The latest Commitment of Traders report covers the week ending February 2 that included the FOMC meeting and the BOJ's surprise cut. There was also speculation of a potential deal between Russia and OPEC to cut output. Speculative position adjustment in the futures market was more limited than one might have expected. Speculators cut 10.5k gross long yen contracts, leaving 82.5k contracts. The bears added only 2.3k contracts to their gross short position, giving them 44.9k contracts....

Read More »Big Position Adjustment for Euro, Smaller for Yen

The latest Commitment of Traders report covers the week ending February 2 that included the FOMC meeting and the BOJ's surprise cut. There was also speculation of a potential deal between Russia and OPEC to cut output. Speculative position adjustment in the futures market was more limited than one might have expected. Speculators cut 10.5k gross long yen contracts, leaving 82.5k contracts. The bears added only 2.3k contracts to their gross short position, giving them 44.9k...

Read More »Dollar Beaten Back but Cynicism is Unwarranted

The US dollar traded higher before the weekend with the help a fairly robust jobs report. Although the jobs growth itself was somewhat disappointing, the details were constructive: More people working a longer work week and earning more. The participation rate rose, and the unemployment rate (U-3) fell. The Atlanta Fed GDPNow tracker increased to 2.2% in Q1 16 from 1.2% at the start of the week. Despite the pre-weekend gains, the greenback lost ground against all the major...

Read More »Dollar Beaten Back but Cynicism is Unwarranted

The US dollar traded higher before the weekend with the help a fairly robust jobs report. Although the jobs growth itself was somewhat disappointing, the details were constructive: More people working a longer work week and earning more. The participation rate rose, and the unemployment rate (U-3) fell. The Atlanta Fed GDPNow tracker increased to 2.2% in Q1 16 from 1.2% at the start of the week. Despite the pre-weekend gains, the greenback lost ground against all the major...

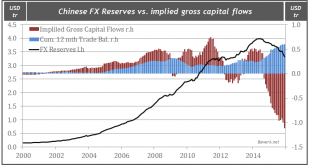

Read More »Brief Thoughts on Chinese Capital Flows Ahead of the Year of the Monkey

Chinese markets will be closed next week for the Lunar New Year celebration. However, over the weekend, China will report its January reserve figures. The market suspects that the PBOC burnt through another $120 bln of reserves. China's reserves stood at $3.81 trillion in January 2015. They are expected to stand near $3.21 trillion as of the end of last month. This draw down, coupled with its trade surplus and the pressure on the currency have led many to express concerns about...

Read More »The Swiss National Bank Doubled Its Apple Holdings in 2015

In the spring of 2015 we showed something unexpected: one of the biggest buyers, and holders, of AAPL stock was none other than the already quite troubled – in the aftermath of its disastrous Swiss Franc peg which ended up costing it tens of billions in losses – largest hedge fund in Switzerland, its central bank, the Swiss National Bank. What is curious is that unlike the Fed, the hedge fund also known as the Swiss National Bank not only proudly admits it purchases stocks, ETFs and...

Read More »China’s 3 trillion dollar mistake

When looking at the current state of the Chinese economy it is important to note what happened leading up the ongoing predicament. By managing the USD/CNY exchange rate the Chinese factory worker was essentially funding excess consumption in the United States. One of the many perks enjoyed by global reserve issuer. The factory worker obviously did not do this out of his own volition; on the contrary, he was duped into it by swallowing the propaganda spewed out by party apparatchiks in...

Read More »Emerging Markets: What has Changed

1) China relaxed some rules on foreign capital flows 2) Malaysian Prime Minister Najib is tightening his grip on power 3) The Czech National Bank (CNB) has tilted more dovish 4) Ukrainian Economy Minister Abromavicius resigned abruptly, throwing the ruling coalition into turmoil 5) Argentina unexpectedly settled with holdout Italian investors 6) Press reports suggest Brazil’s central bank is considering rate cuts later this year.In the EM equity space, UAE (+6.2%), Indonesia (+4.0%),...

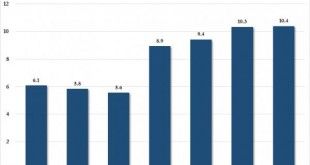

Read More »Employment Details Better than the Headlines

The US created fewer jobs than anticipated and the December gain was revised lower. However, the other details were favorable--better than expected. The unemployment rate ticked down to 4.9%, a new cyclical low, despite the rise in the participation rate (62.7% from 62.6%). Average hourly earnings were stronger than expected at 2.5%. The consensus expected a 2.2% year-over-year pace. The December pace was revised to 2.7% from 2.5%. The average weekly hours also ticked up to 34.6...

Read More »It is Not All About U.S. Jobs

The US nonfarm payroll report typically dominates the first Friday a new month. In recent years, it has become among the most important economic reports globally. Not today. The market's focus has shifted from Chinese stocks and yuan that dominated the first week or so, then oil, and now it is heightened concern about a US recession. This means there is likely to be an asymmetrical response to the jobs report. Stronger than expected data is unlikely to deter those who think the US...

Read More » SNB & CHF

SNB & CHF