Larry Summers - Click to enlarge At an event in Davos, Switzerland earlier today, Former U.S. Treasury Secretary, Larry Summers, argued that Central Bank independence from national governments should be scrapped in favor of a coordinated effort between politicians, central bankers and treasury to engineer inflation. Seems reasonable, right?…what could possibly go wrong? According to Market Watch, Summers argued that...

Read More »Bond yields shift higher

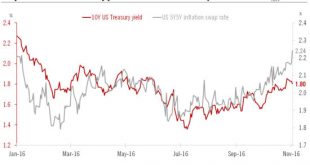

Recent rises in benchmark bond yields have caused us to revise upwards our year-end forecasts for US Treasury and Bund yields.We have revised our year-end target for the 10-year US Treasury yield from 1.7% to 2% and for the 10-year German Bund yield from 0.08% to 0.3%.Since the end of September, markets’ inflation expectations have rebounded, with euro and USD 5Y5Y inflation swap rates and 10-year breakeven yields rising. This rise is due to several factors, the most obvious one being the...

Read More »Jim Grant Puzzled by the actions of the SNB

Retaken from Christoph Gisiger via Finanz und Wirtschaft, James Grant, Wall Street expert and editor of the investment newsletter «Grant’s Interest Rate Observer», warns of a crash in sovereign debt, is puzzled over the actions of the Swiss National Bank and bets on gold. From multi-billion bond buying programs to negative interest rates and probably soon helicopter money: Around the globe, central bankers are...

Read More »Cashless Society – Is The War On Cash Set To Benefit Gold?

Submitted by Jan Skoyles via GoldCore.com, Introduction Cash is the new “barbarous relic” according to many central banks, regulators, and some economists and there is a strong, concerted push for the ‘cashless society’. Developments in recent days and weeks have highlighted the risks posed by the war on cash and the cashless society. The Presidential campaign has been dominated for months and again this week by the...

Read More »Financial Repression Is Now “In Play”

Submitted by Gordon T Long via FinancialRepressionAuthority.com, A FALLING MARKET CANNOT BE ALLOWED – at any cost! The Central Bankers have clearly painted themselves into a corner as a result of their self-inflicted, extended period of “cheap money”. Their policies have fostered malinvestment, excessive leverage and a speculative casino approach to investments. Investors forced to take on excess risk for yield and...

Read More »“Subtle forward guidance”: The marriage between best practice central banking and commodity markets

In the years following the 2008 crash and today, the use of forward guidance from central banking policy makers has become increasingly important. What this nonsense ultimately has translated into is a ridiculous track record in posting upbeat assessments on the economic environment, aimed at trying to fool the marginal investor into believing “there are no need for worry, central bankers have everything under...

Read More »The Swiss Begin To Hoard Cash

While subtle, the general public loss of faith in central banking has been obvious to anyone who has simply kept their eyes open: it started in Japan where in February hardware stores were reported that consumers were hoarding cash, as confirmed by the spike in demand for safes, “a place where the interest rate on cash is always zero, no matter what the central bank does.” Then, as we reported just over a week ago,...

Read More »NIRP Has Failed: European Savings Rate Hits 5 Year High

One year ago, when it was still widely accepted conventional wisdom that NIRP would “work” to draw out money from savers who are loathe to collect nothing (or in some cases negative interest) from keeping their deposits at the bank, and would proceed to spend their savings, either boosting the stock market or the economy, we showed research from Bank of America demonstrating that far from promoting dis-saving, those...

Read More »Why Krugman, Roubini, Rogoff And Buffett Hate Gold

Why Krugman, Roubini, Rogoff And Buffett Dislike Gold By Jan Skoyles Edited by Mark O’Byrne A couple of weeks ago an article appeared on Bitcoin Magazine entitled ‘Some economists really hate bitcoin’. I read it with a sigh of nostalgia. As someone who has been writing about gold for a few years, I am used to reading similar criticisms as those bitcoin receives from mainstream economists, about gold. As with...

Read More »Do our money managers really believe this will end well?

Central banks are currently creating the mother of all bubbles. To my view it was caused by masses of cheap labor in China that entered the global economy in the early 1990s.This reduced inflation and interest rates, while Chinese productivity continously improved, in particular when rural workers came into the cities.The mother of all bubbles will pop at the latest, when Chinese wages approach Western levels....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org