bull Market in Stocks May Be Done

It has come to my attention that, perhaps, the great stock bull market is done. To most people, a bull market is good, and its end is bad. After all, a rising market signifies a healthy economy. Investors are making money. And it seems to prove that the free market is validated, able to deliver miracles despite Obamacare. Share prices are connected to business productivity, aren’t they? In a free market they are, of course. However—and this cannot be said too often—we don’t have a free...

Read More »The Big Central Bank Split

What central banks do – and how their policies diverge from one another – will continue to drive financial markets in 2016, impacting fixed income markets and creating opportunities for equity investors in places where policy is easing, according to the 2016 Investment Outlook from Credit Suisse’s Private Bank. The Federal Reserve seems almost certain to raise interest rates for the first time since 2006 in December – and, Credit Suisse believes it will raise them three more times in 2016....

Read More »Diverging Toward Europe and Switzerland

December could be a big month for central bankers. The Federal Reserve is expected to make its first rate hike in nine years on December 16, while the European Central Bank is expected to announce further easing measures on December 3. The Swiss National Bank is likely to follow the ECB’s footsteps, sending deposit rates in the country even further into negative territory. Those moves, particularly combined with the divergence from American monetary policy, should provide a boost to European...

Read More »The Upside and Downside of 2016

The same, only more of it. That’s the kind of year 2016 promises to be, according to Credit Suisse’s Global Markets annual outlook. Markets will obsess over if, when, and how much the Federal Reserve will raise interest rates. (Four times starting in December for a total of 1 percentage point, says Credit Suisse.) Credit Suisse’s Global Markets team believes global economic growth will pick up, driven by improvement in the U.S. and Europe, central bank policy will diverge further, and...

Read More »The Euro Glut: The Summer 2015 Update

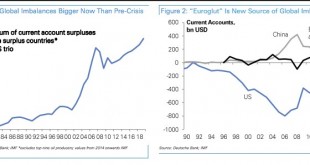

One of the first to use the word “euro glut” was Deutsche Bank’s George Saravelos. His idea of the euro glut is that European banks and investors drive the euro down despite the massive European current account surplus and the high European household savings rates of 12% compared to 4% in the US. Saravelos argues that ECB easing will lead to some of the “largest capital outflows in the history of financial markets”. This would counter the “European savings glut” created by savings and...

Read More »Falling Yields, Rising Asset Prices -Rising Yields,Falling Prices

Our monetary system is failing, but explaining that isn’t easy. The most popular argument is that the dollar has falling purchasing power and rising inflation. The problem with this argument is that consumer prices aren’t skyrocketing now. So, of course, people remain skeptical. Yields across all markets were falling worldwide. This causes the income generated from assets to fall. I wrote about this serious problem last time, introducing the concept of yield purchasing power—which is how...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org