An X exchange over the weekend is bringing new light to an issue long shrouded in mystery—the status of America’s purported stockpile of 8,133 tons of gold stored in Fort Knox and other government vaults across the country.News aggregator ZeroHedge tweeted at President Trump’s head of government efficiency, Elon Musk, “It would be great if @elonmusk could take a look inside Fort Knox just to make sure the 4,580 tons of US gold is there. Last time anyone looked was 50 years ago in 1974.”Mr. Musk responded, “Surely it’s reviewed at least every year?”Senator Paul of Kentucky then jumped in, tweeting, “Nope. Let’s do it.”A national leader on this front, American bullion dealer Money Metals jumped into the viral fray on X, urging passage of legislation sponsored by the

Read More »Articles by Jp Cortez

Report: 2025’s Best and Worst US States for Sound Money

December 10, 2024The newly-released 2025 Sound Money Index has identified Wyoming, South Dakota, and Alaska as the states with the most favorable policies toward constitutional sound money, while Vermont, Maine, and California take the most hostile stances.Released annually by the Sound Money Defense League and Money Metals Exchange, the Sound Money Index is a comprehensive scorecard evaluating how each US state promotes or impedes sound money policies. Ranked policies include sales, income, and gross revenue taxes connected with precious metals, state affirmation of gold and silver as money, strengthening protections of gold and silver clause contracts, and state precious metals depositories. Additional criteria include issuing or investing in gold bonds, inclusion of physical

Read More »Sound Money Movement Chalks Up Seven State Legislative Victories in 2024

December 9, 2024What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order. We believe that our foundational ideas are of permanent value, and oppose all efforts at compromise, sellout, and amalgamation of these ideas with fashionable political, cultural, and social doctrines inimical to their spirit.

[embedded content]

Read More »Alabama Abolishes Income Taxes on Gold and Silver

May 27, 2024Alabama Governor Kay Ivey signed a bill on May 17 that removes all income taxes on capital gains from the sale of gold and silver, enabling the state to take an important step forward in reinforcing sound money principles.With this move, Alabama joins a growing number of states prioritizing the protection of citizens against the deleterious effects of inflation, currency debasement, and mounting federal debt.Enactment of Senate Bill 297 makes Alabama the 13th state in the nation that does not impose capital gains taxes on sales of gold and silver.Under the new law’s provisions, any profits or losses arising from the sale of precious metals, as reported on federal tax returns, will be excluded from the calculation of an Alabama taxpayer’s adjusted gross income

Read More »U.S. Representative Introduces Bill to End Federal Taxation on Gold and Silver

May 26, 2024U.S. Representative Alex Mooney (R-WV) has re-introduced sound money legislation to remove all federal income taxation from gold and silver coins and bullion.The Monetary Metals Tax Neutrality Act (H.R. 8279) backed by the Sound Money Defense League, Money Metals Exchange, and free-market activists – would clarify that the sale or exchange of precious metals bullion and coins are not to be included in capital gains, losses, or any other type of federal income calculation. Gold and silver would be treated as a non-entity for tax purposes, putting it on par with the U.S. dollar.Reps. Scott Perry (R-PA) and Randy Weber (R-TX) joined as original cosponsors.“My view, which is backed up by language in the U.S. Constitution, is that gold and silver coins are money and

Read More »Nebraska Ends Income Taxes on Gold and Silver, Declares CBDC’s Are Not Lawful Money

May 8, 2024With Gov. Jim Pillen’s recent signature, Nebraska has become the 12th state to end capital gains taxes on sales of gold and silver.LB 1317 is the fourth major sound money bill to become law this year, as state lawmakers across the nation scramble to protect the public from the ravages of inflation and runaway federal debt.Under the new Nebraska law, any “gains” or “losses” on precious metal sales reported on federal income tax returns are backed out, thereby removing them from the calculation of a Nebraska taxpayer’s adjusted gross income (AGI).Supported by the Sound Money Defense League, Money Metals Exchange, and in-state advocates, Nebraska’s sound money measure passed out of the unicameral legislature’s Revenue committee unanimously before being amended into a

Read More »Kentucky Becomes 45th State to End Sales Taxes on Gold and Silver

April 25, 2024(Frankfort, Kentucky) — In a high-stakes showdown with Gov. Andy Beshear over a gold and silver sales tax exemption, the Kentucky legislature has deemed his attempted line-item veto as an illegal act — and directed the Secretary of State to enroll the exemption into law.

