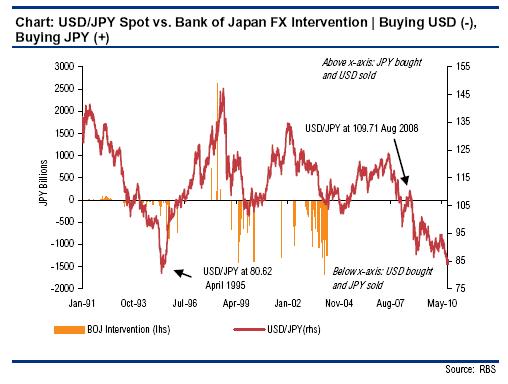

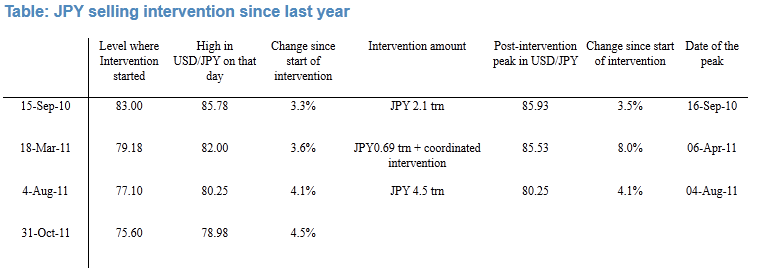

We show the history of Japanese FX interventions. The Japanese only intervened when the USD/JPY was under 80. Therefore the 2016 FX intervention threads at 108 are ridiculous.As opposed to the Swiss National Bank, the Japanese only talk, they do not fight. 2016 Japanese interventions thread Once the Fed finally reduced rate expections, the USD/JPY depreciated from 120 to 108 in a single quarter. (via Reuters and investing.com) Gains for stock markets and a warning of the chances of intervention from Japan’s finance minister knocked back the yen on Friday after a week of startling gains. The yen surged at one point by as much as 2 percent against the dollar on Thursday, and Minister Taro Aso responded early on Friday by warning rapid currency moves were “undesirable,” that the yen’s were “one-sided” and that Japan would take steps as needed. That is language that Tokyo has used in the past to flag intervention, and the yen’s run to 17-month highs against the dollar has required investors to believe that it would hold fire at least until after next week’s G20 meetings in Washington. “Of course there is some fear in the market,” said Manuel Oliveri, a strategist at Credit Agricole (PA:CAGR) in London. Looking at the history below, the intervention is pretty rediculous. The Bank of Japan did interventions only when USD/JPY was under 80.

Topics:

George Dorgan considers the following as important: balance sheet, Bank of Japan, BoJ, Featured, Japan, Ministry of Finance, MoF, Monetary Policy, Reserves, SNB

This could be interesting, too:

investrends.ch writes SNB schreibt 2024 definitiven Gewinn von über 80 Milliarden Franken

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

We show the history of Japanese FX interventions. The Japanese only intervened when the USD/JPY was under 80. Therefore the 2016 FX intervention threads at 108 are ridiculous.

As opposed to the Swiss National Bank, the Japanese only talk, they do not fight.

2016 Japanese interventions thread

Once the Fed finally reduced rate expections, the USD/JPY depreciated from 120 to 108 in a single quarter.

(via Reuters and investing.com) Gains for stock markets and a warning of the chances of intervention from Japan’s finance minister knocked back the yen on Friday after a week of startling gains.

The yen surged at one point by as much as 2 percent against the dollar on Thursday, and Minister Taro Aso responded early on Friday by warning rapid currency moves were “undesirable,” that the yen’s were “one-sided” and that Japan would take steps as needed.

That is language that Tokyo has used in the past to flag intervention, and the yen’s run to 17-month highs against the dollar has required investors to believe that it would hold fire at least until after next week’s G20 meetings in Washington.

“Of course there is some fear in the market,” said Manuel Oliveri, a strategist at Credit Agricole (PA:CAGR) in London.

Looking at the history below, the intervention is pretty rediculous. The Bank of Japan did interventions only when USD/JPY was under 80.

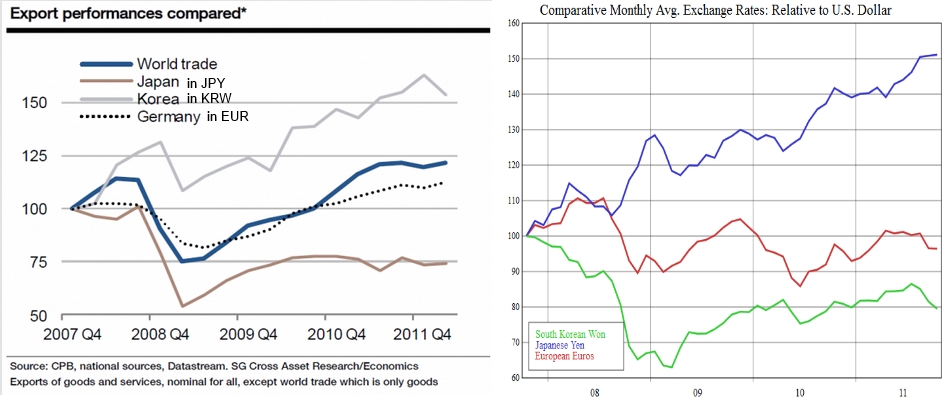

Japanese Interventions 2009-2011: Bank Of Japan intervenes

Japanese exports had clearly been harmed by the strong yen in the years 2009 to 2011, visible in the weak export performance, especially compared to its competitor Korea. Still it seems that most of the bad performance vanishes when the export values are translated in US dollar.

SNB Remains the Only Central Bank Currency Warrior: The Japanese do not Fight, they Talk

But the Japanese did far less FX interventions than the Swiss National Bank.

They were far more afraid than the Swiss, as we showed in SNB Remains the Only Central Bank Currency Warrior: The Japanese do not Fight, they Talk