Swiss Franc The Euro has risen by 0.17% to 1.1396 CHF. EUR/CHF and USD/CHF, September 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar fell to new lows since mid-2015 against the Canadian dollar yesterday. It is flattish today as the market awaits the central bank’s decision. We are concerned that given the strong performance and market positioning, a rate...

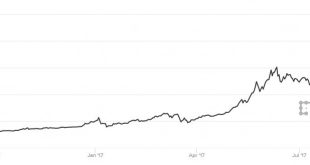

Read More »Bitcoin Falls 20 percent as Mobius and Chinese Regulators Warn

– Bitcoin falls 20% as Mobius and Chinese regulators warn – “Cryptocurrencies are beginning to get out of control” – warns respected investor Mark Mobius – Mobius believes governments will begin to clamp down on cryptocurrencies sparking rush to gold– Yesterday China’s PBOC ruled Initial Coin Offerings (ICOs) are illegal and all related activity to halt– China is home to majority of bitcoin miners– Paris Hilton latest...

Read More »Switzerland’s most expensive apartments in Zurich, Maloja and Lavaux

Lavaux – © Annanahabed | Dreamstime According to data from comparis.ch, Switzerland’s most expensive apartments are found in Zurich, Maloja – home to Saint-Moritz, and Lavaux-Oron. One square metre will cost you CHF 12,250 (US$ 13,000) in Zurich, CHF 11,500 in Maloja and CHF 11,250 in Lavaux-Oron. Lavaux-Oron contains posh parts of Greater Lausanne, such as Lutry, and the UNESCO-listed wine terraces of Lavaux on the...

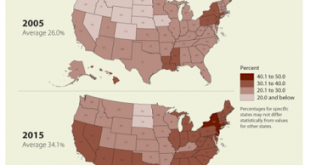

Read More »Great Graphic: Young American Adults Living at Home

This Great Graphic caught our eye (h/t to Gregor Samsa @macromon). It comes from the US Census Department, and shows, by state, the percentage of young American adults (18-34 year-olds). The top map is a snap shot of from 2005. A little more than a quarter of this cohort lived at home. A decade later, and on the other side of the Great Financial Crisis, the percentage has risen to a little more than a third. The deeper...

Read More »The Forking Paradise – Precious Metals Supply and Demand Report

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Forking Incentives A month ago, we wrote about the bitcoin fork. We described the fork: Picture a bank, the old-fashioned kind. Call it Acme (sorry, we watched too much Coyote and Road Runner growing up). A group of disgruntled employees leave. They take a copy of the book of accounts. They set up a new bank across the...

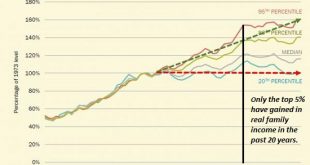

Read More »Why We’re Doomed: Stagnant Wages

The point is the present system cannot endure. Despite all the happy talk about “recovery” and higher growth, wages have gone nowhere since 2000–and for the bottom 20% of workers, they’ve gone nowhere since the 1970s. Diverging Income Trajectories 1947 - 2014 - Click to enlarge Gross domestic product (GDP) has risen smartly since 2000, but the share of GDP going to wages and salaries has plummeted: this is simply...

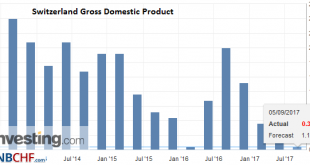

Read More »Switzerland Q2 GDP: +0.3 percent QoQ

Switzerland’s real gross domestic product (GDP) grew by 0.3 % in the 2nd quarter of 2017. Manufacturing, the financial sector and the hotel and catering in-dustry significantly boosted growth, while developments in trade, public administration and the healthcare sector were sluggish. On the expenditure side, growth was driven by domestic demand, with positive momentum coming from both consumption and investment. By...

Read More »FX Daily, September 5: Greenback Mixed, North Korea and PMIs in Focus

Swiss Franc The Euro has risen by 0.07% to 1.1406 CHF. EUR/CHF and USD/CHF, September 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Reports suggesting that North Korea is moving an ICBM missile toward launch pad in the western part of the country at night to minimize detection, while South Korea is escalating its military preparedness and the US seeks new...

Read More »4 Reasons Why “Gold Has Entered A New Bull Market” – Schroders

– 4 reasons why “gold has entered a new bull market” – Schroders– Market complacency is key to gold bull market say Schroders– Investors are currently pricing in the most benign risk environment in history as seen in the VIX– History shows gold has the potential to perform very well in periods of stock market weakness (see chart)– You should buy insurance when insurers don’t believe that the “risk event” will happen–...

Read More »Proving Q2 GDP The Anomaly, Incomes Yet Again Fail To Accelerate

One day after reporting a slightly better number for Q2 GDP, the BEA reports today that there is little reason to suspect it was anything more or lasting. The data for Personal Income and Spending shows that the dominant condition since 2012 remains in effect – “good” quarters, or whatever passes for one these days, are the anomaly. There still is no meaningful rebound in income. Real Personal Income excluding...

Read More » SNB & CHF

SNB & CHF