This action makes the Bluegrass State the 45th state in the nation to enact this sound money policy – and the second this year.

Originally introduced by Rep. Steven Doan as a standalone bill, the sales tax exemption on purchases of gold, silver, platinum, and palladium coins, bars, and rounds enjoyed strong grassroots support — thanks, in large part, to the hard work of the Sound Money Defense League, Money Metals Exchange, and in-state activists.

Ultimately, Kentucky House and Senate leaders

Fixing FDR’s Biggest Blunder: From Gold Standard to Fiat Folly and Back

April 5, 2024Today, states across the country are beginning to actively embrace prosound money legislation, inviting a critical examination of how America abandoned the gold standard of money and racked up $34.5 trillion in debt. To understand how we got here, it’s important to understand the policy that initiated our monetary decline.More than ninety years ago today, April 5, 1933, President Franklin D. Roosevelt issued Executive Order 6102, forever reshaping America’s monetary system. This controversial order marked a pivotal moment in the nation’s financial history. Executive Order 6102 banned private ownership of gold coins, bullion, and gold certificates with the penalty for noncompliance being up to ten years in prison, a fine of $10,000, or both. This draconian edict

Read More »Wisconsin Formally Ends Sales Taxes on Gold and Silver

April 1, 2024Responding to an overwhelming groundswell of grassroots pressure, Gov. Tony Evers today signed a bill into law that secures Wisconsin’s place as the 44th state in America to end sales taxes on the purchase of precious metals.Assembly Bill 29 and Senate Bill 33, carried by Rep. Sortwell and Sen. Stroebel, respectively, enjoyed strong bipartisan support in both chambers of the Wisconsin legislature before it landed on Gov. Evers’ desk.Backed by the Sound Money Defense League, Money Metals Exchange, and in-state Wisconsin dealers and investors, the legislative effort built upon last year’s educational campaign.In 2023, similar bills had been introduced in Madison but failed to receive a hearing.The new statewide sales tax exemption on bullion coins, bars, or rounds

Read More »Utah Formally Empowers State Treasurer to Protect State Funds with Gold and Silver

April 1, 2024Utah Governor Spencer Cox has signed legislation explicitly empowering the state treasurer to protect state funds with an allocation to physical gold and silver.Sponsored by Rep. Ken Ivory, House Bill 348 permits – but does not require – the Treasurer to hold up to 10 percent of certain state reserve accounts in physical gold and silver to help secure state assets against the risks of inflation and financial turmoil and/or to achieve capital gains as measured in Federal Reserve Notes.The Treasurer has limited options for holding, managing, and investing Utah’s state monies, making this legislation necessary in order for gold and silver to be included.Utah’s reserves are invested almost exclusively in corporate bonds and banking agencies. These debt instruments

Read More »Sound Money Movement Strikes Gold in 2023

December 30, 2023Against the backdrop of high inflation rates and geopolitical uncertainty, states are increasingly enacting measures that encourage saving in precious metals and even using gold and silver as money.

With five bills signed into law in 2023, sound money reforms are gaining momentum across the United States.

Money Metals Exchange’s Sound Money Defense League project has emerged as an influential force, actively engaging in legislative battles by prompting intense grassroots support, drafting legislation, recruiting bill sponsors, and providing expert testimony directly to lawmakers.

Twenty-five states considered fifty pieces of legislation this year aimed at ending taxes on monetary metals, strengthening state finances by investing reserve funds in physical gold,

Vermont Seeks to Become 44th State to Roll Back Sales Tax on Sound Money

February 23, 2023(Montpelier, Vermont) – On the heels of overwhelming votes to remove all taxes from purchases of precious metals in Mississippi, legislators in Vermont have introduced a measure to curtail the controversial tax in their own state.

Introduced yesterday by Rep. Peterson, Demar, Highly, and Smith, House Bill 295 would cancel sales taxes on larger-sized purchases of “rare coins of numismatic value, gold or silver bullion or coins, or gold or silver tender of any nation traded and sold according to its value as precious metal.”

In the past two years alone, the governors of Alabama, Ohio, Arkansas, Tennessee, and Virginia each signed legislation to enact or extend sales tax exemptions on precious metals in their states.

Both chambers of the Mississippi legislature this

Wyoming Senate Votes to Hold, Invest, and Receive Tax Payments in Gold and Silver

February 5, 2023Cheyenne, Wyoming, USA (February 2nd, 2023) – The Wyoming State Senate today voted 16-15, on a bipartisan basis, to pass a bill prompting the Wyoming state treasurer to hold gold and silver “specie” to protect the state – as well as establish a process to receive certain tax payments in specie.

Introduced by Senator Bob Ide (R-Casper), SF 101 amends and further implements the Wyoming Legal Tender Act, a popular 2018 law that had removed all tax liability from gold and silver transactions and affirmed that the monetary metals are legal tender in Wyoming.

Senate File 101 prompts the Wyoming state treasurer to create a formal system to deal directly in constitutional money – a system that would also include holding gold as an asset to help the Cowboy State hedge

Missouri Bill Would End Capital Gains, Invest State Funds in Gold and Silver, Establish State Gold Depository

December 18, 2022(Jefferson City, Missouri, USA — December 14, 2022) – A state senator from St. Charles County has introduced a bill in Missouri to eliminate income taxes on sales of gold and silver, invest state funds in gold and silver, and establish the Missouri Bullion Depository.

Sen. Bill Eigel introduced Senate Bill 100 creates new provisions related to gold and silver in the Show Me State.

First, SB 100 would require the State Treasurer to invest no less than 1% of the funds held in the state’s Budget Reserve Fund (currently valued at nearly $880 million).

The second issue SB 100 tackles is income taxation. Missouri correctly ended sales tax on the purchase of gold and silver long ago. This measure would additionally exempt from state income tax the portion of capital

History Repeats Itself: Abandoning Sound Money Leads to Tyranny and Ruin

September 30, 2022Money is one of the most misunderstood topics of our time, and we’re seeing the implications of this play out every day. To understand money, one first must first understand that human beings have always been incentivized to participate in exchange. If humans could not, or did not, trade, most people would die young from starvation, disease, or exposure to the elements.

The survivors would be left with an extremely low standard of living in a world in which none of us would want to live. This means that exchange is a necessary condition, not only for our economy, but for human flourishing.

The Origins of Money

Before there was money, there was barter (also known as direct exchange)—a system in which every good is traded directly against every other good. A small

Oklahoma to Consider Holding Gold and Silver, Removing Income Taxes

January 23, 2022(Oklahoma City, Oklahoma — January 20, 2022) – An Oklahoma state representative introduced legislation today that would enable the State Treasurer to protect Sooner State funds from inflation and financial risk by holding physical gold and silver.

Introduced by Rep. Sean Roberts, HB 3681 would include physical gold and silver, owned directly, to the list of permissible investments that the State Treasurer can hold. Currently, Oklahoma money managers are largely relegated to investing in low-yield, dollar-denominated debt instruments.

Other than Ohio, no state is currently known to hold any precious metals, even as inflation and financial turmoil accelerate globally. Yes, Oklahoma’s own investment guidance prescribes safety of principal as a primary objective for

Pro-Sound Money Lawmaker Wants To End Income Taxes on Gold and Silver in Oklahoma

January 22, 2022(Oklahoma City, Oklahoma, USA – January 20, 2022) – Oklahoma ended sales taxes on purchases of precious metals long ago, but now a representative from Broken Arrow wants to eliminate yet another tax on on gold and silver transactions.

Introduced by Sen. Nathan Dahm, Senate Bill 1480 would end capital gain transactions on the exchange of gold and silver.

Arizona, Utah, and Wyoming have enacted similar measures into law. Idaho has considered this measure recently and a similar measure is expected to be heard before the West Virginia legislature this year.

In recent decades, monetary gold and silver — and dollars redeemable in gold and silver — have been supplanted by the Federal Reserve Note as America’s currency. However, an increasing number of West Virginia

Will 2022 Be “The Year of Sound Money” in the States?

January 21, 2022Last year was a good year for state-level sound money legislation across the United States. 2022 could be even better.

Building on the success enjoyed by sound money advocates in Arkansas and Ohio last year, more than a half dozen states are now considering legislation that rolls back discriminatory taxes and regulations on the sale, use, and purchase of gold and silver.

More States Are Removing Sales Taxes on Gold & Silver

To date, 42 states have removed some or all taxes from the purchase of gold and silver. And there are new bills pending now in five of the eight remaining states, i.e. Tennessee, Mississippi, Kentucky, Hawaii, and New Jersey.

Taxing the exchange of Federal Reserve Notes for the monetary metals is an atrocious policy, for several reasons.

States

Alabama to Consider Extending Sales Tax Exemption on Sound Money

January 11, 2022.

(Birmingham, AL, USA – January 10, 2022) – Alabama currently exempts precious metals from state sales tax, however this exemption is set to expire in 2022. A senator in the Yellowhammer State hopes to extend this popular exemption.

Introduced by Senator Tim Melson (1-R), and supported by the Sound Money Defense League, Senate Bill 13 maintains current law by extending the existing sales tax exemption on the purchases of precious metals purchases

If Senate Bill 13 is not enacted, and this exemption is therefore allowed to expire, Alabama small businesses would immediately be harmed – along with Alabama citizens seeking to protect their savings against the devaluation of the dollar.

The Alabama sales tax exemption on the monetary metals should be maintained for a

Ohio House Votes to Fix Blunder, Remove Sales Tax on Sound Money

April 23, 2021The Ohio House of Representatives just approved a bill which helps Buckeye State citizens protect themselves from the loss of monetary purchasing power caused by federal money printing.

Introduced by Representative Oeslager, House Bill 110 includes a provision to eliminate the sales and use tax on purchases of gold, silver, platinum, and palladium coins and bullion in Ohio.

Ohio recently repealed a longstanding sales tax exemption on the sale of precious metals. Seeing the harm caused to in-state businesses, tourism dollars, and Ohio investors, the state seeks to reinstate the exemption.

This is no surprise. In 2016, the state of Louisiana experimented briefly with slapping sales taxes on precious metals purchases. They quickly reversed course only one year later

Alabama House Considers Eliminating Income Taxes on Gold and Silver

February 8, 2020Representative Sorrell has introduced House Bill 122, a tax-neutral measure to exclude from gross income any net capital gain and any net capital loss derived from the exchange of precious metals bullion.

Policies that penalize savers in precious metals reduce the likelihood that Alabama citizens will take prudent steps to insulate themselves from the inflation and financial turmoil caused by the Federal Reserve.

In recent years, legislation to remove capital gains taxes currently assessed on the sale of the monetary metals progressed through several state legislatures – Wyoming and Arizona were the last two states to remove income taxes from constitutional money. Alabama ought to be the next.

Here are a few reasons why slapping an income tax on the monetary

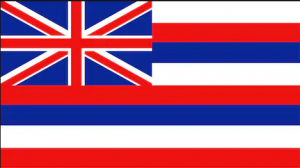

Hawaii Representatives Consider Ending Taxation on Sound Money

February 1, 2020Introduced by Representative Okimoto (R-36), House Bill 1830 removes sales and use tax against gold and silver bullion and currency in Hawaii.

Under current law, Hawaii citizens are discouraged from insuring their savings against the devaluation of the dollar because they are penalized with taxation for doing so. Passage of this measure would remove disincentives to holding gold and silver for this purpose. HB 1830 is important for a few reasons:

Levying sales taxes on precious metals is inappropriate. Sales taxes are typically levied on final consumer goods. Computers, shirts, and shoes carry sales taxes because the consumer is “consuming” the good. Precious metals are inherently held for resale, not “consumption,” making the application of sales taxes on

Sound Money Scholarship Winners Announced – 7 Outstanding Thinkers Earn Nearly $10,000 in Tuition Assistance

November 6, 2019Eagle, ID (November 6, 2019) – Seven outstanding students beat out over 100 of their high-school and college peers in making the best case for sound money through an international, gold-backed scholarship competition…

…and the winners walked away with almost $10,000 in scholarship awards for their exceptional, thought-provoking essays.

For the fourth-straight year, Money Metals Exchange, the national precious-metals dealer that was recently ranked “Best in the USA,” has teamed up with the Sound Money Defense League to offer the first gold-backed scholarship of the modern era.

These groups have set aside 100 ounces of physical gold to reward exemplary students who display a thorough understanding of economics, monetary policy, and sound money.

The 2019 Sound Money

The Sound Money Showdown in U.S. States

August 7, 2019Policies relating to sound money have been the subject of substantial debate at the state level this year, with bills, hearings, and/or votes taking place in nearly a dozen legislatures.

As most state legislatures have now wrapped up their work for the year, let’s review the victories (both offensive and defensive)—and lone defeat—for sound money during the 2019 session.

The Sound Money Defense League’s primary goal is to remove every kind of taxation imposed on constitutional money. Given its practical importance, the hottest issue in the states has been taxation—i.e. whether citizens should face a levy when buying or selling gold and silver.

House Bill 2684, introduced by West Virginia Delegate Pat McGeehan, aimed

Washington State Politicians Drop Cynical Attempt to Impose Taxes on Gold & Silver

April 22, 2019Well, here’s some encouraging news…

Efforts in Washington State to impose sales taxes on gold and silver were SHUT DOWN today thanks to intense efforts by the Sound Money Defense League, a group of in-state coin dealers led by Dan Duncan, the Association of Washington Businesses, and a large number of vocal grassroots supporters.

Here’s the backstory…

Since last month, a few misguided Washington State senators and representatives have been trying to ram through a new tax on constitutional money.

Their cynical efforts stalled out last month on the senate side, and today, the House Finance Committee voted decisively against imposing a new sales tax on precious metals.

Maintaining current law and not levying sales

West Virginia Joins Growing Sound Money Movement – Six Other States Now Weighing Their Own Bills to End Taxes on Gold & Silver

April 10, 2019Before the ink could even dry on West Virginia Governor Jim Justice’s signature on a repeal of sales taxation on gold, silver, platinum, and palladium bullion and coins, legislators in Wisconsin and Maine introduced similar measures in their own states.

All told, 39 states have now reduced or eliminated sales taxes on the monetary metals, and Wisconsin, Maine, Kansas, Arkansas, Minnesota, and Tennessee are all actively considering bills of their own this month.

West Virginia’s Senate Bill 502 enjoyed tremendous popularity, passing through the State Senate unanimously before passing out of the House 90-9. Starting July 1, investors, savers, and small businesses in the state are no longer required to pay sales and use

U.S. Congressman Introduces Bill to Remove Income Taxation from Gold and Silver

February 14, 2019The battle to end taxation of constitutional money has reached the federal level as U.S. Representative Alex Mooney (R-WV) today re-introduced sound money legislation to remove all federal income taxation from gold and silver coins and bullion.

The Monetary Metals Tax Neutrality Act (H.R. 1089) backed by the Sound Money Defense League and free-market activists – would clarify that the sale or exchange of precious metals bullion and coins are not to be included in capital gains, losses, or any other type of federal income calculation.

“My view, which is backed up by language in the U.S. Constitution, is that gold and silver coins are money and are legal tender,” Rep. Mooney said.

Congressman Alex X. Mooney (R-WV)

Read More »Congressman Demands CFTC Explain Its Failure to Find Silver Market Manipulation Where DOJ Did

February 6, 2019Washington, DC (February 5, 2018) – A member of the U.S. House Financial Services Committee today pressed the Commodities Futures Trading Commission (CFTC) on its conspicuous failure to uncover the very silver market manipulation now being prosecuted by the U.S. Department of Justice.

In a probing letter dated February 5 to CFTC Chairman J. Christopher Giancarlo, Rep. Alex X. Mooney (R-WV) writes:

“U.S. Justice Department obtained a guilty plea from a former commodities trader for JPMorganChase & Co. to charges of manipulating the gold and silver markets between 2009 and 2015, and its investigation into the actions of related parties is ongoing.

“The period of time at issue substantially overlaps the time during

Tennessee Considers Removing Tax on Gold and Silver

February 5, 2019Several bills introduced in the Tennessee legislature would eliminate sales and use tax against gold, silver, platinum, and palladium.

Introduced by Representative Ron Gant (R-Rossville), House Bill 212 removes sales and use tax against platinum, gold and silver bullion, some numismatic coins, and numismatic coins sold at trade show.

Senator Delores (R-Somerville) has introduced a bill, Senate Bill 333, identical to Representative Gant’s.

A third measure, Senate Bill 457, introduced by Senator Stevens (R-Huntingdon) would remove taxes on coins, currency, and bullion made “in whole or in part from gold, silver, platinum, palladium, or other material; used solely as legal tender, security, or commodity in this or

Idaho House Votes Overwhelmingly to Remove Income Taxation from Gold & Silver

February 16, 2018– Click to enlarge

Boise, Idaho (February 12, 2018) – The Idaho State House today overwhelmingly approved a bill which helps restore constitutional, sound money in the Gem State.

State representatives voted 60-9 to pass House Bill 449 sending the measure introduced by House Majority Leader Mike Moyle and Senate Assistant Majority Leader Steve Vick to the Senate for a hearing in the Local Government and Taxation Committee.

Backed by the Sound Money Defense League, Idaho Freedom Foundation, and Money Metals Exchange, HB 449 is a tax-neutral bill which excludes gains and/or losses on the sale of precious metals coins and bullion from an Idaho taxpayer’s taxable income.

“Gold and silver are the only money mentioned